General conditions

2. The Euroloan market is priced at a margin (the profit on the transaction) over the relevant inter-bank offered rate, e.g. LIBOR, EURIBOR. The inter-bank offered rate is that at which banks lend to each other in the deposit market and in theory the rate at which banks fund their loan portfolios. The stronger banks fund below that rate through a combination of customer deposits and alternative fund raising methods.

3. As a United Kingdom domiciled borrower, fund raising by LCR in the Euro-loan market would be in the context of prevailing conditions in the Western European sector and the United Kingdom sector in particular. A brief analysis of the type of borrower, the business and industries, and the loan purpose in these two geographies is worthwhile.

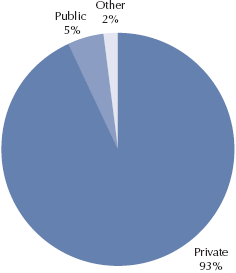

4. The majority of borrowers in Western Europe are private, accounting for 88.9% of volume in 1997 and 93.5% in 1998. In the United Kingdom, almost all borrowers are private sector/corporates, project finance and PFI (Figure 22). The lack of sovereign/state agency borrowers is not a reflection of the lack of appetite amongst lenders for this sector but a reflection of the cheaper, alternative funding sources available to these borrowers.

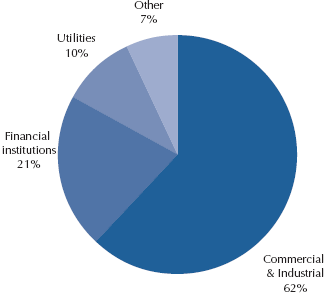

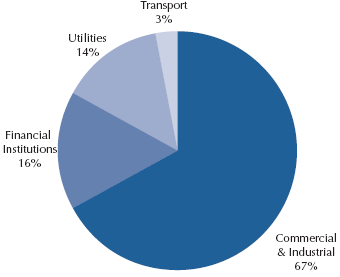

5. A further analysis of the Western European and United Kingdom geographies by business type reinforces the commercial private sector nature of the typical borrower with the state sector taking almost no part (Figures 23 and 24).

22 |

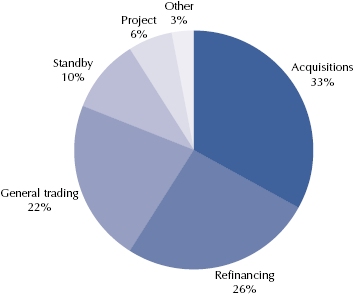

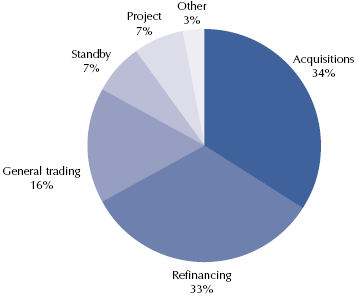

| Loans by borrower type: Western estern Europe 1998 |

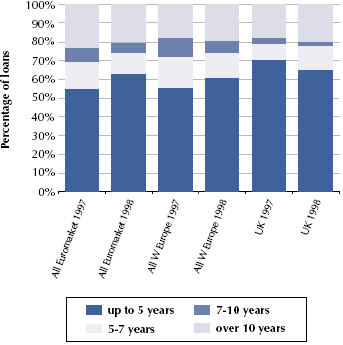

|

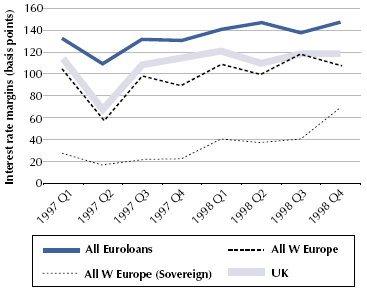

|

|

|

| Source: Capital DATA Ltd |

23 |

| Loans by business type: Western Europe 1998 |

|

|

|

|

| Source: Capital DATA Ltd |

24 |

| Loans by business type: UK borrowers 1998 |

|

|

|

|

| Source: Capital DATA Ltd |

6. During 1998, acquisition-related facilities grew from US$89.7 billion equivalent to US$107 billion equivalent. Project financing volume edged up slightly from US$19.2 billion equivalent to US$19.9 billion equivalent in 1997 and 1998, reflecting the continued appetite amongst lenders for structured, higher margin assets (Figure 25). This trend was reflected in the United Kingdom, where project financing rose from US$7.2 billion equivalent in 1997 to US$11.6 billion equivalent in 1998. Despite this increase, and the decline in overall volume, project financing as a percentage of borrowings in the United Kingdom only increased from 5% of total to 7% (Figure 26).

25 |

| Loans by purpose: Western estern Europe 1998 |

|

|

|

|

| Source: Capital DATA Ltd |

26 |

| Loans by purpose: UK borrowers 1998 |

|

|

|

|

| Source: Capital DATA Ltd |

7. Across the market as a whole, maturities of less than 5 years increased in proportion to the total volume. The trend was less marked in the stronger economies of Western Europe, and the exception to the rule was the United Kingdom where the proportion of under 5 year maturities fell slightly, along with the virtual demise of the 7-10 year maturity. The changes are shown in Figure 27 below.

27 |

| Maturity trends in the Euroloans market 1997 and 1998 |

|

|

|

|

| Source: Capital DATA Ltd |

8. Average pricing in the Euro-loan market has risen in general since the middle of 1997 but the withdrawal and in some cases, exclusion, of many emerging market borrowers during 1997 and 1998 who traditionally borrowed at higher rates disguises the steep rise seen in margins paid by those still active. The sudden pick up in pricing can be clearly seen in the averages for all Western European and all United Kingdom borrowers and is a truer reflection of the market. By the end of 1998, average corporate pricing had risen by almost 65% from a low point in the middle of 1997 (Figure 28).

28 |

| Pricing trends in the Euroloans market 1997 and 1998 |

|

|

|

|

| Source: Capital DATA Ltd |