SBS has met and exceeded key performance indicators with one major exception

1.15 We compared SBS's performance in the first six months of the contract with the six months immediately prior to the start of the contract. The contract has provided effective incentives for SBS, performance has improved and measurement has become more open and rigorous. During the first six months of the contract, if National Savings had performed against the key performance indicators as it had done in the six months prior to the commencement of the contract, it would have faced performance deductions of up to £3.8 million. National Savings considers it now has greater control over the business through a clearer definition of outputs and that SBS's performance is better because of the disciplines on it to deliver against key performance indicators embedded in the contract.

1.16 SBS has failed one important key performance indicator during the first six months of the contract. On this occasion, receipts of £600,000 out of a total of £15.8 million were not transferred to the Bank of England on the day they were received. As the money was not available to the Exchequer for one day, interest foregone amounted to £108. National Savings and SBS reviewed this failure through their agreed performance improvement process, illustrated at Figure 2.

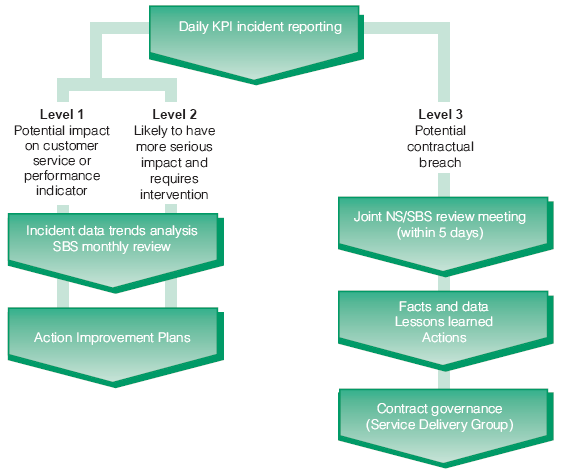

Performance review process | Figure 2 |

|

| ||

|

| This figure shows the processes and actions National Savings and SBS take to review performance and apply lessons learned |

|

|

|

Source: National Savings |

| |

1.17 National Savings has the power to decide the level of performance deduction to apply (Figure 3), which in this instance ranged from £0 to £426,000. The review concluded that the performance deduction should be £43,000. National Savings reached this figure taking into account that:

a) It was an opportunity to emphasise that achieving continual improvement is of more value than extracting financial penalties for failure.

b) The consequential loss involved and the potential damage to National Savings' reputation and brand were small.

c) The primary cause of the failure was a third party failing to inform SBS of system changes.

d) It was early in the life of the contract when SBS had not had sufficient time to build successful relationships with its new suppliers.

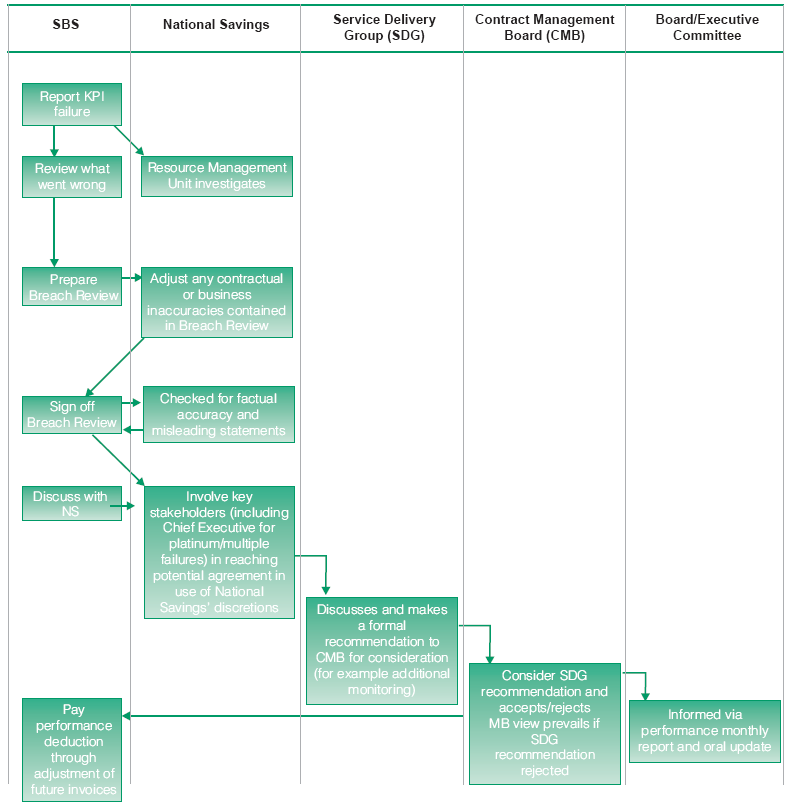

Figure 3 |

|

Performance deduction process | |

This figure shows that National Savings and SBS have agreed a process for determining performance deductions | |

| |

Source: National Savings | |

e) Achieving a balance between the minimum and maximum deduction would encourage openness and continual improvement. On the other hand, it would also reinforce the need for SBS to achieve consistently excellent performance. SBS has now implemented improved operational processes and more effective controls at all three sites for the transfer of funds to the Bank of England.

1.18 Although SBS has recorded other breaches of key performance indicators, National Savings has chosen to regard them as "technical incidents" which do not merit performance deductions, as losses have been negligible. For instance, there have been five breaches of a banking indicator due to a small number of low value cheques not being banked on the day of receipt. National Savings considers that such "technical incidents" have always occurred from time to time and will continue to occur. In National Savings' view, it is preferable for them to be reported and subjected to lessons to be learned reviews rather than hidden, which could be a consequence of imposing performance deductions in every instance.