Were the bonds received well by investors and have they performed well since?

82. We believe that the success of the GGBs has been illustrated above and that the hostile reception given to some of the early proposals regarding distribution method (via an auction) and pricing had no detrimental effect on the outcome of the issues in terms of the launch price. This is important as the success of the launch may influence the performance of the bond in the aftermarket. This in turn acts as a benchmark for further issuance.

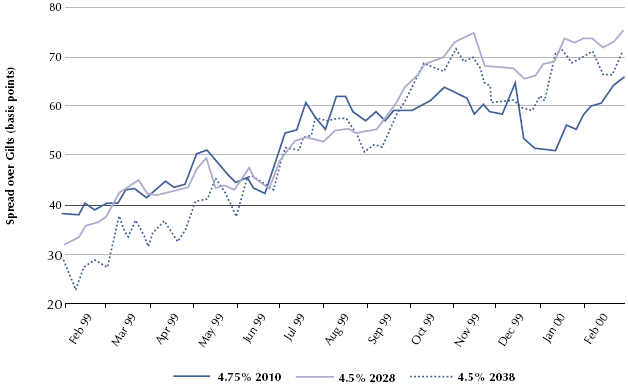

83 Figure 36 overleaf illustrates the performance of the bonds against Gilts in the after market. The widening trend in spread broadly tracks the trend in the sterling swap and AAA corporate bond markets. The 2010 issue appears to have relatively outperformed the others in spread terms. This may in part be due to the fact that swap spreads have tightened at 10 years relative to the long maturities. However, it may also be due to the fact that the 2010 issue was originally placed at a wider spread to compensate investors for the perception that is was the least popular of the three issues.

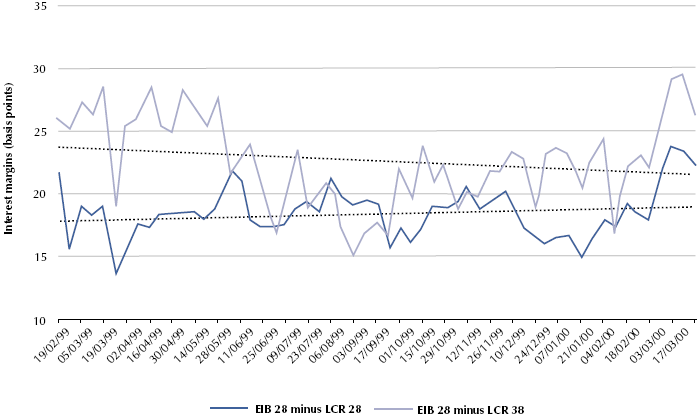

84. Figure 37 overleaf illustrates the relative performance of the long LCR bonds to the long EIB bond. If the margin on bond A narrows relative to that on bond B, in relative terms bond A is said to have outperformed bond B as its price has risen more, or fallen less, than bond B's. In this case LCR 38s have outperformed EIB 28s and LCR 28s have very slightly underperformed over the period.

36 |

| LCR bonds: market performance after issue |

|

|

|

|

| Source: RBC Dominion Securities |

37 |

| Performance of LCR bonds maturing in 2028 and 2038 against European Investment Bank bonds maturing in 2028 |

|

|

|

|

| Source: RBC Dominion Securities |