5.2 Valuing Competitive Neutrality

Competitive Neutrality only includes advantages that accrue to a government business which are not equally available to a bidder. It does not include differences in performance or efficiencies that arise in a competitive market and should be distinguished from differences in cost levels between the public and private sector. An example of competitive neutrality is land tax that is payable by the private sector, but would not otherwise be incurred by government.

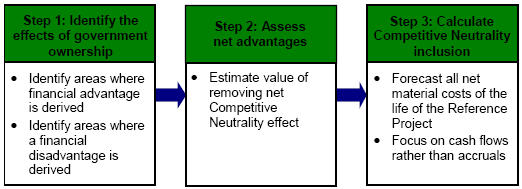

Figure 5-2 provides an outline of the process in calculating Competitive Neutrality in a PSC.

Figure 5-2 Steps in calculating Competitive Neutrality

The PSC is a cash flow calculation and thus Competitive Neutrality inclusions should be based on cash flow adjustments, rather than on an accruals basis. Non-cash adjustments, such as depreciation, therefore would not form part of Competitive Neutrality.

Table 5-1 outlines some of the potential cost advantages and disadvantages that may apply to government businesses and how to adjust the PSC for such changes.

Table 5-1 Potential government advantages/disadvantages and PSC adjustments

| Potential advantage | Cost treatment |

| No requirement to cover the cost of capital | • Use of an appropriate cost of capital to discount periodic cash flows |

| Land tax exemption | • Determine whether the land required for the Reference Project would be subject to land tax, if acquired by a bidder • Quantify the amount of land tax a bidder would incur • If calculation of full costs includes an estimation of commercial rent, no adjustment needs to be made |

| Local government rates exemption | • Determine whether the premises required for the Reference Project would be subject to local government rates if acquired by a bidder • Quantify the amount of local government rates that a bidder would incur • The cash flow timing should correspond with the periodic obligation to pay the rates • If calculation of full costs includes an estimation of commercial rent, no adjustment needs to be made |

| Stamp duties exemption | • Determine whether a government exemption would exist under the Reference Project • Identify transactions associated with the Reference Project that would be dutiable but for the government exemption • If a duty would not otherwise be payable, calculate the implied duty applicable for relevant transactions |

| Payroll tax | • Quantify the amount and timing of payroll tax that a bidder would incur if it had the payroll tax expense that the public sector expects to incur on the Reference Project |

| Corporate overheads | • Calculate the cost of obtaining the 'free' corporate overheads, including payroll services, human resource services, office accommodation, marketing and IT services |

Competitive Neutrality costs need to be identified and included throughout the term of the Reference Project. This includes recurrent costs (e.g. local council rates) and costs that arise through specific transactions over the life of the Reference Project (e.g. stamp duty).