The calculation of the refinancing gains

2.17 The Treasury had issued guidance to departments in October 2002 on how refinancing gains should be calculated. This guidance was referred to in the code but had not been fully accepted by the private sector when the code was published in October 2002. The private sector had concerns about the Treasury's proposal that refinancing gains should be calculated using as a discount rate the investors' rate of return set out in the base cases the private sector submitted when bidding for the PFI deals.

2.18 As a result of the private sector concerns, in this early refinancing under the new code, THC Dartford challenged the 21 per cent nominal discount rate proposed by the Treasury based on THC Dartford's rate of return for its investors set out in its bid information. THC Dartford considered that using the Treasury's proposed 21 per cent nominal discount rate would require THC Dartford to allocate to the Trust an unreasonably high amount from the refinancing given the risks THC Dartford had borne in taking forward this pathfinder deal. THC Dartford proposed a discount rate of 10 per cent nominal which it uses as its target reinvestment rate of return. The Department and the Treasury agreed, after extensive negotiation with THC Dartford, to a compromise that the discount rate would be 15 per cent nominal. The Department and the Treasury considered this was the best outcome which could be achieved on this refinancing and was in line with the basis for calculating refinancing gains they expected to achieve on future refinancings.

2.19 If the 21 per cent nominal discount rate for this deal (the rate required to be consistent with the Treasury guidance) had been adhered to it would, other things being equal, have increased the amount of refinancing gain to the Trust by £1.4 million. Further information on the negotiations over the discount rate is set out in Appendix 4. The Trust's financial advisers, Ernst & Young consider, based on discussions with THC Dartford, that THC Dartford would, however, have sought to recover from the Trust a £1.2 million reduction in benefits from taking the refinancing gains over time (Figure 13) if the Trust had sought to increase its share of the refinancing gains by using a 21 per cent nominal discount rate.

13 | The allocation of the refinancing gains agreed by the Trust and THC Dartford |

| THC Dartford | Trust | Total |

Without contract extension (70/30) | 18.3 | 7.8 | 26.1 |

From contract extension (50/50) | 4.6 | 4.6 | 9.2 |

Adjustment from taking gains over time | (1.2) | (0.7) | (1.9) |

Total | 21.7 | 11.7 | 33.4 |

Source: NAO (based on analysis by Ernst & Young, the Trust's financial advisers on the refinancing) | |||

NOTES 1 The above figures are expressed as net present values based on the negotiated discount rate of 15 per cent nominal used for calculating the refinancing gains. 2 The adjustment from taking gains over time arose because, after taking account of the interest THC Dartford would pay to the Trust on its deferred share of the refinancing gain, THC Dartford was not able to raise as much debt, or generate as great a refinancing gain, as would have been possible if the Trust had taken the refinancing gain as a lump sum. | |||

2.20 The Department and the Treasury consider they achieved a very good outcome from these negotiations over the discount rate to be used in calculating the refinancing gains. They believe it was the best deal for the Trust that could have been secured on this first hospital refinancing under the refinancing code. They also consider that it moved the market by establishing a satisfactory marker with the private sector for the type of discount rate to be used in calculating the gains arising from future refinancings (which were expected to involve deals where bidders' base cases had often assumed a rate of return of between 15 and 17 per cent nominal). The Treasury Refinancing Taskforce notes that, subsequent to the Darent Valley hospital refinancing, the private sector has accepted the calculation of subsequent refinancing gains on other deals using discount rates in line with the Treasury's guidance.

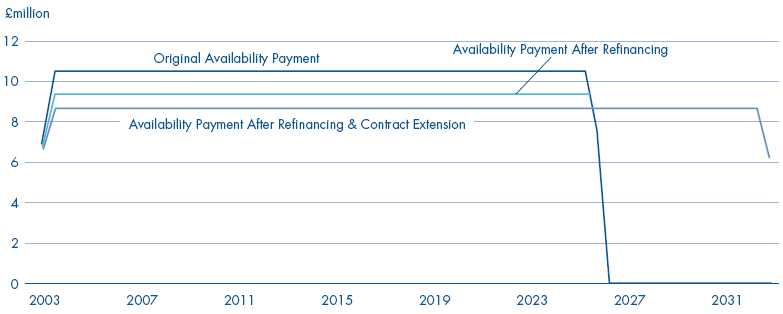

14 | Revised availability payments in real terms to be made by the Trust as a result of the refinancing and the contract extension |

| |

Source: Ernst & Young, the Trust's financial advisers on the refinancing | |

NOTE The graph is presented in real terms. In cash terms, after taking account of inflation, the total reduction to the Trust's annual PFI payments arising from both the contract extension and the refinancing is around £2 million. | |