The scope of the contract

1.8 Under the contract, EDS is responsible for delivering most aspects of the Department's information technology requirements, including the development and implementation of new systems and the operation, maintenance and enhancement of both new systems and the systems inherited from the Information Technology Office. EDS also supplies some items of capital, for example mainframe computers, under the contract where these are required. The Department pays for these on an amortised basis.

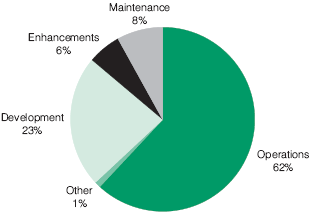

1.9 At 31 March 1999, cumulative revenue expenditure on the provision of information technology services under the contract with EDS stood at £874 million, and payments to EDS for the use of capital equipment amounted to £163 million. Figure 1 illustrates the proportionate value of the components of the total volume of work (excluding payments for the use of capital equipment).

|

Mix of services by value provided by EDS in the first five years of the contract

|

Figure 1 |

|

|

|

||

|

|

|

|

|

|

A significant proportion of contract costs is devoted to the development and enhancement of information technology services. |

|

1.10 The Department's desktop equipment, for example, personal computers, terminals, printers and other equipment installed on its premises, was not transferred to EDS and remains the Department's property. The Inland Revenue procures new equipment from a number of suppliers under call-off contracts. EDS is responsible for its successful integration into the office environment, for live support, and for maintenance.

1.11 The information technology systems provided by EDS include:

■ national taxes systems supporting, for example, PAYE and self assessment, which can be accessed by staff in most of the Department's network of over 700 local and central offices;

■ systems supporting the activities of specialist offices, such as the Oil Taxation Office and the Capital Taxes Office; and

■ systems supporting the administration of the Department, for example, the Payroll and Personnel Management Information System.

Developments continually take place in response to changes in the tax system, such as the introduction of tax credits, and in response to business needs, for example, to improve the design of the statement of account provided to income tax payers under self assessment. In addition, new systems are developed in response to Government initiatives, for example the introduction of individual savings accounts. As a result, by the end of the contract the Department's information systems and information technology infrastructure will be substantially different from those in place at the outset.