The best bid was selected

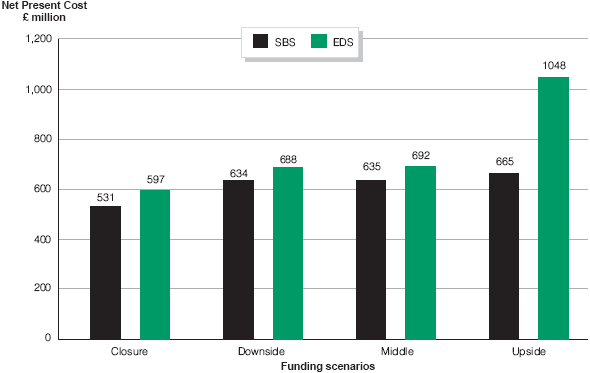

3.30 The SBS bid was superior on price to that of EDS on all four transaction scenarios, as shown at Figure 16. The significant difference between the two bids on higher transaction volumes is explained by the much higher price EDS quoted for each additional transaction of £4.82 (plus 72p postage) compared with SBS's price of up to 40p (plus 21p postage). For a lower number of transactions, EDS proposed a rebate of 34p a transaction, compared with 10p from SBS. However, as SBS's price of £31.3 million to take over accommodation at the three sites was half that of EDS's at £67.2 million, the higher rebate from EDS at lower transaction volumes was insufficient to bring its price below that of SBS for the downside and closure scenarios.

Figure 16 |

|

Comparison of SBS and EDS charges over the four funding scenarios | |

This figure shows that SBS's projected charges were lower than those of EDS on all funding scenarios | |

| |

Source: National Savings | |

3.31 The prices of the final bids at the middle volume scenario were close, as were the estimates of the number of employees each bidder would need to run the operational service. The major difference between the two bids was the inclusion in EDS's bid of a charge for the possible failure of the Post Office Counters Automation project. In negotiation, SBS indicated to National Savings that it had made an error in calculating the charge for additional transactions, which it had priced at 10p plus postage. In exchange for being allowed to change its price for additional transactions, SBS agreed to remove the potential charge for failure of the Post Office project from its bid.

3.32 The arrangement reached with SBS on the accommodation element of the deal was superior to that proposed by EDS on both price and other terms. SBS has taken leases on the whole estate and will pay a market rent of £4.1 million a year, recovered in the unitary charge, leaving National Savings with a saleable asset. Surplus land has been excluded from the leasing arrangements and retained for future sale. To date, National Savings has sold surplus land at the Glasgow site for some £200,000 and is seeking improved planning consents at Blackpool before considering a sale.

3.33 Aside from price, SBS was prepared to accept more risk than EDS. An example of this is the higher level of performance deductions SBS accepted. The difference between National Savings' proposed performance deductions, what SBS proposed and then accepted and the levels proposed by EDS are shown at Figure17, which also shows that both bidders accepted escalating deductions for frequency of performance failure.

Figure 17 |

| |||||||||||||

Maximum performance deductions | ||||||||||||||

This figure shows that SBS was prepared to accept higher maximum performance deductions than EDS and that after negotiation it moved closer to the levels specified by National Savings | ||||||||||||||

| Platinum | Gold | Silver | |||||||||||

Number of months key performance indicator not achieved | NS | SBS | Agreed | EDS pro-posed level % | NS | SBS | Agreed | EDS pro-posed level % | NS | SBS | Agreed | EDS pro-posed level % | ||

|

|

|

|

|

|

|

|

|

|

|

|

| ||

First month in any six months | 10 | 0.61 | 5 | 1 | 1 | 0.13 | 0.5 | 0.5 | 0.7 | 0.09 | 0.35 | 0.1 | ||

|

|

|

|

|

|

|

|

|

|

|

|

| ||

Two or more in any six months | 15 | 1.03 | 6 | 3 | 3 | 0.13 | 1.5 | 1.5 | 1.6 | 0.09 | 0.80 | 0.3 | ||

|

|

|

|

|

|

|

|

|

|

|

|

| ||

Four or more in any six months | 15 | 1.44 | 7 | 6 | 10 | 0.13 | 5 | 3 | 4 | 0.09 | 2 | 0.6 | ||

|

|

|

|

|

|

|

|

|

|

|

|

| ||

Six or more in any 12 months | 20 | 1.91 | 8 | 10 | 20 | 0.13 | 7 | 5 | 10 | 0.09 | 5 | 1 | ||

|

|

|

|

|

|

|

|

|

|

|

|

| ||

Notes: | 1. Each 1 per cent deduction is equivalent to £85,163 of the unadjusted volume monthly fee in the first contract year. 2. The performance deductions are maximum deductions. The actual deduction applied is at National Savings' discretion and will take into account any loss suffered and the circumstances giving rise to the KPI failure | |||||||||||||

Source: National Savings | ||||||||||||||

3.34 SBS did seek, however, to mitigate potential performance deductions where the degree by which a target was missed could be measured in percentage terms. National Savings accepted that in such instances only a proportion of the maximum performance deduction should be made, as shown at Figure 18. There were other significant differences in the bids in favour of SBS, as shown at Appendix 5. There were no increases in the price agreed with SBS after its selection as the preferred bidder.

Variations in maximum performance deductions |

| Figure 18 |

|

| |||

|

| This figure shows that SBS proposed and National Savings agreed that performance deductions should be lower where it was possible to quantify the relevant failure in percentage terms | |

SBS proposals | Agreed levels | ||

Percentage by which | Proportion of | Percentage by which | Proportion of |

0 to 1 | 20 | 0 to 1 | 20 |

1 to 2 | 40 | 1 to 3 | 60 |

2 to 3 | 60 | 3 plus | 100 |

3 to 5 | 80 |

|

|

5 plus | 100 |

|

|

| Note: | 1. None of the platinum KPIs can be graded; eight of the gold and 25 of the silver can be graded. 2. 20 per cent and 60 per cent of a first failure of a gold KPI are £8,516 and £25,549 respectively and for a first failure of a silver KPI they are £5,961 and £17,884. 3. The level of deduction increases with the frequency with which the Key Performance Indicators are not met. 4. The performance deductions are maximum deductions. The actual deduction applied is at National Savings' discretion and will take into account the loss suffered as a result of the KPI failure and have regard to the circumstances giving rise to the KPI failure. |

Source: National Savings |

|

|