6.2.2 Adequacy and timing of the business case

Business cases are not just one-off documents to gain government funding, but tools which when used wisely will improve VfM in project implementation, service delivery and substantiate general government sector accountability52.

A sound business case will detail costs (both Capex and Opex), timeframes and risks together with the project's operational specifications and service outcomes both in delivery and operational phases. It is a fundamental step in the government's investment decision.

The state uses business cases as the principle vehicle for making decisions on the investment of public funds involving capital assets. The business case allows the state to make investment decisions on projects on an opportunity cost of capital basis. Therefore, the absence of a robust and comprehensive business case is problematic for the state and Owner.

Moreover, the business case is used as a critical reference point for the Owner to ensure cost, time and quality objectives and constraints are managed. The absence of a robust business case introduces the high likelihood for uncontrolled scope growth and budget drift. While the state may support a particular investment proposal with a capital component priced at $200 million (for example), if price was to increase to $300 million (see Key finding 1) it may wish to revisit the investment decision and support an alternative investment proposal. A material increase from the business case project budget and the AOC could mean a significant erosion of VfM for the state.

The responsibility for preparing the business case rests with the Owner, as noted earlier. It is a potential conflict of interest for the alliance to prepare the business case given the commercial interest of the NOPs in the business case outcomes and delivery of the value proposition.

Furthermore, without the analytics of a business case, dimensioning the costs, risks, scope and benefits of the investment proposals, the Owner is not in a position to benchmark the project deliverables and VfM proposition that the alliance has been engaged to deliver. This is particularly exacerbated in the absence of price competition since the level of project detail required in the business case can be significantly less than that required for traditional methods of project delivery. Expressed more pointedly, shortfalls in the business case may be less evident when the alliance delivery method using non-price selection process is selected for delivering the project.

A sound business case is expected to provide the following benefits:

• Confirms the service need, including how it aligns with government policy objectives.

• Evaluates the costs and benefits of alternative proposals for meeting an identified service need (including non-asset solutions).

• Clarifies the key assumptions, risks, timeframes and costs on which the project is based.

• Analysis and recommendation of the optimal procurement method and strategy for achieving the VfM proposition.

• Evaluates project progress by continuously referring back to the business case and benchmarking actual versus planned performance.

• Dimensioning and evaluating project benefits.

• Identifies funding sources for the investment proposal.

• Improves accountability for the proposal and increases management's ability to monitor whether the alliance is achieving set milestones and key outcomes including VfM.

It was found that business cases often did not meet the above expectations. It was also noted that, for whatever reason, the alliance team rarely had access to the business case.

There was occasionally an underlying frustration by NOPs that they were not privy to the business case which mitigated against the ability of the alliance to optimise VfM. The open and transparent principles of alliancing mean that the business case should be made available to the alliance (barring any sections subject to confidentiality).

Alliances are often associated with projects where time is of the essence. In those situations where government has mandated an urgent start to a project with the expectation of early completion, it may be that it is not realistic to prepare a full, properly documented business case before the alliance selection process commences. In these rare situations a business case should not be dispensed with, rather a fast track process implemented to define the value proposition including project objectives, options, scope of work, program and a robust cost plan. This will ensure that an alliance, when evaluated as the appropriate delivery method, is able to focus on optimising VfM, although Owners should recognise that early commencement will almost certainly attract a significant price premium and not guarantee earlier completion.

