Yield curve

7. The gross redemption yields for Gilts with different redemption dates form a curve, known as the yield curve. The shape of this yield curve reflects a number of economic factors such as expectations of inflation and the likely direction of interest rates in the short term. However, the prices of Gilts and bonds are influenced by a number of other factors. These include:

■ supply and demand;

■ tax treatment of income and capital;

■ the size of the premium or discount at which the security trades to its par value;

■ relative size and/or age of issue;

■ special rights available to holders or unusual features;

■ eligibility for inclusion in a benchmark index.

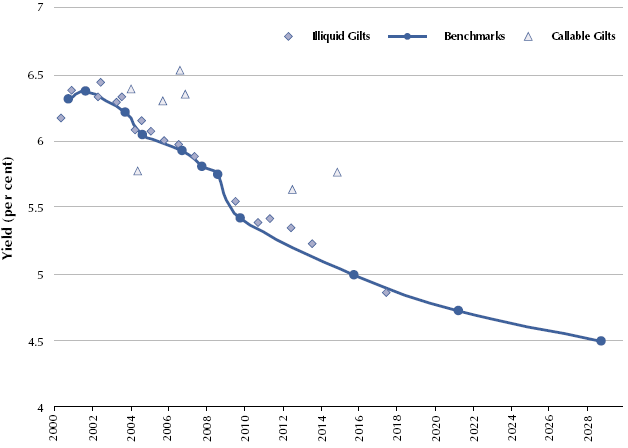

8. All of these features may affect the price of a) all the securities in the market, b) those with a particular maturity or c) an individual bond or Gilt. In the Gilt market, it is possible to identify Gilts with characteristics set out above as the gross redemption yield does not lie on the yield curve (Figure 41 overleaf).

41 |

| UK Gilts at 28 February 2000 |

|

|

|

|

| Source: RBC Dominion Securities |

9. The liquidity of a security may be defined as the ease with which a buyer or seller can trade the security. A liquid security is often characterised as one where at a particular point in time, there is little difference between the price at which an amount of that security can be bought and that at which the same amount could be sold ("bid/offer spread"). In addition, the bid/offer spread for trading a large amount of the security will be similar for trading a smaller amount and will be consistent. It can be seen, therefore, that the relative demand for an issue will also affect liquidity.

10. Each of the factors described above, particularly the size of the issue, may have a positive or negative effect on the liquidity of a security. Generally, a small issue will be illiquid. However, a large issue may also become illiquid because of excess demand. In this case, the price will be high but the bid offer spread will be wide. This latter situation can be observed at the long end of the Gilt market, where excess demand for long dated Gilts by pension funds has driven up prices. The chronic shortage of Gilts has resulted in very poor liquidity at the long end.

11. In general, Gilts are very liquid. Non-government bonds or bonds issued by foreign governments are not as liquid because they are placed in smaller tranches. Liquidity is a very valuable characteristic to investors especially in volatile market conditions where liquidity tends to decrease. As a result, investors keep a large proportion of their portfolios in Gilts. If an investor expects a newly issued bond to be less liquid, he will expect a higher return. Apart from size of issue, other characteristics, such as an unusual repayment schedule, can also have a detrimental effect on liquidity. Therefore, two bonds identical in credit quality but of different sizes may trade at different prices. This can even be seen in the Gilt market, where certain smaller issues are illiquid and therefore have to offer a high return to investors (see Figure 42).