The refinancing was completed in March 2003 and the gains were shared

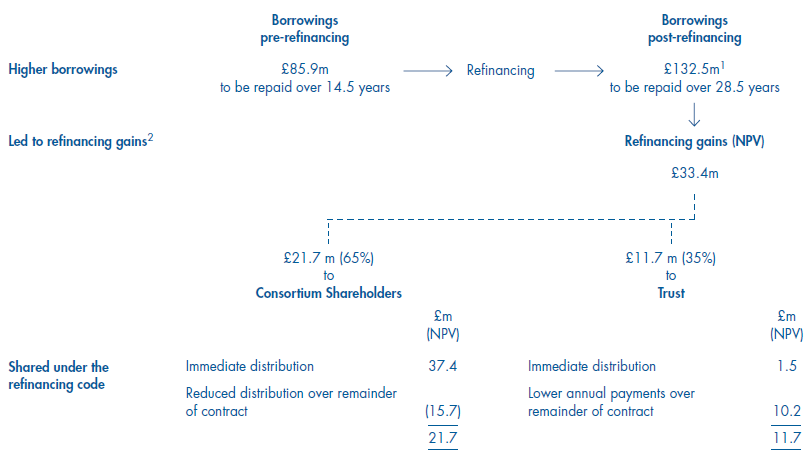

2.8 THC Dartford completed the refinancing of the project in March 2003 in line with the plans it had developed. The final arrangement was that THC Dartford replaced its outstanding13 bank borrowings of £85.9 million repayable over 14.5 years with a bond of £132.5 million repayable over 28.5 years and at lower interest rates than had applied to the bank finance. The new finance increased THC Dartford's outstanding borrowings by 54 per cent (Figure 10).

2.9 Before any sharing of the benefit, the resulting refinancing gain – the increased cash flow available for distribution over the remaining years of the project – was calculated as £33.4 million in net present value terms.

2.10 After applying the voluntary code the NPV gain was allocated: £21.7 million to THC Dartford's shareholders and £11.7 million to the Trust (Figure 10).

2.11 Key features of the refinancing from the perspective of THC Dartford's shareholders were:

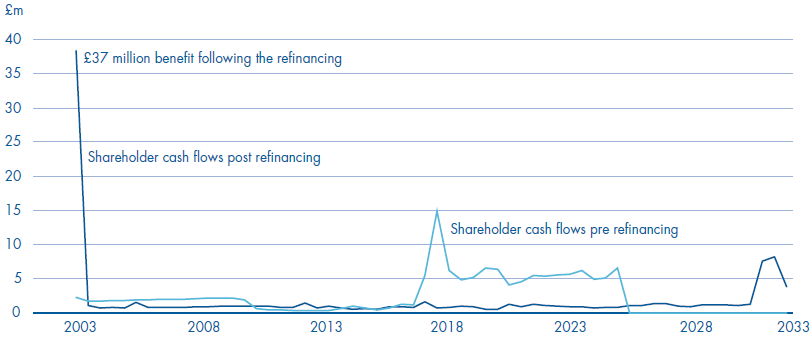

■ THC Dartford's shareholders were able to accelerate the benefits that they withdrew from the project. Following the refinancing they realised, within three years of the hospital opening, a financial benefit from the project of £37.4 million, a benefit not included in their financial plans at contract letting. They were able to realise £37.4 million immediately following the refinancing by agreeing that they would take lower shareholder benefits than they had previously been projecting over the remainder of the contract (Figure 11 overleaf). The net effect, in the long run, would be to leave the shareholders with the gain in present value terms of £21.7 million following the refinancing.

■ The immediate distribution to shareholders of £37.4 million following the refinancing was substantially more than the total shareholder returns over the 28 year contract period which THC Dartford had projected in its financial model when the contract was let. Discounted from the date of the refinancing the present value of those projected returns (based on the discount rate of 21 per cent nominal used in the financial model) was £20.9 million.

10 | Summary of the refinancing |

This figure shows that by taking on higher borrowings over an extended period THC Dartford achieved a refinancing gain (in net present value terms) of £33.4 million. The Trust will receive just over a third of the gain mainly by way of lower annual contract payments. THC Dartford shareholders receive two-thirds of the gain. They have taken this and further amounts as an immediate accelerated distribution at the expense of reduced distributions later in the contract period. | |

| |

NOTES 1 The borrowings increased by 54 per cent following the refinancing. 2 The refinancing gains were evaluated at a discount rate of 15 per cent (nominal). | |

■ The total benefits to THC Dartford's shareholders over the life of the contract are now expected to be £51.0 million in present value terms based on the 15 per cent nominal discount rate agreed for calculating the refinancing gains. Using the same discount rate this represents an increase of 74 per cent compared to the shareholder returns of £29.3 million THC Dartford projected prior to the refinancing (Figure 12 overleaf). Based on the same discount rate and excluding the refinancing benefit, the shareholders' expected returns at the time of the refinancing had reduced by £2.2 million from their expectations at contract letting. Following the refinancing the shareholders' returns are 62 per cent higher than their anticipated returns when bidding for the contract.

■ The internal rate of return to THC Dartford's shareholders over the contract period is now expected to be 56 per cent nominal compared to 21 per cent nominal which THC Dartford had predicted when bidding for the contract (Figure 12). The internal rate of return is not an indication of the future rate of annual returns which the shareholders anticipate realising from the project but reflects the time value of when benefits are received. It is particularly sensitive to benefits taken early in a project's life such as the large benefits realised following the THC Dartford refinancing. An alternative evaluation by THC Dartford of the benefits to its shareholders in present value terms is also set out in note 1 to Figure 12.

