Attracting new deposits

3.17 Northern Rock has exceeded its targets for attracting new deposits. At 31 December 2008 net retail funding inflows of over £8 billion had been recorded, boosting total retail deposits to £19.6 billion, some £6.6 billion ahead of the initial target for the whole of 2008 (see Figure 11).

3.18 Northern Rock's deposit taking was significantly affected by the crisis in the banking sector in Autumn 2008. The company was perceived by depositors as a place of safety at the height of the crisis and began to attract significant deposits. The company's ability to grow its retail funding base is, however, constrained by a framework of limits agreed as part of its business plan to reduce the risk of unfair advantage over competitors. As part of the framework, the company had agreed that its share of UK retail deposits would not exceed 1.5 per cent. The high inflow of deposits experienced by Northern Rock in October 2008 put this framework at risk, and the company therefore closed a number of popular savings accounts.

12 | Changes in the value of mortgages written between January 2007 and December 2008 |

Period | Total mortgage completions | Together mortgage completions | Together mortgage completions as a percentage of all completions |

January 2007 to August 2007 | 21,296 | 5,618 | 26 |

September 2007 to February 2008 | 6,023 | 1,818 | 30 |

March 2008 to December 2008 | 1,281 | 174 | 14 |

Source: National Audit Office analysis of data held by HM Treasury | |||

NOTES 1 The value of the Together mortgage lending does not include the unsecured element of the product. 2 As part of the company’s stabilisation plan, from 4 October 2007 the maximum that would be advanced under a Together mortgage was reduced from 5.9 to 4.9 times income, the interest rate charged from 29 October 2007 was increased by 0.5 of a percentage point and, from 8 November 2007, new applications were judged against more stringent credit criteria. 3 Together mortgage lending continued after February 2008 because of applications in the pipeline, and also because some customers with a Together mortgage had a contractual right to another Together mortgage when they moved house. | |||

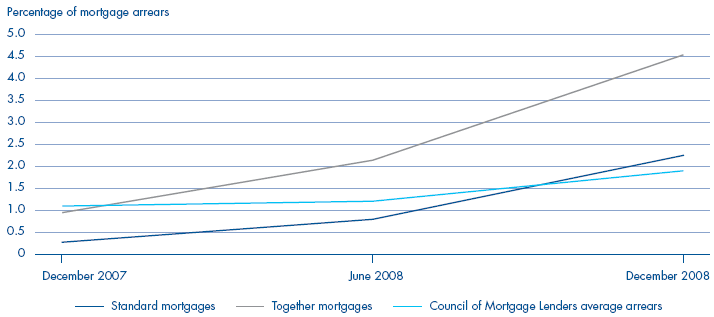

13 | Arrears on Northern Rock’s standard and Together mortgages compared with the industry average |

Source: Northern Rock annual report and accounts for 2008 and Council of Mortgage Lenders published data | |

3.19 Northern Rock's performance on new mortgage lending and on cutting running costs is summarised in Box 6.