Running costs will be lower

1.31 The purpose of a Public Sector Comparator is to inform a department's decision on whether a proposed PFI deal offers value for money. As part of its value for money appraisal of the project, National Savings prepared a comparator which estimated the cost of continuing to manage the operational service in-house. The estimated net present cost was £793 million over 15 years, while the estimated net present cost of the proposed deal with SBS was £635 million. The Public Sector Comparator used by National Savings was a sound basis on which to make a value for money decision (see Appendix 4). The principal reasons for this significant difference are that SBS can invest in transforming the operational service more quickly than National Savings and can create new jobs through the development of significant levels of work for third parties.

1.32 SBS expects to employ fewer staff on the operational service than National Savings would have done if it had remained in-house. There were both technical and generic reasons for this difference. SBS assumed a greater use of imaging and automated decision-making than the in-house solution had assumed. SBS also planned for additional savings from an extension of its business transformation project to other parts of the business, rather than just transaction processing, and envisaged a greater degree of flexibility in the use of staff.

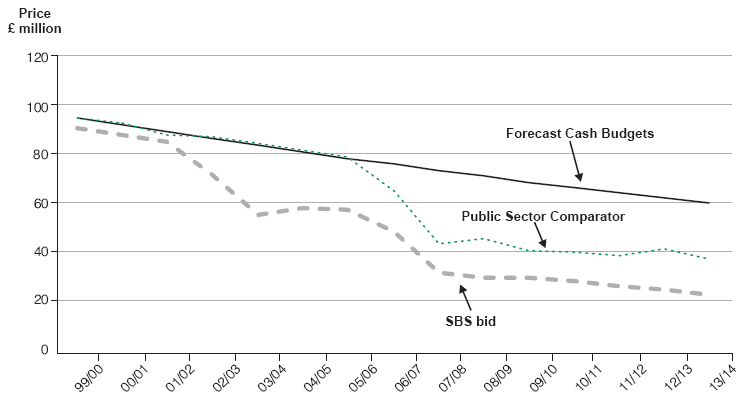

1.33 SBS also expects to re-deploy staff more quickly than National Savings. National Savings' ability to release staff was constrained by annual cash budgets, which would decline in real terms at an annual rate of 2.5 per cent. This acted as an expenditure ceiling for National Savings and a charging limit for bidders. National Savings therefore required SBS and EDS to keep their proposed charges at a level which permitted National Savings to remain within its expected budgets. SBS's bid and the Public Sector Comparator price are compared with the cash budgets at Figure 4.

Figure 4 |

|

Comparison of National Savings' forecast cash budgets, the Public Sector Comparator and SBS's bid | |

This figure shows that SBS's bid was superior to the Public Sector Comparator, and that both were within National Savings' forecast cash budget | |

| |

Source: National Audit Office | |

1.34 As SBS and EDS were not subject to such a budgetary constraint they planned to incur financial losses in the first years of the contract and realise efficiency gains more quickly than National Savings could. Because it lacked sufficient cash to fund necessary severance payments, National Savings could not immediately release surplus staff through redundancy or early retirement. As a significant number of surplus staff would remain on the payroll in the early years of the project, the productivity benefits of business process re-engineering would not feed through to running costs savings immediately.

1.35 SBS will make a profit from the partnership if the business transformation allows staff to be re-deployed and alternative employment for staff is secured. SBS's bid was priced on the basis that at least 1,200 jobs would be created for former National Savings staff on third party work. By January 2000 SBS had agreed contracts with third parties which should secure some 500 jobs.