LCR could only issue bonds to investors on the back of a Government guarantee

2.4 In the Department's view, the problems surrounding the refinancing of the Channel Tunnel had made large infrastructure projects unappealing to investors and there was a perception, which is wrong but still exists, that the Tunnel and the Link are one and the same project. Against this background and the uncertainty over the future performance of Eurostar UK, LCR considered that it would be impossible to raise fresh equity to allow construction of the Link to begin in October 1998. The alternative of raising finance entirely from bank debt was highly unlikely for a number of reasons. First, a syndicated loan of as much as £4,000 million would have been unprecedented in the debt markets. Second, a financing structure involving only debt would have been unacceptable to lending banks, as LCR's ratio of debt to equity would have been too high. Third, assuming such a large amount could have been raised, LCR considered that investors would demand very high levels of interest to compensate them for the risks involved.

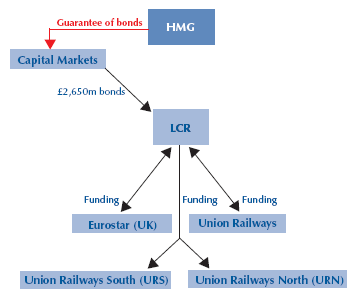

2.5 The cost of finance was important because the level of interest paid on borrowing had been a significant factor in LCR's response to the Government's position that the Link should be built without any material increase in the level of grants agreed for the original deal. To achieve this, LCR had assumed bond financing with a Government guarantee to investors that they would be paid interest and that their capital would be repaid. Such a guarantee would enable LCR to approach the market with certainty that funds would be raised and at much lower interest rates than would otherwise be the case. The Department agreed with LCR that assistance would be needed in raising finance and, following intensive negotiations, the Government provided a guarantee of the payment of interest and repayment of principal on up to £3,750 million of LCR bonds to help finance both sections of the Link. Financial Close 2 took place in February 1999, following the issue by LCR of an initial tranche of £2,650 million of bonds guaranteed by the Government (Figure 11).

11 |

| To fund Section 1 of the Link and Eurostar UK, LCR issued bonds backed by a Government guarantee |

2.6 The issue of fixed interest long-term bonds to finance a construction project is somewhat unusual. Given the potential for variations in the timing and amount of cash required in a construction project, the flexibility to draw down loans as and when needed can help to reduce the cost of funding. We therefore asked RBC Dominion Securities to examine the availability and cost of funds in the financial markets in late 1998 and early 1999 and to compare this with the terms obtained by LCR in the bond markets. The conclusion is that the bonds represented good value in terms of the interest paid compared with what was available in the markets at the time. Furthermore, there are material doubts as to whether it would have been possible to raise all the financing required from the loan market (Appendix 5, paragraphs 1-20).