Discussion Point 2 - Completeness of business case and clarity of objectives The business case must be adequately developed with clearly expressed VfM proposition to allow a robust and transparent investment decision and to provide a framework for ongoing assessment of project success in meeting business case objectives. Business case discipline and rigour should not be dispensed with in fast track projects. Fast track processes need to be developed for those (rare) projects where timing of commencement is of the essence. Owners should recognise that early commencement could attract a significant price premium, particularly when physical works commence prior to finalising commercial arrangements with the NOPs (see Key finding 4). The business case should (barring sections subject to confidentiality) be made available to the alliance to ensure that alliance objectives can be aligned with the business case. |

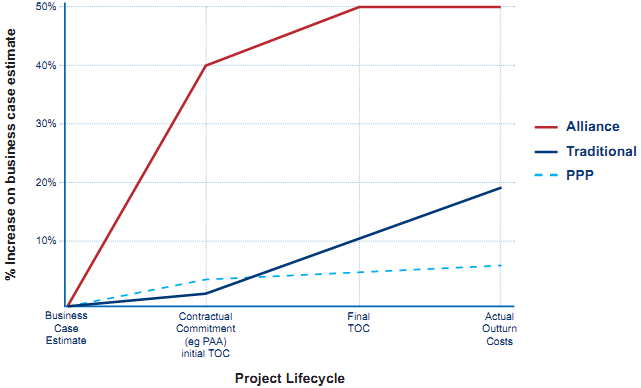

It was found that the estimate of AOC generally increased by approximately 45-55% during the project lifecycle:

• Of the order of an additional 35-45% from business case to initial (agreed) TOC.

• Of the order of an additional 5-10% from initial (agreed) TOC to final (adjusted) TOC

• Negligible difference between the final (adjusted) TOC and the AOC resulting in negligible painshare/gainshare (refer to the discussion in Section 6.4).

These cost movements are significant and raise serious doubts about the basis of the original investment decision and/or the veracity of the cost movements during the course of the alliance.

The movement in costs during the project lifecycle is shown below with a comparison against other delivery methods.64, 68

Figure 6.1: Cost movement for various delivery methods

This would indicate that PPPs provide the greatest cost certainty at business case stage (an increase of 5-10% to AOC), followed by traditional (≈20%) and then alliances (≈50%).

This may reflect the significant difference between the delivery methods when project clarification occurs. For alliances this would appear to occur between business case and contractual commitment, while for traditional projects it occurs to a greater extent between contractual commitment and actual outturn costs.63

The greater differential may also be explained as alliancing is often used for projects with high risk and uncertainty that cannot be dimensioned at the business case stage or soon thereafter.75 In these situations the differential may indicate that business case estimates did not provide a sufficient contingency allowance.

The movement during the project is also noteworthy. An adjustment to the TOC almost certainly reflects an increase to the alliance scope (since that is generally the only grounds for adjustment) and raises doubts as to the widespread perception of certainty of the initial alliance TOC compared to other delivery methods.

The very close alignment of the Final (adjusted) TOC with the actual outturn cost is discussed in Section 6.5.

A strength and weakness of the alliance delivery method is that it is very forgiving of inadequate business cases. A strength is that in times of urgency when it is difficult to prepare a full business case, an alliance can be mobilised faster and more effectively than traditional methods. A weakness is that shortcomings in a business case's VfM proposition are far less transparent under an alliance (particularly ones involving non-price selection of NOPs).

Further research is needed on how governments can best implement fast track projects.

Discussion Point 3 - Adequacy and timing of the business case cost estimate Estimates of AOC generally increased by about 45-55% during the project lifecycle; 35- 45% from business case to initial (agreed) TOC and a further 5-10% to final adjusted TOC. Painshare/gainshare was negligible. It would appear that PPPs provide the greatest cost certainty at business case stage (an increase of 5-10% to final, followed by traditional (≈20%) and then alliances (≈50%)). Alliancing is generally associated with high risks (as in PPPs) that cannot be dimensioned upfront. They are often incomplete contracts. This uncertainty requires effective discipline in setting project objectives and controls to allow the Owner to understand and participate in decisions (including VfM) as the project progresses. This uncertainty also requires the cost estimates to be even more robust, not less. An alliance is more forgiving of inadequate business cases than traditional methods. This is both a strength and a weakness. The weakness is the potential of significant price premiums which may include scope and risk premiums in the absence of adequate project definition at the business case stage. |