What was the strategy?

85. The issue of £2,650 million of bonds on a single day by a single issuer could have been extremely disruptive to the market. Care was taken to ensure that the DMO was informed of the timetable for issuance to ensure that it did not clash with Gilt auctions. However, disruption could still have resulted as it was likely that many investors would sell Gilts in order to release cash to invest in the higher yielding GGBs ("switching"). It was estimated that 30% of purchasers could be switching out of Gilts.

86. Generally investors switching out of Gilts to invest in corporate bonds will conduct this trade at the time the price of the new bond is fixed. This can mean that the Gilt market is disrupted and Gilt prices fall. Investors usually sell the benchmark Gilt against which the bond is priced. As a consequence, the bond is priced with a more expensive coupon. Depending on market conditions, this disruption can occur when a relatively small number of Gilts are sold into the market.

87. The lead managers of the bonds, therefore, advised that a market management strategy be put in place. In summary, this involved selling ("shorting") Gilts before the bond issues were announced and buying them back on pricing of the bonds (from investors who wanted to sell). The strategy was intended to stabilise the Gilt market and it would have protected LCR from an upward movement of the Gilt market just ahead of launch.

38 |

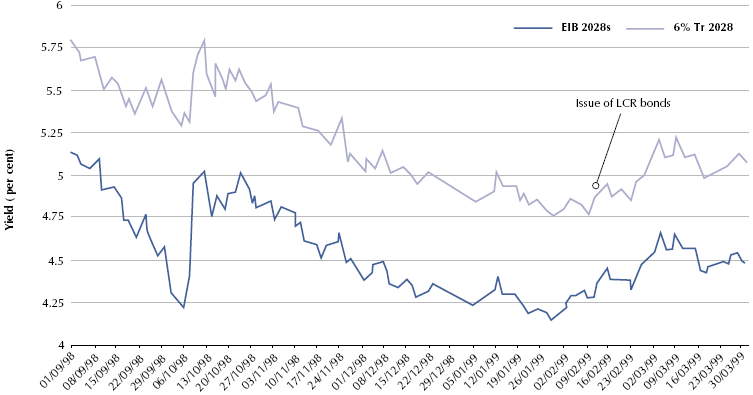

| Movements in the Gilt market and European Investment Bank bond maturing in 2028 |

|

|

|

|

| Source: RBC Dominion Securities |

88. A "short" is a sale by market participants of a security they do not actually own and the trade can only be settled by buying back the security or delivering borrowed stock. Shorting any security exposes the seller to material risk and it is essential that they can estimate accurately how many securities they should sell and that they can buy them back. When this strategy is combined with an issue of bonds (which it frequently is) the gain or loss on the short trade will be matched by an approximately equal and opposite gain or loss on the price of the bond.

89. The risk was also mitigated by the book building exercise which gave the lead managers an indication of the likely number of gilts to be sold on a switch basis ahead of launch. This knowledge enabled them to manage the market in a more efficient manner. The Government, its advisers and LCR took Counsel's opinion to ensure that this market management exercise was not in breach of the Financial Services Act 1986 nor other securities regulations.