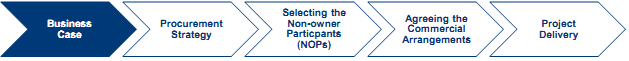

5.2 Business case

The expectation of the business case is that it will clearly define the project's VfM proposition to investment decision-makers so they can determine if there is a compelling case to invest. A clear value proposition will also enable the establishment of parallel alliance objectives and also provide the benchmark against which commercial arrangements with the NOPs can be negotiated and VfM can be assessed at each stage of the project lifecycle.

The argument for investing in a project is best substantiated by rigorously examining the options, costs, timeframe and risks against the identified business case requirements and provides the basis for the investment decision. It is also expected that the business case would consider the delivery method best suited to optimise the VfM proposition.

The business case is expected to reflect a thoroughly documented service need, clear project objectives and cost estimates to a range of accuracy between 15% (lower) to 25% (higher) than the actual outturn cost.52 (Note: this range is positively skewed so there would be an expectation that over a portfolio of business cases, the business case estimate should on average be greater than the actual outturn costs.)

Key finding 1: Business case - Defining the project's VfM proposition Business cases often did not clearly define the project VfM proposition to the rigour required for investment decision making. Particular findings of note: • The average increase from business case cost estimate to AOC was of the order of 45-55%. • The business case assessment of an optimum delivery method often tended to 'default' to alliancing using a non-price selection approach for NOPs and did not consider a range of other delivery options. • In general a robust program and budget was not evident from the business case stage. |