Sharing refinancing gains

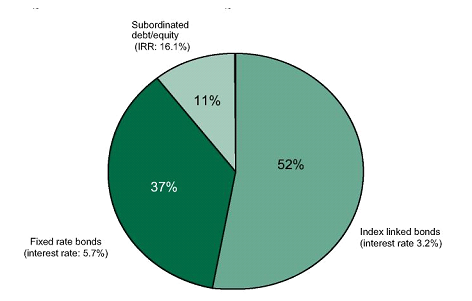

12. The bulk of the external financing for the construction phase of the project comes from two bond issues, supplemented by risk capital in the form of a subordinated loan and a small amount of pure equity (Figure 5).24

Figure 5: Sources of external funding

Source: C&AG's Report

13. Ahead of its selection as preferred bidder, AGP had offered the Home Office a 20% share of any gain from a future refinancing of the project. During the period in which the Home Office and AGP were finalizing the details of the project, the Office of Government Commerce was developing guidance for all PFI deals that was likely to recommend that departments seek a 50:50 sharing of future refinancing gains. After consulting the Office of Government Commerce and the then Treasury Task Force, the Home Office decided it would be prudent to comply with emerging policy advice in advance of its publication in July 2002.25

14. The Home Office therefore decided to re-open negotiations with AGP with the aim of increasing its share of any refinancing gain from 20% to 50%. Following negotiations, the Home Office and AGP will be entitled to equal shares of any future gains on refinancing. In return, even though the Home Office had no idea what the size of any refinancing gain might be, it agreed to increase the payments to be made to AGP over the period of the contract by £2.75 million.26 In October 2002, just over six months after financial close, the Office of Government Commerce published details of a voluntary code of practice agreed between the public and private sectors to share refinancing gains 30:70 on PFI deals agreed before July 2002.

15. In assessing potential refinancing gains, the Home Office considered that there was a low probability of refinancing the two bond issues owing to the potentially high cost of buying out the bondholders. If the existing bondholders were bought out, an interest rate reduction of 0.33% would be required to recover the £2.75 million paid to secure a 50% share of the gain. The cost of buying out the existing bondholders could only be ascertained at the time of refinancing. There was considered to be a greater prospect of refinancing by replacing the more expensive subordinated debt with cheaper junior debt. This would only be possible if the market perceived a reduction in project risk and would therefore be likely to occur in the period after successful completion of construction. In this case, the Home Office considered that refinancing would need to achieve an interest rate reduction of around 4% to recover the additional £2.75 million paid to AGP.27