Retail savings can be an attractive source of funds relative to gilts

2 Private sector retail savings and lending institutions such as banks and building societies will create value in the form of profits from lending to borrowers at higher rates of interest than they pay to investors who deposit money with them. The interest rates charged or paid by banks and building societies will change in line with changes in wholesale money market rates (typically the rates at which the London clearing banks are prepared to lend and borrow).

3 The Government's borrowing requirements are funded largely by issuing gilts to participants in the wholesale capital market. As the payment of interest and repayment of capital on gilts is backed by the Government, they are usually regarded by investors as risk free if held to maturity. The yield on gilts is therefore lower than wholesale market interest rates for other types of securities, where there may be a risk that an investor will not be paid interest or repaid capital in the future.

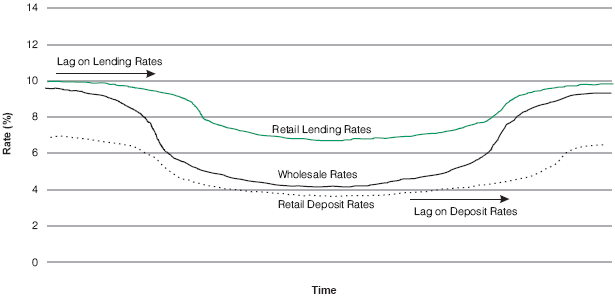

4 To maximise profits when wholesale market interest rates are declining, banks and building societies will try to reduce the rates of interest paid to savers quickly and slow the reduction in lending rates charged to borrowers. On the other hand, when wholesale interest rates are rising, they will raise lending rates quickly but slow any increase in savings rates. This behaviour is illustrated at Figure 19. As National Savings only takes deposits, involvement in the retail savings market provides the Government with an option to borrow funds at lower rates than gilts.

Figure 19 |

|

Retail funding over an economic cycle | |

| |

Source: Corporate Value Associates | |