6.3 Identifying project risks

Identifying (and quantifying) projects risks can be a complex and laborious exercise. Experience suggests that workshopping can greatly assist the process. The workshop is usually led by an experienced practitioner and should at least initially include the widest representation of the project team. Participants must be encouraged to 'brainstorm' so that all potential risks are identified. Many of these risks may be ranked eventually as immaterial but is nevertheless essential that the project team endeavours to identify all project risks.

It is not necessary to quantify the impact of particular risks during the identification phase. The identification process is sufficiently complex without the added complexity of numerical quantification. To assist the quantification of risk in the next stage, the project team should make an assessment of:

• the likelihood of the risk occurring; and

• the consequence, or impact of the risk if it did occur.

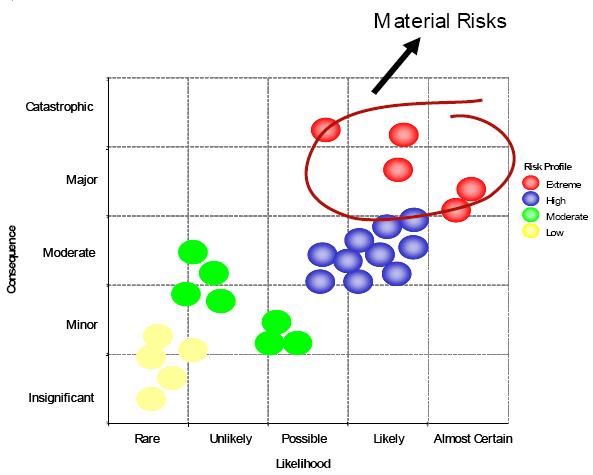

Once all risks have been identified and recorded, the likelihood and consequence of the risk occurring should be recorded and ranked in a simple matrix.

Figure 6-3 provides an example of a matrix which demonstrates the identification of risks by likelihood and consequence:

Figure 6-3 Example Risk Matrix

Table 6-1 provides a general description of the main categories of risks likely to be encountered in most PPP projects.

Table 6-1 Risk identification

| Risk | Description |

| Site Risk | This includes the risk that the project land will be unavailable, or unable to be used at the required time, or in the manner or the cost anticipated, or the site will generate unanticipated liabilities. |

| Design, construction and Commissioning risk | Design, construction and commissioning risk is the risk that the design, construction or commissioning of the facility (or certain elements of those processes) is carried out in a way that results in adverse consequences on cost and/or service delivery. |

| Sponsor risk | In establishing a project Consortium, the sponsor typically establishes the private party in the form of a special purpose vehicle ("SPV"), which contracts with government. The SPV is simply an entity created to act as the legal entity of a project Consortium. Because the arrangement is financed through non or limited recourse debt, creditors have access to the project's cash flows but limited recourse to the sponsors' balance sheets. Sponsor risk is the risk taken by government that the SPV, or its sub- contractors, will not fulfil their contractual obligations. |

| Financial risk | This includes the risk that private finance will not be available, the project will not prove financially robust, or changes in financial parameters will alter the bid price before financial close. |

| Hard and soft facility maintenance operations risk and the payment mechanism | This includes the risk that payments made for services during the service period are abated because of performance incidents, and is typically reflected in both the contractual provisions and the payment mechanism. The larger the size of hard and soft facility maintenance service packages, the more effective is the payment mechanism in influencing service performance. |

| Market Risk | This includes the risk that demand for a service will vary from that initially projected, or that the price for a service will vary from that initially projected, so that the total revenue derived from the project over the project term will vary from initial expectations. |

| Network and interface risk | This arises where the contracted services, or method of delivery of those services are linked to, rely on, or are otherwise affected by certain infrastructure, inputs and other services, or methods of delivering the contracted services. Interface risk is the risk that the contracted services will not be compatible with the delivery of Core Services. |

| Industrial relations risk | This is the risk that industrial action impacts on the performance under the contractual obligations. |

| Legislative and government policy risk | This is the risk that government will exercise its powers and immunities, including but not limited to the power to legislate and determine policy, in a way which negatively impacts, or disadvantages the project. |

| Force majeure risk | This refers to the risk that events may occur which will have a catastrophic effect on either party's ability to perform its obligations under the contract. |

| Asset ownership risk | This includes the risk of maintaining the asset to the requisite standard (including the risk that the cost of maintenance may increase during the term), the risk of premature obsolescence, or that the construction of competing facilities will occur. |

| Tax risk | This is the risk that changes in the taxation framework may impact on the financial assumptions of the project. |

| Interest rate risk | This is the risk of adverse interest rate movements. |

Further guidance on identifying project risks is provided in Risk Allocation and Standard Commercial Principles.

The depth and accuracy of information collected should reflect the materiality of the costs (or revenues) to be quantified. It would generally be inappropriate to devote excessive time and resources to valuing minor, or less sensitive risks.

In addition, there are often a number of risks that may exist, but are unlikely to have any real economic effect on the project being considered. For valuation purposes, only material risks need to be included in a PSC.

The valuation process may be simplified sometimes by aggregating risks into a smaller number of categories according to their likely impact. This may be particularly useful where:

• individual risks are likely to be immaterial, but are material when aggregated;

• quantification is difficult for individual risks;

• risks are influenced by common factors; or

• considerable interaction exists between individual risks.

Care should be taken to not double count risks where identified risks are merely subsets of the main risk identified. Again, the reasons for aggregating individual risks should be documented.

Every effort should be made to identify and quantify all material risks for a project. If a risk is unquantifiable, it should still be identified and included in the list of risks for each project, together with the reasons for exclusion from the PSC. This will help maintain attention on non-pricing aspects of the risk. The possible impact of these risks may be relevant also in writing specifications for the tender process and then as part of the qualitative evaluation of private bids. Section 9.4 discusses qualitative evaluation issues further.