Was the execution strategy of the hedges appropriate?

102 LCR long-term liabilities are the three fixed rate bond issues discussed in the bonds section above. However, its assets are a combination of floating rate cash deposits and a fixed rate debtor - Railtrack's commitment to purchase Section 1 of the Link. The hedging arrangements were put in place to mitigate the basis risk between LCR's assets and liabilities. The Central Case cashflow forecast was used. In theory, it would have been possible to remove this basis risk without the swap by partially funding the project with a floating rate instrument. However, the cost of issuing Floating Rate Notes or borrowing in the Euroloan market would have been far higher than the cost of the fixed rate funding plus the swap.

40 |

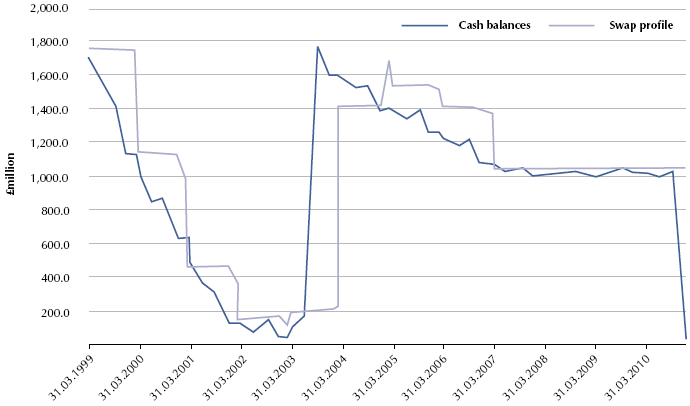

| Government Central Case: cash balance swap profile |

|

|

|

|

| Source: RBC Dominion Securities |