Why the Department restructured the deal

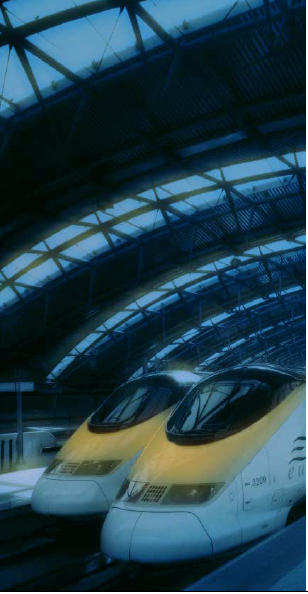

5 The original deal combined construction of the Link with the privatisation of what was at the time a relatively new Eurostar UK train service to Paris and Brussels. It rested on LCR's forecasts that Eurostar UK would grow quickly enough for the revenues generated to support the raising of private finance to cover the heavy costs of constructing the Link. Ahead of a main finance raising exercise, the Department agreed to support initial borrowing by LCR of over £400 million from a syndicate of banks. LCR's original shareholders put up £60 million of equity finance (paragraphs 1.1 to 1.10).

6 In the event, Eurostar UK performed much less well than expected and LCR was unable to continue on the original plan. The Department encouraged LCR to seek other ways of carrying on with the project, and LCR held initial discussions with Railtrack in 1997. Finding that it was not possible to reach agreement with Railtrack LCR approached the Government seeking additional direct grants, before its finances were exhausted (paragraphs 1.11 to 1.26).

7 The Department rejected the option of simply agreeing to pay additional grants and made it clear to LCR that it wanted the Link completed without a material increase in the size of the direct grants. The Department was also unwilling to dispense with LCR and begin the process of selecting a private sector partner all over again. Such a move would have involved a further delay of at least two years and prolonged the planning blight, which had affected properties near the route of the Link (paragraphs 1.27 to 1.32).

8 The Department therefore decided to restructure the deal with LCR. The Department's key objectives for the restructuring were:

a) to ensure that the Link would be built without a material increase in the level of direct grants agreed in the original deal;

b) to inject new private sector management into Eurostar UK;

c) to ensure that the parties to a restructured deal would be financially committed to it and financially strong enough to meet their obligations; and

d) to achieve a true Public Private Partnership with each risk allocated to the party best able to manage it and with rewards commensurate with the risks.

9 The Department achieved its key objectives during the restructuring and the restructured deal is in many respects more robust than the original:

financing the construction of the first Section of the Link is no longer dependent on the performance of Eurostar UK

a) Apart from payments of direct grants, the finance for Section 1 now comes from two sources: commercial bank borrowing by LCR which has been guaranteed by Railtrack, and an issue of bonds by LCR which carry a Government guarantee (paragraph 1.34).

construction risk remains with the private sector

b) Because Railtrack will manage the construction of Section 1 and purchase it at a price linked to the actual cost of construction, the construction risk was allocated to a party that was considered capable of managing it and was strong enough to meet the financial obligations involved (paragraphs 1.35 to 1.37).

there are improved arrangements for sharing Eurostar UK revenue risk

c) Eurostar UK is now being managed by a private sector company appointed by LCR, Inter Capital and Regional Railways Limited (ICRR). The management fee paid to ICRR is a percentage of Eurostar UK turnover, adjusted by a sharing of operating cashflow risk with LCR (paragraphs 1.38 to 1.40).

the Department has improved its monitoring of the project

d) Under the original deal, the Department decided not to demand all the information it was entitled to under the contract with LCR. This decision hampered the Department's ability to monitor progress and at the same time denied the external financiers at the early stages of the project the opportunity to bring private sector financial disciplines to the deal. In the restructured deal, the Department now has considerable influence on the way the whole project is being managed. It has a special share in ICRR; it is a co-signatory to the contract between Railtrack and LCR and the Department has appointed a director to the board of LCR. In addition, the Department is actively monitoring the performance of LCR and the other parties to the project (paragraphs 1.41 and 1.42).

financing for Section 2 of the Link is yet to be secured

e) Railtrack has an option to purchase Section 2, but no obligation to construct it. LCR is contractually committed to construct Section 2, but may not offer the right to acquire Section 2 to anyone other than Railtrack prior to the expiry of the option in 2003 or Railtrack's agreement to surrender it earlier. As a private sector company reliant on its trading income from the Link, LCR cannot guarantee to be able to raise the necessary finance for Section 2 when it is required (paragraphs 1.43 to 1.45).

f) The Department is discussing the arrangements for Section 2 of the Link with LCR, Railtrack and other parties with the intention of concluding a deal very soon. The National Audit Office is monitoring developments and may report further if necessary (paragraph 1.46).