Cost differential between AAA-rated debt

40. The Government's advisers clearly identified that the cost to the public sector of providing a guarantee was not the net present value of the risk margin on the bonds above Gilts. Rather, the cost was the amount of other support Government had to provide to LCR as a result of higher funding costs (e.g. in access charge loan facilities) and, in extremis, the cost of any calls on the guarantee.

41. The extent of these costs and their degree of contingency were dependent on LCR meeting or improving on the Department's base case projections. We understand that extensive stochastic analysis had been carried out on the traffic forecasts and it was concluded that the likelihood of a call on the guarantee was low. Timely payment of the bonds is also dependent on the receipt of purchase proceeds from Railtrack for each section of the Link. The likelihood of Railtrack meeting its obligations should be reflected in its credit rating. Railtrack's gearing is also taken into account by its regulator, who has an interest in the company retaining a sound credit rating and continuing access to the debt markets.

42. It was important, therefore, to minimise LCR's cost of funds in order to keep the secondary government support as low as possible and to minimise the financial risks within LCR. This section illustrates that AAA bonds of identical credit risk do not necessarily trade at the same spread and puts the GGB pricing into the context of other risk-free or very low risk bond yields.

33 |

| Sterling AAA bond yields |

|

|

|

|

| Source: RBC Dominion Securities |

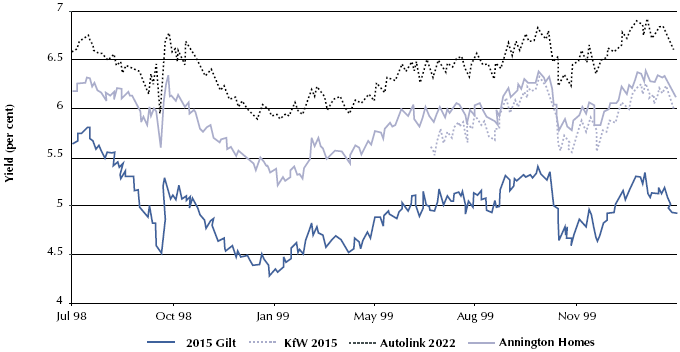

43. Non participants in the market can be shocked by the differential spread between bonds of the same maturity and same credit rating. Figure 33 shows the yields of three AAA bonds relative to the Gilt. (We have illustrated these bonds because they have a similar weighted average life. There is not a suitable range of AAA bonds at 2028-38 maturities).

44. Although these bonds have the same credit rating there are a number of differences in their structure, eligibility for investment and investors' perception of how each will perform relative to other investments. All of these differences can be said to contribute to the liquidity of the bonds.