The Treasury guarantee arrangements and other measures taken to stabilise the company

1.10 Banks take deposits from customers which can be withdrawn on demand and make longer term loans to customers which, in the past, were held to maturity. This combination of shorter term liquid liabilities backed by longer term illiquid assets makes a bank vulnerable if depositors perceive that their money may be at risk and demand immediate repayment of their deposits.

1.11 The Treasury regards banks to be systemically important because deposits held in banks are a key part of the payment mechanism for households and businesses and because they play a central role in the clearing and settlement of large-scale transactions and of securities. The failure of a major bank would leave individuals and businesses unable to access savings, to raise finance or to meet ongoing payment obligations. A single bank failure has the potential to spread to other parts of the financial system (contagion) through its impact on consumer confidence, the inter-bank lending market or other channels. This contagion, in turn, can have knock-on effects for the wider economy.

1.12 By mid-September 2007, Northern Rock realised that continued funding on the wholesale markets was not possible. It sought an assurance of support from the Bank of England, as lender of last resort, for a substantial liquidity facility pending a longer term resolution of its difficulties. This facility, which was uncommitted and on demand, was announced by the company on 14 September 2007 and was granted partly as a loan secured on prime residential mortgages and partly as an agreement for the Bank to buy some of Northern Rock's high quality securities on the understanding that the company would buy them back on demand (a "Repo facility").

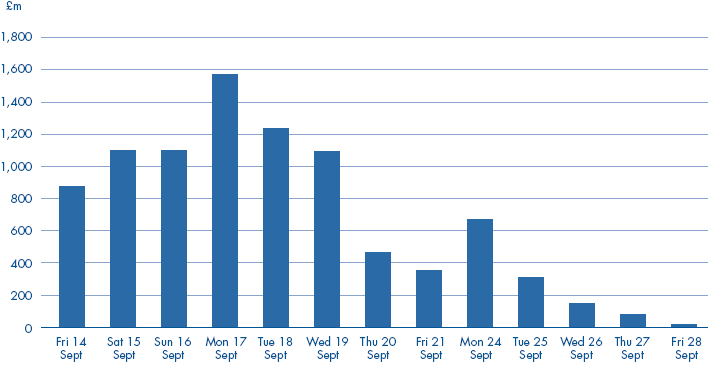

1.13 Between the announcement of the Bank's liquidity support facility on Friday 14 September and the following Monday 17 September, Northern Rock's financial situation deteriorated further:

■ Retail depositors began withdrawing money and closing accounts. Around £4.6 billion (20 per cent of Northern Rock's retail deposits) was withdrawn over four days (Figure 3, Friday 14-Monday 17 September). The company's credit default swap rate1 increased by around 1.75 percentage points and its share price fell 56 per cent (from 639p to 282p).

3 | Outflows of retail deposits from Northern Rock |

Source: National Audit Office analysis of documents held by HM Treasury | |

■ The run on deposits was widely reported, with pictures of queues of retail customers outside the company's branches.

■ The risk of contagion increased, credit default swap rates rose for Bradford & Bingley and Alliance & Leicester, the two closest comparators to Northern Rock, and their share prices fell (Figures 4 and 5).

_______________________________________________________________________________________

1 Credit Default Swaps are tradeable financial instruments which provide a form of third-party insurance for lenders against a borrower defaulting on a loan. A higher price for such swaps indicates that the perceived credit worthiness of the borrower has worsened.