A consequence of these arrangements was that the Trust could become liable for some or all of THC Dartford's increased debt taken on to facilitate the refinancing

2.46 Following the refinancing the Trust's commitment to making payments in the event of contract termination continue to be important to ensuring that THC Dartford's outstanding debt will be repaid if the contract is terminated (Figure 18). This is in a situation where THC Dartford's debt has increased by £46 million to enable THC Dartford's shareholders to draw accelerated benefits from the project and for the Trust to share in those benefits.

2.47 The Trust's termination liabilities may now include not just the borrowings used to build the hospital or to provide a refinancing benefit to the Trust, but part or all of the additional borrowings which THC Dartford has used to pay its shareholders accelerated benefits from the project. The Department considers that it would not have been possible for THC Dartford to complete the refinancing, and that the refinancing gain would certainly have been lower, from which the Trust stood to benefit, if the Trust had not agreed to these termination arrangements. Other approaches which could have further restricted the Trust's exposure to termination liabilities, but which may have reduced the refinancing gain which could be generated, would have been to seek to negotiate either of the following arrangements:

■ That the termination liabilities would not increase above the levels the Trust accepted at the time the contract was let.

■ That the termination liabilities in future would be calculated as the market value of the contract at termination (the recommended basis now set out in the Treasury and the Department's standard PFI contract terms).

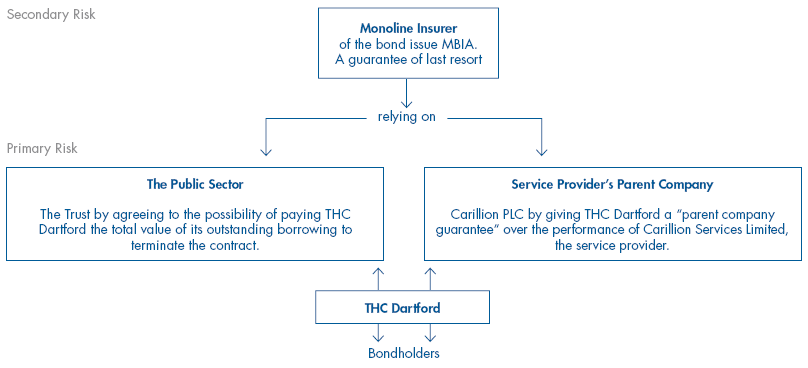

18 | The parties that have given guarantees to safeguard the repayment of the new finance provided by bondholders |

| |

Source: The National Audit Office | |

NOTE THC Dartford's ability to repay the bondholders is safeguarded by guarantees given by Carillion PLC and MBIA, the monoline insurer. The Trust's obligation is particularly important as it has agreed to the possibility of being liable to pay THC Dartford the full value of its outstanding borrowings in the event of contractor default. | |