LCR's original shareholders have not provided new equity finance but retain an economic interest in the project

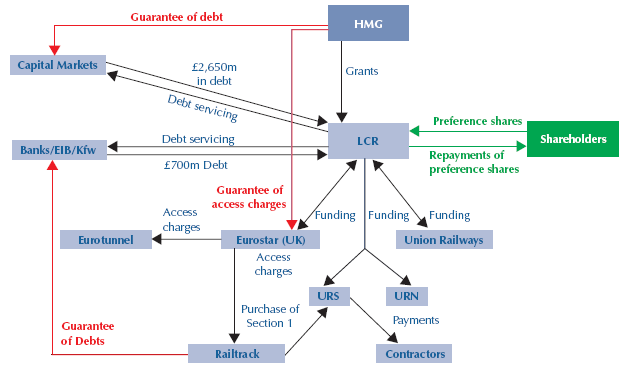

2.13 One of the Department's objectives for the restructuring of the deal was to remove the existing shareholders from management control but require them to maintain an economic interest in the success of the project. The original shareholders with a continued fixed interest in LCR have converted 95 per cent of their equity stake into preference shares. The preference shares accrue interest at 7 per cent a year from February 1999 (Financial Close 2) and will be repaid 50 per cent on completion of Section 1 (the scheduled repayment for this stage will be £37million, including the rolled up interest) and 50 per cent on completion of Section 2. The remaining 5 per cent of their original investment will remain at risk as ordinary shares. LCR's original shareholders did not therefore lose their original investment and did not contribute any further equity to the project (Figure 14).

2.14 As the shareholders stood to receive different financial benefits from the restructured business, it was considered that they would need an incentive to approve the restructuring. It was therefore intended that the original shareholders would convert their entire equity to preference shares and new ordinary shareholders would be brought in. However, new shareholders would have required an incentive to purchase shares in LCR, given the uncertainty of receiving dividends in the near future. It was proposed that the new shareholders should be allowed to purchase the considerable tax losses that had built up in LCR since 1996 at a reduced price in order to provide a return in the short term. However, prospective investors would not buy LCR shares without an assurance that such tax losses could be bought and used elsewhere. Such an assurance was refused by the Inland Revenue on general taxation policy grounds.

14 |

| LCR shareholders did not provide new equity but retain an interest in the project |

2.15 Some of the original shareholders and their associated businesses have made and may make further profits through alternative routes. For instance, Bechtel will receive 40 per cent of any savings on the target construction cost for Section 1, up to a maximum specified level. Bechtel will also take a share of what the Department's advisers considered were higher than normal project management fees charged by Rail Link Engineering and agreed during wide-reaching negotiations on the restructured deal. SBC Warburg Dillon Read was joint corporate finance adviser with Deutsche Bank to LCR, joint lead bookrunner on the sale of the GGBs and the joint arranger with Deutsche Bank of swaps for the LCR interest rate hedging strategy.