Performance risk

12. One of the features of a liquid bond, therefore, is that the price of that bond will tend to be higher than a bond which is identical except in terms of liquidity. Liquid bonds are therefore said to outperform illiquid bonds. Sterling bonds are bought and sold on the basis of relative value. When the price of one bond rises against another (or an index) with which it is compared, it is said to outperform. A number of factors affect performance including the period of measurement, the shape of the yield curve, liquidity and credit risk.

42 |

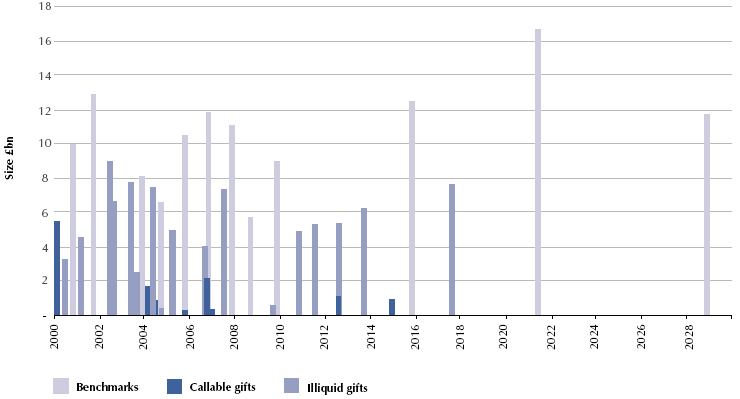

| Capital amounts of outstanding gifts |

|

|

|

|

| Source: RBC Dominion Securities |

13. All corporate bonds are measured against the credit risk free rate earned on a Gilt, and the success of a fund's strategy may be evaluated in this way. There are also an increasing number of corporate bond indices which can also be used for performance measurement. When a fund manager considers buying a new investment, he/she will take into account the likelihood of the price of that bond outperforming the benchmark against which it is measured over a given period of time. The correlation of the bond to the constituents of the index will be very important but also the attitude of other investors in the market to the security.

14. The fund manager will therefore take into account a number of factors such as whether the bond has been fully placed at launch (supply matching demand), whether retail investors may buy the bonds at a later date and how many market makers are prepared to bid for and offer the bonds (liquidity). If there is doubt about these factors, the fund manager may still buy the bond but only at a lower price. Performance risk, therefore, can be said to affect a bond's price and be reflected in its risk margin.