Volume risk was transferred

3.12 National Savings closely defined the transactions on which a unitary charge by a private sector partner would be based. Although individual products may encounter sharp fluctuations around their launch and anniversary dates, the overall volume of transactions each year tends to be stable. Moreover, even in the event of declining financing requirements, the Treasury would normally expect National Savings to plan on the basis of a steady state of funding. This is to assist business planning, in a competitive market, over the medium term and also because the gilts market is normally better placed to cope with changing financing requirements.

3.13 In 1998, at the time of the Invitation to Negotiate, some 55 million transactions were processed annually: 19 million sales, 30 million payments and 6 million after-sales transactions. Of the sale and payment transactions, 21 million represented the automatic processing of transactions such as the re-investment of Premium Bond prizes and monthly interest on Income Bonds. National Savings therefore based the pricing mechanism on 28 million manual transactions, of which some 20 million were directed via Post Office Counters Limited. After-sales transactions such as customer enquiries were excluded from the payment mechanism as a private sector partner could influence the number of such transactions by improved performance. Their exclusion provides SBS with an incentive to minimise them through handling transactions correctly and avoids the transfer of risk back to National Savings.

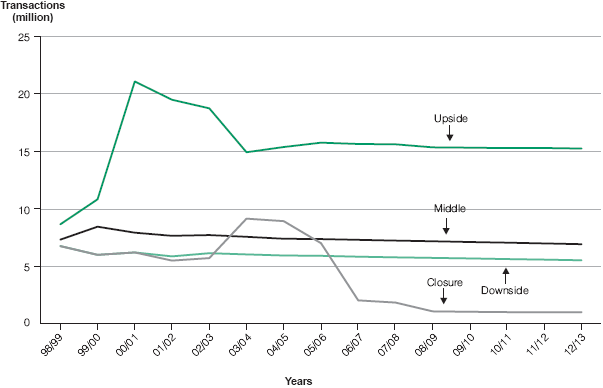

3.14 The Invitation to Negotiate included four forecasts of transaction volumes, prepared in consultation with the Treasury, based on a combination of transactions on existing products and those expected to be generated from new and replacement products. The forecasts are shown at Figure 12. The four funding scenarios were:

Upside: assumed no Treasury restrictions on funds to be raised from year to year;

Middle: a steady improvement in sales of existing savings products;

Downside: assumed Treasury restrictions on funding levels and non-participation in new opportunities in the retail savings market;

Closure: the downside scenario during the first five years of the partnership, followed by no product sales thereafter.

Figure 12 |

|

Projected transaction volumes by funding scenario | |

This figure shows projected transaction volumes under the four funding scenarios agreed with the Treasury | |

| |

Source: National Savings | |

3.15 For manual transactions directed through Post Office Counters, National Savings assumed there would be some 20 million in the first year but that the number would decline and ultimately disappear by 2002/03, as the Post Office Counters Automation project came on stream. As the Post Office project was not within National Savings' control, SBS and EDS were asked to put a price on the risk of delays in its implementation.

3.16 Final bidders had to propose a base unitary charge for each year of the contract covering the fixed and variable costs of the operational service for the volume of transactions assumed in the middle funding scenario. To avoid contract price variations from normal changes in volume and allow for forecasting errors, National Savings also required the unitary charge to cover a "nil-adjustment" band of one million more and 200,000 fewer transactions a year. Bidders also had to price volume fluctuations outside of the "nil adjustment" band. For transactions directed through Post Office Counters Limited, bidders had to bid a marginal cost for transactions in excess of the 20 million currently processed.