SBS is not taking a "big-bang" approach

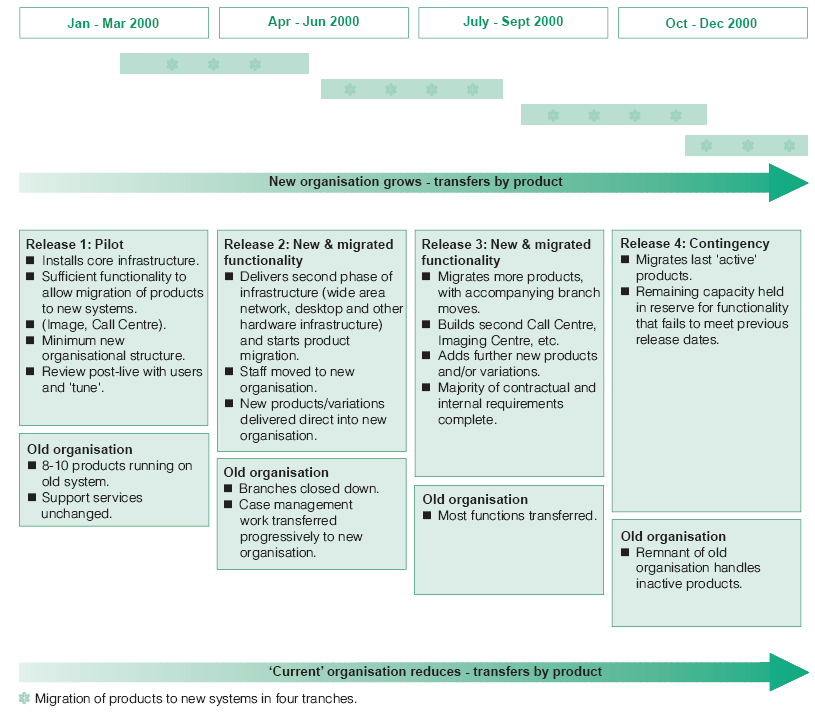

1.27 SBS plan to put new IT systems in place gradually, as shown at Box 1, rather than attempting to transfer all savings products to one new system in one go. Each stage, comprising proven IT packages seen to work elsewhere and some bespoke software where necessary, is to be rolled out well in advance of contracted targets, and experienced operational staff will test usability and identify potential improvements. Alongside new IT, SBS is conscious of the human resource consequences of what is proposed, especially the need for cultural change and adequate training of staff. Staff training will be incremental, involving small groups at the start, who will champion the changes and train their colleagues.

1.28 As transformation of operational processes is central to the success of the project, National Savings is monitoring progress through an agreed governance structure, joint plans and formal business reporting, in addition to working level contacts. Alongside this, National Savings has employed independent IT consultants to help it act as an intelligent customer when assessing SBS's proposals and progress. The consultants have indicated that that they are impressed by SBS's technical solutions but that it is still early days and there will need to be ongoing monitoring of SBS's plans and controls. SBS is using IT experts from other parts of the SBS organisation including the parent company, Siemens AG. Both partners will share the conclusions of their respective experts. National Savings has defined the outputs required from the operational service and will not become involved in the design or development of new IT systems or specify the project management methodology, thereby avoiding the transfer of risk back to itself. National Savings will, however, monitor progress in a critical and positive way.

|

Box 1 |

|

|

SBS's gradual approach to the development and implementation of IT and human resource solutions |

|

|

|

|

|

Source: SBS |

|

1.29 SBS's approach to dealing with the processing of applications for Premium Bonds is an example of how it is using the expertise of other subsidiaries of its parent company and new technology. Premium Bond sales have continually risen in recent times with National Savings receiving a record 300,000 applications in July 1999. To process the applications, staff at the Blackpool site have had to sort and check each one before manually keying the information into a mainframe computer. This resulted in inevitable data entry errors, onerous checking procedures to ensure accuracy and difficulties in achieving same-day banking of Applicants' cheques. The growing popularity of Premium Bonds indicated to SBS that it needed a radical technical innovation if performance standards were to be met, including the need to bank all cheques by 1pm on the day they are received.

1.30 To speed up the process and improve accuracy, a system that could scan incoming documents, avoiding information being manually keyed, would have to be designed. Following a feasibility study by a subsidiary of Siemens AG specialising in high volume transaction processing systems, a new character-recognition system was installed in November 1999 to read and store automatically information from applications and then transfer that information to a customer database.