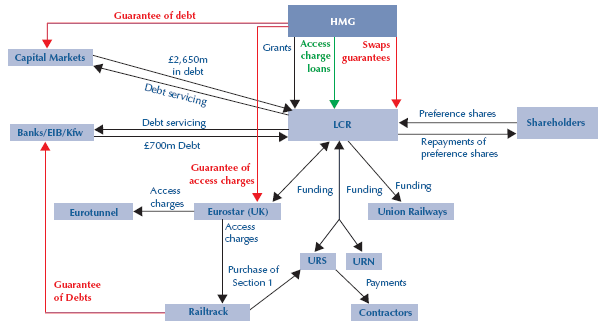

The Government has also guaranteed LCR's potential liabilities on the swaps used to hedge interest rates

2.29 LCR had to consider whether to take action to hedge against future changes in interest rates. Under the terms of the agreements entered into between LCR and Railtrack, LCR has the equivalent of a fixed interest rate receivable in the form of Railtrack's obligation to pay 7 per cent a year on monies provided by LCR to fund the construction of Section 1. The underlying source for this lending is the £1,000 million in proceeds from the issue by LCR of the GGB at a fixed interest rate of 4.75 per cent a year maturing in 2010. However, the actual amount of interest paid by Railtrack to LCR is not fixed and will depend on progress against the construction profile of Section 1 and the exercise of the flexibility allowed to Railtrack in the agreement with LCR governing the timing of the sale of Section 1.

2.30 Railtrack has to purchase Section 1 within one year of completion or by 30 September 2005 or, failing completion of construction, by 31 December 2010. If, as expected, Railtrack purchases Section 1 before the GGB matures in 2010, LCR will have to invest the proceeds at what could be lower rates of interest than had been assumed underpinning the restructured deal. A lower level of interest income could therefore necessitate an increase in the amount of money lent by the Department to LCR to maintain its ability to pay Eurostar UK access charges. On the basis of market expectations for future inflation and associated interest rate changes, SBC Warburg Dillon Read estimated that any additional call on public funds could amount to between £150 million and £300 million.

2.31 The Government and LCR agreed that exposure to a fall in the interest earned on LCR's cash deposits should be hedged through appropriate interest rate swaps. A series of interest rate swaps were therefore put in place by LCR to convert the variable receipt from Railtrack and the fixed interest paid on the 2010 bond to floating rates and maintain the interest rate margin of 2.25 per cent a year LCR would earn as if the timing and quantum of the asset and liability were matched. LCR was responsible for appointing the banks that transacted the swaps and chose SBC Warburg Dillon Read (for two thirds of the business) and Deutsche Bank (for the remaining one third). LCR considered that SBC Warburg Dillon Read had undertaken a significant amount of work in preparation for likely interest rate swaps transactions and, having shared this work with Deutsche Bank, a joint proposal was made by the banks. On the basis of the respective amounts of work undertaken by the banks, LCR determined the split of business between them.

2.32 Benchmarking the price of swaps is difficult in such a large transaction. The Department, through its financial adviser, therefore put in place measures to police the swaps transactions and monitor their pricing in order to ensure that good value would be obtained. Given the complexity of the long-term credit rating of the project, the banks would only enter into interest rate swaps with LCR if it set aside sufficient cash to meet potential payments under the swaps or the Government agreed to guarantee LCR's obligations. The swaps were entered into following the issue of the GGBs on the basis that LCR provided cash collateral in the short term. For the longer term, the Government agreed to provide a guarantee over the remaining life of the swaps, subject to the outcome of a European Commission review of state aid implications. This approach was preferable to the alternative of LCR providing long-term cash collateral of around £150 million, which could have undermined the refinancing plan if, in particular, Eurostar UK revenues did not meet expectations.

15 |

| The Department will lend money directly to LCR and will guarantee potential |

Note: | The swaps guarantees will be provided to LCR once the Department has obtained state aid clearance from the European Commission |

Source: |