Sterling

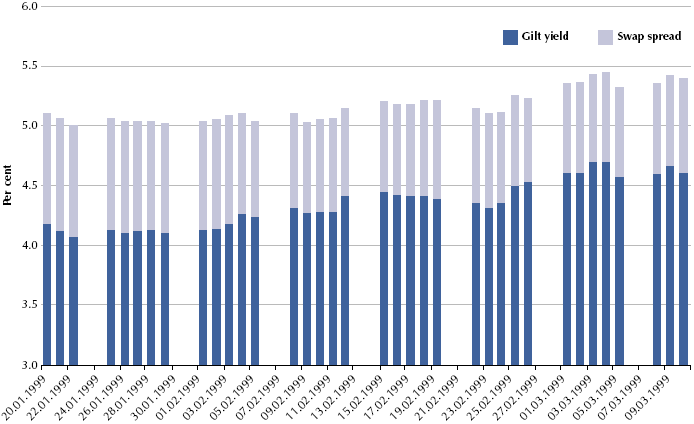

100. Sterling swap spreads followed the general market pattern described above. Swap spreads at 10 years declined from a high of 93 basis points at the end of January 1999 to 69 basis points in early March 1999. This is illustrated in Figure 39.

39 |

| Swap spreads during first quarter of 1999 |

|

|

|

|

| Source: RBC Dominion Securities |

101. The historic lower liquidity in the Gilt, Sterling Swap, Agency and Mortgage Markets compared to the US accentuated the impact on certain occasions through the second half of 1998, and sterling swap spreads tended to lag the stabilisation compared to the US. Absolute rate sentiment (that is, all-in swap rates as opposed to Gilt yields and swap spreads evaluated on an individual basis) moved from anticipating an interest rate cut in early February 1999 (looking at a 50 basis point cut by mid-year) to negative, following Greenspan's comments in his Humphrey Hawkins Testament on 25 February. All-in 10-year swaps traded in a 5% to 5.35% range throughout the period.