Additional capital investment in Northern Rock

3.22 The Financial Services Authority requires all financial institutions taking deposits to maintain a pre-determined level of capital as a safety buffer, and to operate above this threshold on day to day business. (Appendix 9 summarises the regulatory capital requirements for UK banks.) Any financial institution which finds itself at risk of breaching the threshold must take action to strengthen its balance sheet.

14 | Published forecasts of changes in house prices |

Date of Forecast | Prediction for 2008 | Prediction for 2008 and 2009 | Forecaster |

October 2007 | 0 |

| Lombard Street Research |

October 2007 | -5 |

| Capital Economics |

November 2007 | 0 |

| Nationwide |

December 2007 | 0 |

| Rightmove.co.uk |

December 2007 | -2 |

| Charcol.co.uk |

December 2007 | -10 |

| BBC |

January 2008 | -3 |

| Centre for Economics and Business Research |

January 2008 | -3 |

| Union Bank of Switzerland |

January 2008 | -10 |

| Invesco Perpetual |

January 2008 | -10 |

| Institute of Economic Affairs |

January 2008 |

| -20 | London School of Economics |

January 2008 |

| -30 | London School of Economics |

January 2008 | 0 |

| United Trust Bank |

March 2008 |

| -20 | Morgan Stanley |

April 2008 | -3 |

| Knight Frank |

May 2008 | -5 |

| Royal Institute of Chartered Surveyors |

May 2008 | -7 |

| Council of Mortgage Lenders |

May 2008 | -9 |

| Jones Lang LaSalle |

Source: published forecasts | |||

15 | Comparison of Northern Rock’s assumptions on house prices in the base case and recession scenarios with market traded house price futures |

|

| Annual implied change (%) |

| |

Trading in forward contracts during: | Year 1 | Year 2 | Year 3 | Year 4 |

September 2007 | 0.0 | 2.0 | 3.0 | 8.0 |

October 2007 | -6.5 | -6.5 | -6.5 | -4.0 |

November 2007 | -8.0 | -8.0 | -7.0 | -4.5 |

December 2007 | -9.0 | -10.0 | -10.0 | -7.0 |

January 2008 | -9.0 | -11.0 | -11.0 | -11.0 |

February 2008 | -8.0 | -11.5 | -11.5 | -9.0 |

March 2008 | -8.0 | -13.0 | -14.0 | -11.0 |

Northern Rock Business Plan: |

|

|

|

|

Base case | -5.0 | 0.0 | 0.0 | 0.0 |

Recession case | -10.7 | -2.3 | -6.5 | 1.8 |

Source: Promontory Financial Group/DTZ Tullett Prebon HPI mid-price derivatives | ||||

NOTE There are limitations on using this information for interpretative purposes: a) these markets are often illiquid; b) they are relatively new; and c) they are dominated by a small number of large banks, mostly seeking to hedge exposures to the property markets and may lead to a downward bias. A more liquid, established market may have indicated a less precipitate change in prices. The futures markets have, however, tended to give a largely accurate indication of actual price declines. | ||||

3.23 In July 2008, the Northern Rock management team asked the Treasury for an additional £3 billion capital injection to strengthen its capital base. Subject to approval from the European Commission, which is still pending, the Treasury agreed to:

■ convert £400 million of preference shares into ordinary shares;

■ swap up to £3 billion of the Bank of England loan into ordinary shares.

3.24 A number of factors had contributed to a weakening of the company's capital position:

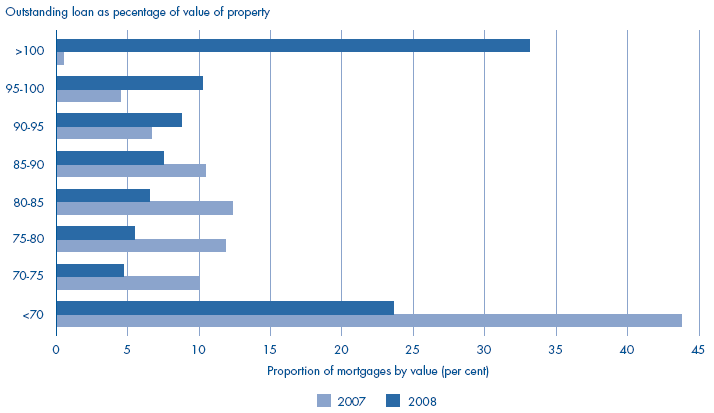

■Impact of declining house prices. Declining house prices and higher arrears during 2008 meant that the risk weighting of mortgage assets, used to calculate the capital needed to meet regulatory requirements, was likely to increase. For instance, between December 2007 and December 2008, the proportion of the company's residential mortgage book where the amount lent exceeded the value of the property increased from 0.5 per cent to 33 per cent, excluding the unsecured element of Together mortgages (Figure 16);

■ Impact of losses on commercial activities. The company's profitability and capital had also been exposed to funding risks largely caused by a higher than forecast difference between LIBOR (the rate at which commercial banks normally lend to one another and a benchmark for the cost to Northern Rock of its funding) and bank base rates, on which many of its mortgage products were priced;

■ Understatement of mortgage arrears. The company had capitalised outstanding amounts in arrears following receipt of three consecutive full monthly payments, whereas other lenders did not capitalise arrears until five or six consecutive payments had been received. Following a review of risk management after public ownership, the policy on arrears capitalisation was changed in May 2008, increasing the reported rate significantly and bringing it into line with reported arrears at other lenders. The review also found that internal controls over discretion to capitalise amounts in arrears when the borrower had paid less than three monthly payments were inadequate, and such discretion was removed;

■ Overstatement of regulatory capital due to misclassification of debt instruments. Following a routine review of Northern Rock's capital position in June 2008, the Financial Services Authority concluded that the company had overstated by some £300 million the amount of regulatory capital available as a result of a misclassification of some debt instruments within regulatory capital. The impact was, however, temporary as it was addressed by a waiver of the capital rules granted to Northern Rock by the Financial Services Authority at the end of July 2008.

3.25 The further planned support from the Treasury will increase the company's regulatory capital. The conversion of preference shares and the debt-to-equity swap does not provide additional cash to Northern Rock nor does it result in a short term loss to the taxpayer, but it does increase the taxpayers' exposure to risk.

3.26 Following a strategic review of its business plan in consultation with the Treasury, Northern Rock announced in January 2009 that it would aim to reduce the rate of mortgage redemptions and that repayment of the Bank of England loans (which were transferred to the Treasury in 2008) would continue at a slower rate than expected in the business plan.

3.27 As part of the government's financial interventions to support lending in the economy, the Treasury announced in February 2009 that a detailed planning exercise was underway to allow Northern Rock to begin writing new mortgages, expected to be worth £14 billion by 2010. Additional funding to support this lending will be provided in part by an increase in the Treasury's outstanding loan to Northern Rock, with an extended repayment schedule. A restructuring of the company will also be undertaken. In the event of a sale of the restructured company, the value of the newly created ordinary shares will be dependent on market conditions at the time of sale.

16 | Loan to value ratios across Northern Rock’s residential mortgage book at December 2007 and December 2008 |

| |

Source: Northern Rock Annual Report and Accounts 2008 | |

NOTE The figures do not include the unsecured element of Together mortgages (£2.7 billion at 31 December 2008). The value of the residential mortgage book at 31 December 2007 was £91 billion and at 31 December 2008 £67 billion. | |