National Savings set out clearly what was wanted from a private sector partner

3.9 The Invitation to Negotiate set out the objectives for the deal and what would be expected from a private sector partner (Box 4). In providing such a detailed output specification, National Savings was careful to avoid setting out what was required in input terms, so that bidders' ability to innovate would not be restricted. The outcomes expected from the successful development and implementation of business process re-engineering were made clear but bidders were not told how to achieve them.

|

Box 4 |

|

|

National Savings' objectives for the deal and its requirements of a private sector partner to meet those objectives |

|

|

|

|

|

Objectives |

National Savings required a private sector partner to: |

|

a) The transfer of responsibility and the risk for the delivery and enhancement of an integrated operational service. |

■ substantially increase operational efficiency through business process re-engineering; ■ meet detailed product and customer quality standards as measured by specified key performance indicators; ■ accept progressive reductions in the fee if key performance indicators are not met; ■ develop a link with the planned Post Office Counters Automation system; ■ be responsible for transaction accounting; ■ accept all risks associated with the year 2000; ■ take on the risk of the impact of future legislative changes on the operational service; ■ take operational responsibility for implemention of the first National Savings ISA product. |

|

b) Cost reduction to the most competitive levels achievable throughout the contract. |

■ charge a declining fixed fee based on a "middle case" volume transaction scenario with a pre-determined free band of volume variations around the "middle case"; ■ charge a different fee for each band of transactions above or below the "middle case" volume and free band; ■ benchmark services and costs throughout the contract and offer downward only price movements and/or improvements in quality of service; ■ share in higher than expected profits from National Savings work; ■ share in profits and cost savings made from third party business using National Savings assets; ■ agree that severance costs above an agreed cap will be at the provider's risk. |

|

c) A collaborative and flexible contractual relationship with a provider incentivised to support National Savings strategies. |

■ allow National Savings the right to audit all aspects of service delivery and key performance indicator calculations; ■ maintain complete transparency of accounts relating to the performance of the National Savings contract and the third party work conducted from the transferred undertaking; ■ allow National Audit Office access; ■ supervise, on a day to day basis, the processing services provided by Post Office Counters Ltd; ■ ensure that the entity performing the National Savings contract remains an identifiable and separable undertaking at all times enabling National Savings to be able to regain control at any time; ■ not charge for variations which are simply regular amendments; ■ provide new products at no additional cost, with a marginal increase or decrease in cost if National Savings requires more or fewer of such products. |

|

d) An equitable commercial relationship. |

■ take a long term view of investing in a partnership with National Savings; ■ agree that where new products or channels are fundamentally different, National Savings retains the right to tender more widely; ■ agree to a 12 or 15 year contract term with both parties able to terminate five years before contract end; ■ assume responsibility for staff, operational assets and liabilities from National Savings. |

|

e) The transfer and protection of staff. |

■ maintain Investors in People accreditations; ■ retain a significant presence at all three sites for at least the first five years of the contract; ■ apply Transfer of Undertakings Protection of Employment rules to the transfer of staff; ■ provide redundancy and pension terms which are broadly equivalent to the Principal Civil Service Pension scheme. |

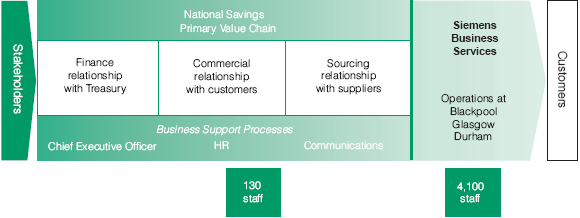

3.10 In addition, National Savings clearly defined the scope of its own responsibilities and those of a private sector partner. It required a private sector partner to be responsible for actions involved in, or supporting, the delivery of products. Such actions would encompass service delivery, service development, support services to National Savings and database management and information. The roles and responsibilities of each party are given in greater detail at Boxes 5 and 6 respectively.

|

Box 5 |

|

|

National Savings' role and responsibilities |

|

|

|

|

|

Source: National Savings |

|

|

Box 6 |

|

|

|

SBS's responsibilities |

||

|

|

|

|

|

Service delivery |

The actual provision of products to customers. It involves performing three generic processes: Sales: A sale is the investment by customers of money in a National Savings' product. This involves creating appropriate records, providing the customer with appropriate documentation and associated processes, such as dealing with enquiries and despatching appropriate literature. After sales: All aspects of maintaining records, issuing statements and dealing with customer queries and problems. Payments: A payment involves any one of the following: a) returning the customer's investment, with or without interest; b) making a regular payment of interest or dividend; c) paying a Premium Bond prize. There are a number of ancillary services which are involved in delivering the products: a) transaction accounting and reporting; b) treasury management; c) forms printing and distribution (according to National Savings design); d) distribution of brochures; e) operational liaison with other National Savings agents including Post Office Counters Limited. |

|

|

Service development |

SBS will be expected to advise National Savings on the operational and technical impact associated with the design of brands, channels and products and the effect this will have on operational efficiency. SBS will be expected to implement new brands, channels and products within demanding timescales. |

|

|

Support services to National Savings |

National Savings requires SBS to provide some support services including: a) IT services (including voice and video conferencing); b) records management and archiving services; c) office services. |

|

|

Database management and information services |

SBS will manage the data that it collects via the new operational IT system which it is required to develop. Management of the data in the database will involve the use of sophisticated data warehousing techniques to allow National Savings' Directorates to exploit all of the information held about National Savings' customers. National Savings requires SBS to provide information concerning its service delivery performance. Such information will take two forms: a) regular reports to be delivered to National Savings on a daily, weekly, monthly or annual basis; b) ad hoc reports which may cover any aspect of information about customers, products or service standards. SBS will provide an easy to use report writing facility that will allow National Savings to interrogate the database and financial systems. |

|

3.11 In setting an output specification, National Savings paid particular attention to the handling of volume risk and the use of a performance measurement regime to provide appropriate incentives for high service quality.