Asset transfer

5. The freehold and long-leasehold properties transferred under the deal are held by a subsidiary company based offshore (Mapeley STEPS Limited - Figure 3). As a result, gains from selling the properties would not be subject to UK tax. Furthermore, as Mapeley's shareholders are also based offshore, they will not be liable to UK tax if they sell their shareholdings. Mapeley estimated that if it had been required to hold the properties onshore, its price would have increased by £55 million to cover extra UK tax that may have been due.6

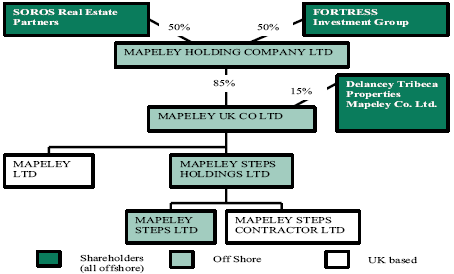

Figure 3: The structure of Mapeley

Source: C&AG's Report

6. Mapeley had always intended to hold the properties offshore but this intention had been made known to members of the Departments' project team only late in the procurement process, between selection of preferred bidder and finalisation of the contract. The project team had taken the view that Mapeley's intention to transfer the properties to an offshore company was a normal arrangement where shareholders were also based offshore. The Board of the Inland Revenue judged that the arrangement was legal, particularly as the shareholders were offshore. The Departments took the view that under public procurement law they had no choice but to go ahead with the contract.

7. With the benefit of hindsight the Departments said it had been a mistake that the bidding documents had not specified that the properties should be held onshore. The Government has since responded to the tax issues raised in this deal by suggesting a new clause for future PFI contracts that limits the ability of contractors to go offshore. As highlighted in the C&AG's Report, the Departments consider that it remains to be seen how such a clause will work out in practice.7

__________________________________________________________________________________