11 | Change in profile of shareholder benefits following the refinancing |

| |

Source: Ernst & Young (the Trust's financial advisers on the refinancing) based on THC Dartford information | |

12 | How the refinancing has accelerated and increased THC Dartford shareholders' benefits in present value terms |

This figure shows that the total benefits the shareholders now expect over the life of the contract are £51.0 million in present value terms, an increase of 74 per cent over what they were expecting prior to the refinancing calculated using a 15 per cent discount rate. Evaluation at the agreed 15 per cent nominal discount rate at the time of the refinancing1 | |||||

| At contract letting | Pre- | Post | Refinancing | % Gain from refinancing |

Refinancing distribution in 2003 | - | - | 37.4 | 37.4 |

|

Other projected distributions over contract period | 31.52 | 29.3 | 13.6 | (15.7) |

|

Total projected distributions (in NPV terms) | 31.5 | 29.3 | 51.0 | 21.7 | 74% |

Funds invested by the shareholders | 13.4 | 13.4 | 13.4 | 13.4 |

|

Projected internal rate of return3 | 21%4 | 23% | 56% |

|

|

Source: THC Dartford | |||||

NOTES 1 THC Dartford has informed us that although it agreed through negotiation at the time of the refinancing that a 15 per cent nominal discount rate would be used to determine the refinancing gain its internal calculations are based on a 10 per cent nominal discount rate. Using a 10 per cent nominal discount rate THC Dartford calculate the present value of its returns to its shareholders following the refinancing as £57.2 million compared to £43.3 million prior to the refinancing. This represents an increase to THC Dartford's shareholders' returns arising following the refinancing of £13.9 million compared to the increase of £21.7 million calculated using the negotiated 15 per cent nominal discount rate. 2 In our earlier report on the PFI Contract for the new Dartford & Gravesham Hospital (HC 423 1998-99) the expected shareholder returns shown in Figure 9, page 37 were £25.7 million. That was on the basis of 1996 prices at a discount rate of 21 per cent nominal, being the shareholders expected rate of return disclosed in THC Dartford's bid information. The figure of £31.5 million shown above is on the basis of prices at the time of the refinancing in 2003 at the negotiated 15 per cent nominal discount rate used for calculating the refinancing gain. On the basis of 2003 prices and a 21 per cent nominal discount rate the returns to shareholders at contract letting were £20.9 million. 3 The internal rate of return to shareholders is the standard measure which the public sector has used to compare the returns expected by shareholders of consortia bidding for PFI contracts. It is not an indication of the future rate of annual returns which the investors in THC Dartford anticipate realising from the project but reflects the time value of when benefits are received including the benefits realised immediately following the refinancing. The increase to 56 per cent following the refinancing reflects the high value of receiving large returns early in the contract period. 4 This is the original internal rate of return projected by THC Dartford when bidding for the contract. | |||||

■ In simple cash terms the shareholders projected total receipts from the project fell from £187 million to £117 million following the refinancing. This is acceptable to the shareholders because they place particular value on the immediate benefit of £37.4 million which they can reinvest to generate further income which is reflected in the increased internal rate of return and the higher value of the returns in present value terms following the refinancing. A year by year analysis of the benefits to THC Dartford shareholders in both cash and present value terms is set out in Appendix 3.

2.12 Because this first PFI hospital contract was, at the time it was let, breaking new ground both the Trust and THC Dartford were exposed to risks which had not occurred in previous projects to build new hospitals. There are, therefore, no direct benchmarks from previous experience for what a reasonable rate of return to private sector shareholders should be on this project. In part, THC Dartford's benefits following the refinancing can be considered as a reward for successfully managing the risks of bringing this first PFI hospital into operation. The Department would not, however, expect private sector shareholders on more recent PFI hospital contracts to make the level of returns which have accrued to THC Dartford's shareholders because better financing terms can be obtained at the outset and be reflected in the contract price. The Department, taking a view across all its PFI projects, also expects the private sector to bear losses on PFI contracts where they arise. An example is the Dudley hospital where the contractors Sir Robert McAlpine reported losses of £27 million in the two years to 31 October 2003.

2.13 Following the refinancing, Carillion plc, whose operating companies had built the new hospital and are responsible for the ongoing facilities management services, also sold its investment in THC Dartford. Carillion sold the £4.1 million investment it had made in 1997 to Barclays Infrastructure Ltd, a general partner of Barclays UK Infrastructure Fund LP, one of the other shareholders in THC Dartford, for £5.2 million in November 2003. Benefits from the earlier refinancing, together with the proceeds of the sale of its investment, provided Carillion with £16 million from the project which contributed to the net exceptional profit of £11.2 million on its investment in the project which Carillion plc reported in its 2003 accounts. This was equivalent to an annual rate of return on Carillion's investment of around 50 per cent. Carillion previously told the Committee of Public Accounts it was normally looking for a return of 15-17 per cent on its investment in PFI hospitals. But Carillion emphasises, however, that its returns on successful projects need to be at a level to offset the effect of projects which do not go to plan. On this project, although Carillion gained on its investment in the project, it incurred higher than expected costs and only broke even on its construction work. The additional construction costs were not passed on to the Trust.

2.14 The extent to which contractors have funds available to invest in projects is a factor which contributes to whether they will enter bidding competitions for new projects. Carillion informed us that it has a policy of selling its equity interests in mature projects and reinvesting in new projects. It currently expects to invest over £20 million in five new PFI projects where it is part of private sector teams which have been selected as preferred bidders.

___________________________________________________________________________

13 £85.9 million was outstanding out of the original bank debt of £98.2 million.