Further measures to stabilise the company

1.14 The Treasury took the view that there was an increasing risk of system-wide contagion in the financial markets and decided that further measures were necessary to maintain stability. On 17 September, the Chancellor of the Exchequer announced that the Treasury would put in place arrangements to guarantee existing deposits in Northern Rock while the instability in financial markets continued. These guarantee arrangements supplemented but did not replace any compensation payable by the Financial Services Compensation Scheme. Appendix 6 provides a summary of the workings of the scheme.

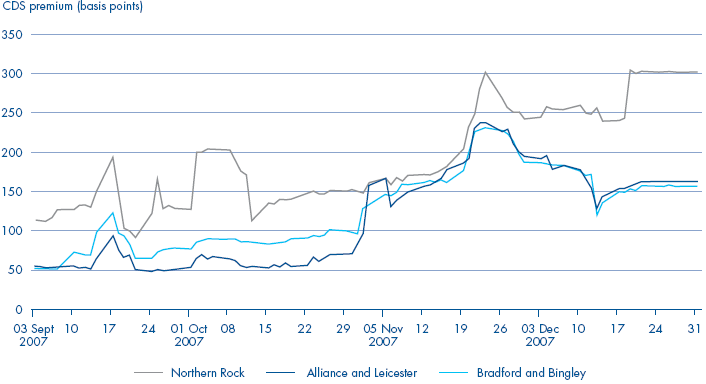

1.15 The guarantee arrangements removed the queues outside Northern Rock branches, reduced media coverage and avoided the potential contagion of other banks and mortgage lenders, whose credit default swap rates fell in line with that of the company (see Figure 4 opposite). The guarantee arrangements did not prevent further, although smaller, outflows of retail deposits or safeguard Northern Rock's access to the wholesale markets, and it continued to experience difficulties in obtaining wholesale funding. The Treasury therefore announced on 20 September that the guarantee arrangements would be extended to cover existing and renewed wholesale deposits and unsecured wholesale borrowing.

1.16 Developments after the emergency liquidity assistance and the Treasury's initial guarantee arrangements made further measures necessary. First, the Bank's facilities were limited by Northern Rock's ability to provide suitable high-quality security. It became clear to the Tripartite Authorities towards the end of September that Northern Rock's eligible assets would be exhausted by around 10 October 2007, which would prevent further borrowing under the Bank's facilities. Secondly, the Bank's loan facility as lender of last resort was at a rate higher than the Bank's usual rate for the provision of liquidity across the banking sector. It was higher than the rate charged on many of Northern Rock's mortgages, however, so the interest payments would gradually erode the capital it needed to meet requirements set by the Financial Services Authority - the company's regulatory capital (Appendix 9).

1.17 The guarantee arrangements did not stem the outflow of customer deposits. By October 2007, customer deposits had shrunk to 15.3 per cent of the company's funding (a drop from £30 billion to £17 billion); and wholesale loans had fallen to 11.8 per cent (from £17 billion to £13 billion). Wholesale funding was maturing and could not be renewed because the market had effectively closed to Northern Rock and the problem was compounded by the fact that retail deposits were shrinking at the same time. Northern Rock was becoming heavily dependent on Bank of England support.

1.18 If Northern Rock's financial position was to be stabilised for long enough to find a longer term solution, further measures were necessary to provide liquidity support and to prevent the company's regulatory capital eroding. The following measures were announced on 9 October 2007:

■ At the request of the company, additional financial assistance was made available by the Bank to enable Northern Rock to borrow further money secured against all of its assets;

■ The Treasury extended its guarantee arrangements to cover new retail deposits, in return for a fee on the aggregate amount of any new retail deposits accepted. The fee was judged to be sufficient to ensure that Northern Rock would not benefit from any commercial advantage the guarantee arrangements gave it in attracting new depositors;

■ The guarantee arrangements would remain in place during the current market instability and until the Treasury gave reasonable notice to depositors that such arrangements were to be terminated.

1.19 The additional facilities offered on 9 October 2007 were different in nature from the facilities granted on 14 September 2007, in that the taxpayer was exposed to a much higher level of risk:

■ The new facilities were secured by a fixed charge and a floating charge over all the assets of Northern Rock, rather than just high quality assets, and were not limited to the value of those assets;

■ The Treasury granted an indemnity to the Bank so that any losses incurred as a result of a default by Northern Rock in relation to the new facilities would be met by the taxpayer;

■ Payment of the margin between the Bank's usual lending rate and the rate charged to the company was deferred for five years. In addition, the deferred interest was subordinated to the claims of other creditors, including depositors, meaning that it would count towards Northern Rock's regulatory capital resources.

4 | Credit Default Swap rates for Northern Rock, Bradford & Bingley, Alliance & Leicester |

Source: Markit Group Limited | |

NOTE The graph shows the premium in basis points (0.01 per cent) for five year senior debt issued by each institution. The price, or premium, of a credit default swap is the annual amount an investor must pay over the length of the contract, expressed as a percentage of the amount insured. For example, if the premium for debt issued by ABC plc is 50 basis points, then an investor buying £10 million of protection must pay £50,000 a year. These payments would continue until either the credit default swap contract expired or until ABC plc defaulted. | |

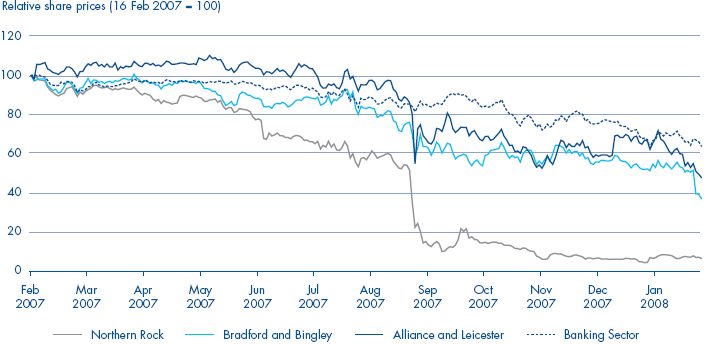

5 | Changes in share prices of mortgage banks |

Source: National Audit Office analysis of published share prices | |

1.20 To limit the risks for the taxpayer, the company put in place a stabilisation plan agreed with the Tripartite Authorities. As further falls in retail and wholesale funding were expected, a key element of the plan was to conserve cash by reducing the level of mortgage lending from an average of 1,000 loans a day in the first six months of 2007 to less than 200 a day by the last quarter of 2007. In addition, the terms of the loan from the Bank required Northern Rock to obtain the Bank's approval before entering into any corporate restructuring, making substantial changes to the general nature of its business and paying any dividends.