Decision to take forward discussions with the Virgin consortium

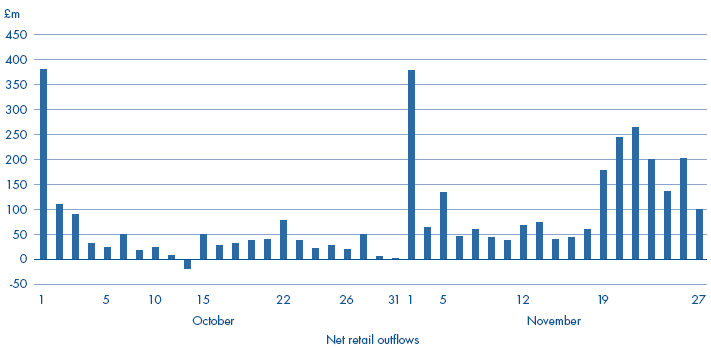

2.27 Northern Rock began negotiations with the three companies that had expressed interest in the whole company. Media reporting of the search for a buyer prompted a further run on Northern Rock's retail deposits during the week starting 19 November 2007, with a total outflow of over £1 billion (Figure 9). By 3 December, retail deposits stood at £10.8 billion, compared with £13.2 billion on 16 November, while the bidders had envisaged a minimum level of £8-8.5 billion as necessary for their bids to stay on the table.

2.28 To stop the run, and with the agreement of the Treasury, Northern Rock announced on 26 November 2007 that it would take forward Virgin's bid on an accelerated basis. In effect, Virgin was named as the preferred bidder, although not on an exclusive basis as the other bidders could still submit further proposals. The announcement slowed the retail outflows from £200 million to £43 million a day. This rate of outflow was considerably higher than the £10-15 million a day allowed for by the company in September, and meant the company had to fill the gap by increased borrowing from the Bank of England.

8 | Non binding proposals |

Type of non-binding proposal | Number of proposals |

Whole company (acquisition) | 2 (JC Flowers, Virgin) |

Whole company (minority interest) | 1 (Olivant Advisers Limited) |

Prime mortgage company (high quality mortgages and other assets plus deposits and access to cashflows from the Granite and covered bond securitisation programmes) | 4 (Apollo Management International LP, Cerberus, Tyne Consortium, Terra Firma) |

Deposits and a matched book of assets only | 1 (Bradford & Bingley) |

Portfolio of selected residential mortgages | 2 (ING Direct, Bradford & Bingley) |

Lifetime mortgages portfolio alone (generally made to borrowers aged 60 or over, capital and interest rolled up and repaid when property sold) | 2 (JP Morgan, Lehman Brothers) |

Financing proposals | 4 (Citigroup, Deutsche Bank, Morgan Stanley, Royal Bank of Scotland) |

Source: HM Treasury and Goldman Sachs | |

NOTE During the first half of 2008 Northern Rock sold part of the Lifetime mortgages portfolio to JP Morgan Limited for £2.3 billion. | |

BOX 2 | |

Statement of principles | |

| Criteria for evaluation |

Protection of taxpayers | The Authorities expected the costs and risks associated with Northern Rock to be borne by the current and future private sector providers of capital. All else being equal, the Authorities would view favourably proposals that minimised any residual exposure, involvement or funding from the public sector. Accordingly the Authorities expected to assess: a) the extent, timing and method of the unwinding of the Treasury's guarantee arrangements relating to deposits; and b) the timing of repayment of the Bank of England facility. The Bank of England's funding, together with all other related liabilities, is secured against Northern Rock's assets. The successful proposal would not provide for any payments to subordinated bondholders or shareholders unless such funding had been fully repaid and all other liabilities to the public sector, including the guarantee arrangements, had been discharged. |

Ongoing financial stability | The Authorities would assess proposals to ensure that Northern Rock and any proposed buyer have a sustainable long term capital structure that meets the Authorities' stability and policy objectives, including adequacy of credit ratings where applicable; and that the business plan under the proposal is viable in the medium term. |

Protection of consumers | The Authorities would view favourably any proposal in so far as it minimises disruption to the service provided to Northern Rock's customers. |

Other considerations

| The Authorities attached considerable importance to speed and certainty of execution, and would assess proposals in relation to any pre-conditions, risks or approval requirements that could threaten execution within the envisaged timeframe. The Authorities expected the purchaser's equity and debt commitments supporting the successful proposal to be without significant conditions to drawdown or termination rights. Any proposal would be viewed favourably in so far as it was not conditional upon European Commission approval of further aid measures. The Authorities were willing to discuss any proposal that envisages an ongoing role for them beyond their usual statutory and regulatory functions. |

Source: HM Treasury | |

9 | Net outflows of retail deposits from October 2007 |

Source: National Audit Office analysis of information held by HM Treasury | |

NOTE The high outflows at the beginning of October and November reflected maturity dates for fixed rate bonds. | |

2.29 At the time of the announcement, Northern Rock and Virgin planned to sign a deal before Christmas. By 6 December 2007, however, Virgin's financiers were indicating that, because of a further deterioration in market conditions, they would not be able to commit firmly until mid-January at the earliest. In addition, JC Flowers pulled out of the sale process because of concerns surrounding the effectiveness of the sale process, the continuing decline in the company's deposit base and a worsening outlook for house prices. In the light of this withdrawal and the failure to make significant progress with Virgin, discussions with Olivant were intensified and it submitted a detailed proposal on 7 December. On 13 December the Northern Rock board announced that it would focus on developing detailed proposals from Virgin and Olivant.

2.30 At around this time, the Treasury made a separate approach to the major UK banks to explore contingency plans in case the sale process was unsuccessful. The major banks were invited to consider either a funding package for the successful bidder or a joint venture company to take over Northern Rock, leading to a sale of some or all of the company or a run-down over time. Although a solution could not be agreed, the Treasury maintained contacts with the major banks over the following months to continue to explore their willingness to become involved.

2.31 By mid-December 2007, it had become clear to the Treasury that commercial funding on a matched basis would yield too little to repay the Bank of England facility. The funding difficulties were such that both Virgin and Olivant were considering withdrawing from the process. The Treasury had to decide whether its objectives would best be met by continuing with the sale process or by taking the company into public ownership as quickly as possible. Although a draft bill to enable public ownership could have been put before Parliament, for practical and procedural reasons the last date to do so before the Christmas recess was 14 December 2007. The Treasury decided that a new financing package should be developed that would allow the process to find a private sector solution to continue