But the taxpayer is entitled to future dividends and could sell LCR if Eurostar UK is successful in attracting expected levels of patronage

2.33 In return for Government guarantees and the access charge loan facility, LCR is not allowed to pay dividends on ordinary shares until at least 2021. In the event that LCR is performing well and no longer needs to borrow under the access charge loan facility, the restriction on dividend payments prior to 2021 may be lifted, provided all accumulated borrowing and interest thereon has been repaid. From 2021, the Government is also entitled to receive 35 per cent of LCR's pre-tax cashflow.

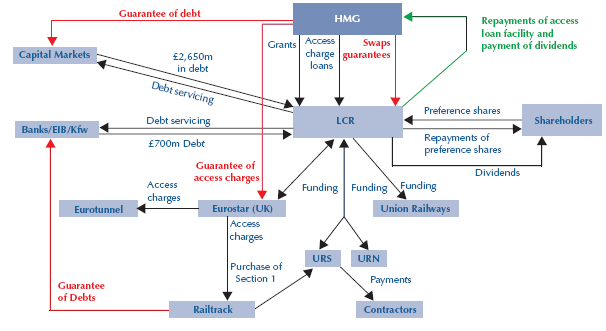

This cashflow is first applied to repay any loans outstanding under the access charge loan facility and then is effectively a dividend to Government for providing additional support to LCR. The quantification of these estimated returns is highly subjective, but the Department has estimated that they could be worth some £250 million (Figure 16).

16 |

| The taxpayer is entitled to share in future dividends from LCR |

Note: | The swaps guarantees will be provided to LCR once the Department has obtained state aid clearance from the European Commission |

Source: |

2.34 The Department also has a right of veto over a sale of LCR before 2011 and may force the sale or flotation of LCR at any time. On a sale or flotation, the Government would receive 90 per cent of the proceeds, with the remainder (subject to a cap) going to the original shareholders.