Illiquidity - maturity

51. Certain structural features can make a risk-free security more or less attractive to certain classes of investor. Maturity is one such feature. As for the majority of PFI style infrastructure projects, extending the prepayment schedule of the LCR debt improved its economics. The project's requirement for long dated funding coincided with a shortage of long dated Gilts which fund managers were finding (and continue to find) a hindrance to the efficient management of their long-term liabilities.

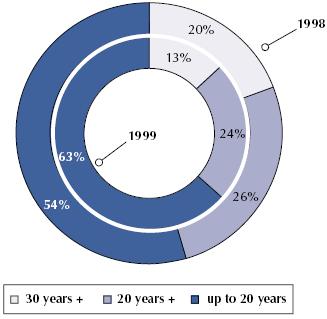

52. The 2028 GGBs were structured to imitate a Gilt in terms of maturity by having pay days identical to those of the 6% Treasury Stock 2028. As a result the GGBs can be seen as a Gilt alternative within a portfolio or for use as a bond market hedge. Figure 34 shows the maturities of sterling bond issues in 1998 and 1999. Some fund managers have a desire for assets with an even longer maturity. This was met by the 2038 issue. From a project net present value point of view, the longer the better. It would seem, however, that demand was fairly limited as the issue is relatively small.

53. Given the appetite for long dated debt, it could be asked why £1,000 million of 2010-dated bonds were issued. As mentioned above, the advantage of issuing a bond in multi-tranche form at different maturities can be that it enables a wider group of investors to be accessed. More importantly, however, the 2010 issue was subject to the swap arrangements discussed later and its redemption coincides with the latest date for receipt from Railtrack of

34 |

| Maturity of sterling bonds 1998 and 1999 |

|

|

|

|

| Source: IFR |

its purchase consideration for the completed Link. It should be noted that redeeming fixed rate debt before its final maturity can be extremely costly due to penalties payable in certain market conditions. It was therefore a better solution to issue 2010 bonds than issue optically cheaper 2028/2038 bonds and pay penalties for early repayment.