Margins

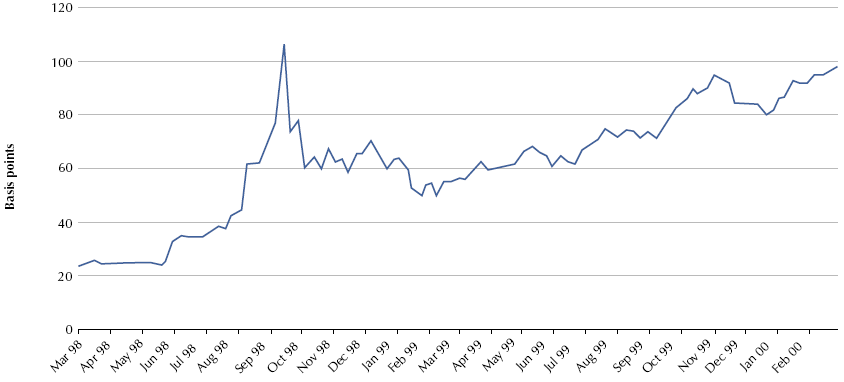

27. A general fear in the credit markets caused swap spreads to widen in Q3 1998. This prompted a flood of AAA issuance in Q3-4 1998, as highly rated agencies borrowed in the bond markets and swapped the funds to raise sub-LIBOR funding. Figure 29 overleaf illustrates the severe widening of credit spreads at the height of the crisis when LTCM was in difficulties and how spreads remained wider into 1999.

29 |

| European Investment Bank 6% Eurosterling Bonds 2028, interest rate margin over 6% Treasury Stock 2028 |

|

|

|

|

| Source: Capital DATA Ltd |

28. Given the disrupted market conditions when the decision to issue the GGBs was taken, it was reasonable to argue that only the highest quality bonds would have been bought by investors in large volume.