Volumes

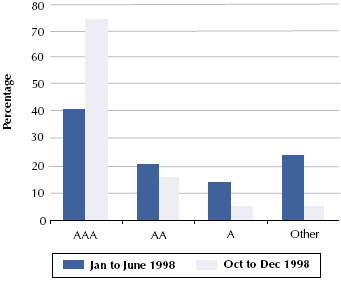

29. Figure 30 below shows that in the last quarter of 1998 almost 75% of the new issues were for AAA names, and 90% for AAA and AA names. This compares with the first half of the year where AAA fixed rate issuance was less than 50% of the total.

30 |

| New fixed-rate sterling issues: investment ratings |

|

|

|

|

| Source: RBC Dominion Securities |

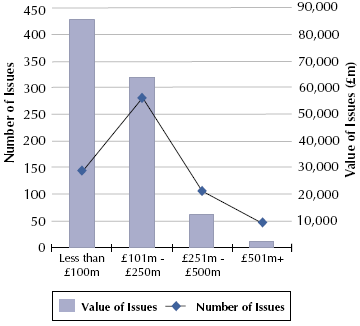

30. It is highly unlikely that in Q4 1998 or Q1 1999 any large issue (over £500 million) could have been launched at an aggressive price without a AAA credit rating. Indeed, even in calm market conditions it is difficult to launch very large amounts of bonds into a single part of the yield curve. Figure 31 below shows a distribution of tranche sizes in the sterling market (fixed rate and floating rates) since 1997. It is clear that issues in excess of £500 million are rare.

31 |

| Sterling bond issues since 1997 |

|

|

|

|

| Source: RBC Dominion Securities |

31. Two other large sales of UK Government assets to the private sector had been funded in the bond market in the last few years, with funding taking place on a single day. These were Annington Homes which launched over £900m of AAA-rated bonds in three different tranches to fund the purchase of MOD Married Quarters Estate and FRESH, the vehicle used to purchase the Housing Corporation Loan Portfolio. FRESH raised over £1,000 million of bonds on one day in 8 tranches, the largest of which were AAA-rated. Both Annington Homes and FRESH were launched into comparatively benign market conditions.