5.2 Implications for the Owner

Governments make investment decisions based on Business Cases submitted by agencies. Faced with finite resources, funding for Business Case Proposals is rationed. The two relevant principles that apply to making decisions to approve a Business Case for funding are:

• VfM-based on the balanced judgement of the value (and priority) of the community service benefit promised vs. the cost of achieving this benefit; and

• Opportunity cost of capital-if a particular Business Case Proposal is approved, what other opportunities for uplifting community services are foregone?

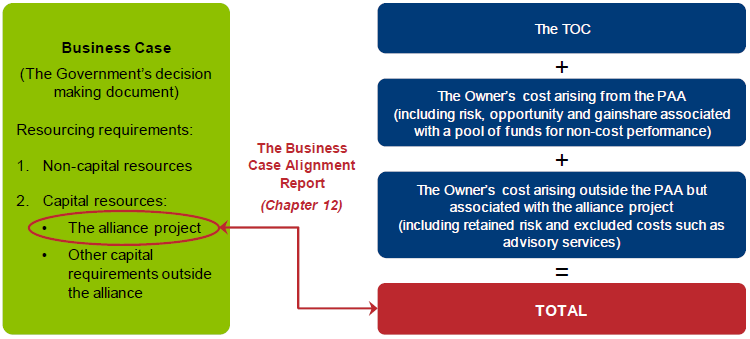

The development of a high quality TOC that (by definition) is reconciled with Business Case functional and performance requirements, as well as with the Business Case cost estimates, is vital for good government decision making. It ensures that limited and rationed resources are optimised against government priorities. Figure 8 illustrates the relationship of the TOC to the Business Case estimate.

Figure 8: Relationship between Business Case and TOC

The ongoing transparency and collaboration in the competitive TOC development process should yield both a best-in-market estimate of the expected cost at completion and a high degree of confidence in its veracity. However, if the offered TOC is materially misaligned with the Business Case estimate, then the integrity of the government decision making on the allocation of limited public resources can be compromised. 'Too low' and government will have foregone opportunities for the early funding of projects leading to an earlier uplift in community services; 'too high' and the government is in the difficult position of having to decide whether to proceed with the project or to source funds from essentially other projects.

Moreover, in the event that the AOC is significantly less than the TOC (resulting in a significant gainshare), there is a likelihood of criticism that the TOC was 'too soft' and VfM has not been achieved by the Owner. This is not known when agreeing the TOC, but may become apparent as the project is delivered. Alternatively, there is the possibility of the alliance managing the cost outcome to the TOC target rather than to the best possible cost for the required scope (i.e. they will 'spend the money').

Normally, prudent government decision making will require an assessment of whether the best market response to a tender process is aligned with the original decision to fund the Business Case. Some of the issues to be considered in assessing the acceptability of the TOC and market response are:

• the alignment of best acceptable tender offer with the approved Business Case and hence the Owner's VfM Statement (including approval for adjustment if necessary);

• an assessment of whether competitive, best-in-market pricing for the best-in-market project solution has been obtained from the tender process; and

• whether the best acceptable tender offer is affordable in terms of the approved Business Case budget; or in the event that the Business Case budget is exceeded, affordable in the context of other government priorities requiring public funds.

The Owner should not accept a TOC-whether determined in competition or otherwise-if the offered project solution, commercial arrangements and/or the TOC are not consistent with the Owner's VfM Statement and the approved project budget.

Chapter 12 deals with the Business Case Alignment Report (BCAR), which is a report by the Owner to government (prior to execution of the PAA) on these points and on actual costs to date and other forecast costs outside of the alliance. The BCAR also includes reporting on the negotiated Commercial Framework and the PAA proposed for execution.

Whilst the focus of this Guidance Note is TOC development, the ultimate objective is achieving a satisfactory AOC during project delivery, preferably that matches or betters the final TOC. The Owner has the benefit of using the TOC development process to assess the quality of the Proponent's proposed team and their ability to manage the project to achieve an AOC that beats the TOC.