In the light of lower than expected growth in Eurostar UK revenues the project was not seen as a good investment

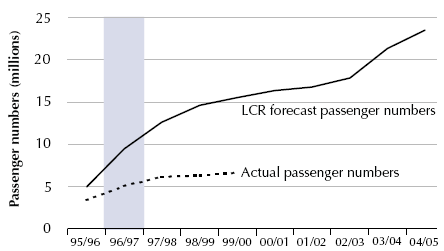

1.11 LCR forecast that in 1996-97, Eurostar UK's second full year of operation, 9.5 million passengers would use the train service. The actual number of passengers using the service in that year was 5.1 million (Figure 6). As the actual performance of Eurostar UK was significantly lower than that forecast and with expected growth for 1997-98 being less than forecast, LCR realised that the Link would not be viewed as a good investment.

1.12 When the Department was evaluating bids, much depended on the bidders' forecasts. As the evaluation would favour the bidder demanding the lowest level of direct grants there was an in-built incentive to take an optimistic view of future demand for the Eurostar UK service. Although the inclusion of private finance in a project can be seen as a means of tempering undue optimism, at the first stage financing of this project there were two structural features that checked the need for detailed scrutiny of passenger forecasts by investors. The first was the Department's support for debt repayments in the Direct Agreement. Although such support was needed if LCR was to raise debt, it also effectively eliminated the need for the lending banks to satisfy themselves that the project could repay the loan. The second concerned the level of equity invested by LCR's shareholders. LCR's shareholders subscribed £60 million, just over 12 per cent of the total stage 1 finance. This equity comprised £30 million of capitalised tender costs and £30 million in cash. Since all the shareholders were also suppliers to LCR, there is some doubt as to whether the value of the equity at risk was sufficient to balance the shareholders' interest in becoming major contractors to the project. LCR expected that project development costs amounting to £92 million would be paid to its own shareholders in the period leading up to the planned flotation in October 1997.

6 |

| LCR's original forecast of Eurostar UK passenger numbers |

Source: LCR

1.13 The reliance on optimistic forecasts was not the only factor that undermined LCR's attempts to convince potential investors that the project was a sound investment opportunity. LCR experienced difficulties marketing Eurostar UK to the widest audience of potential passengers. These difficulties stemmed from the operation of the train service being the responsibility of three different companies, each one responsible for the service within the national boundaries of the three countries served by the business. SNCF and SNCB, the State-owned companies responsible for domestic rail services in France and Belgium respectively, are the two other companies that run the Eurostar international train service. Eurostar UK, by contrast a private company whose sole business is the operation of the UK arm of the international passenger train service, experienced difficulties convincing SNCF and SNCB to adopt vigorous and co-ordinated marketing strategies.

1.14 Eurostar UK also encountered competition that LCR and the Department did not foresee. All the forecasts anticipated that demand on the London to Paris route would continue to grow at historic rates and that Eurostar UK would draw a considerable number of passengers from the airlines. The rate of growth in demand for Eurostar UK has slowed considerably because the growth of low-cost airlines, competing on cost but also offering more choice of destinations, has drawn leisure travellers away from the traditional London to Paris route. Moreover, the adverse impact of low cost airlines has gone beyond suppressing growth in passenger numbers, it has also restricted the ability of Eurostar UK to increase fares for leisure travellers.

1.15 The Channel Tunnel fire in November 1996, just over five months after LCR took over Eurostar UK severely disrupted Eurostar services for two months and continued to impact upon the efficiency of the service for a further five months. The Department considered that the fire would delay LCR's proposed flotation by the amount of time needed for passenger demand to pick up, following the resumption of full operations.