5.4 What does the TOC include?

The TOC will include the expected cost of everything for which the alliance is responsible including risk and any included Owner's costs. However, the TOC is only meaningful when analysed alongside the Commercial Framework. The Framework will impact the TOC during both project delivery and post completion, for example:

• the Risk or Reward Model (including any caps); and

• other costs such as requirements for project insurances (including deductibles and cover provided), Owner's costs in obtaining approvals, land purchases, etc.

The TOC is made up of components that are found in any project cost estimate and to a level of accuracy and certainty that gives Proponents' senior management assurance to approve the submission of the tendered TOC to the Owner and likewise for the Owner's senior management to recommend it to the Owner.

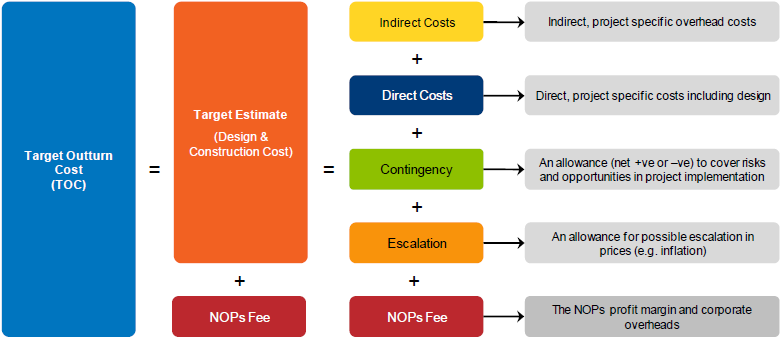

Elements of a generic project estimate for a traditional tender are generally grouped into the following categories:

• Indirect costs-indirect, project specific overhead costs;

• Direct costs-direct, project specific costs including design;

• Contingency -an allowance to cover risks and opportunities in project implementation (noting that this may be a negative number if opportunities out-weigh risks);

• Escalation -an allowance for possible escalation in prices (e.g. inflation); and

• NOPs Fee-the NOP's profit margin and corporate overheads.

A typical TOC structure is shown in Figure 9 below.

Figure 9: Target Outturn Cost (TOC) Structure

These various components of the TOC are discussed below.

The base estimate of design and construction costs is an aggregate of the costs of inputs into the construction project and will be referenced against market rates where possible. The base construction cost of the TOC must be undertaken to the same level of detail and rigour as an experienced Proponent would undertake for a tendered price for a traditional project. The target estimate comprises:

• Indirect Costs-the specific project costs necessary to support the direct cost element of the project delivery. These will be defined in the Alliance Development Agreement (ADA) and agreed in the Project Alliance Agreement (PAA). Typical examples include site facilities, project insurances, site management and supervision.

• Direct Costs-the estimated most likely cost of labour, plant, materials and specialist subcontract work required to deliver the asset based on calculated quantities derived from the proposed design solutions and construction methodologies developed for the Project Proposal and based on industry best practice and as defined in the ADA and PAA.

It is expected that the estimate will be compiled on what is commonly referred to as a 'First Principles' basis by disaggregating the alliance's physical works into discrete activities and assessing the individual labour and plant productivity and material required for each activity. A 'cost plan' approach to the Base Estimate that relies substantially on global historical rates (e.g. $/m2 of bridge deck or $/km track work) will rarely be acceptable unless there is a benchmark from a relevant, traditional, competitively sourced project.

Design fees directly attributable to the project would be included here (an acceptable alternative is to create a separate grouping). As with other elements of the direct costs, best practice is to estimate design fees from a 'First Principles' basis, not using historical percentages (though these may provide a 'sanity' check).

A generic estimate checklist is provided in Appendix A.

• contingency-in estimating capital cost, it is necessary for the estimator(s) to make numerous assumptions about what will be delivered and how and what circumstances will arise as it is delivered. It is inevitable that these assumptions will not all be correct and these unknowns or uncertainties can and will either cause cost increases or decreases relative to the assumed cost.

The unknowns and uncertainties are addressed by a project specific contingency allowance (which can be positive or negative depending on the level of residual risk and opportunity). Consistent with the definition of the TOC, being the expected cost at completion, this contingency allowance must reflect the expected cost of risk and should be neither conservative nor non-conservative. Assumptions and the potential cost impacts of risks and opportunities to all parties should be rigorously analysed after devising and implementing responses appropriate to the potential impact of those risks or opportunities on the base estimate (direct and indirect costs). This will generally include a risk management process that conforms to the requirements of the Australian Standard AS/NZS ISO 31000:2009. Modelling of the cost impact of treated risks and opportunities must be complete and defensible. The modelling can include 'bottom-up' techniques, such as Monte Carlo simulation and 'top-down' techniques including benchmarking.

Risk and opportunity analysis and contingency calculations are most important in those circumstances when there are considerable levels of undimensionable externality, scope uncertainty and risk.

The TOC process provides the opportunity for risk to be explored in a much deeper, more effective way, through the participation of the Owner. This should have the effect of reducing the need for additional contingency relative to that required without participation; including that which may be found in comparative D&C projects.

• escalation-an allowance to provide adequate compensation for forecast cost increases due to the rise and fall of costs in the construction sector during the construction and defects liability period.

The NOPs Fee, discussed in more detail in the Guide, is generally applied as a percentage markup to the NOPs' components of the TOC, but not to Owners' costs. The NOPs Fee comprises:

• Profit-the respective NOP's agreed profit margin.

• Corporate Overheads-the respective NOP's relevant business unit contribution towards recovery of non-project specific (corporate) overheads. It is important to ensure that this corporate overhead contribution does not include any reimbursement of project Direct and Indirect Costs which should already be included in the base estimate. Costs often mistakenly duplicated include tendering resources, payroll costs, IT support, bonus provisions and other, similar, ambiguous project/corporate overheads.

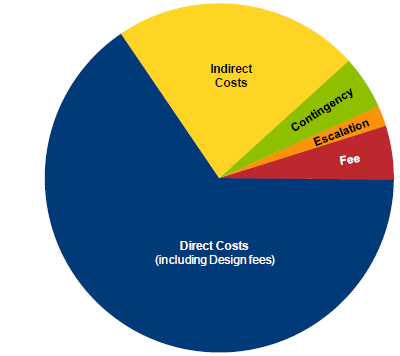

The typical relative magnitude of these components that comprise the TOC is illustrated in the following Figure 10. It highlights the very significant contribution of the Direct Costs to the TOC and the importance of close attention by Owners to this area of the target estimate. Indirect Costs, design costs, contingency, escalation and the Fee are largely a function of the construction Direct Costs of the project. Depending on the particular project, this impact of Direct Costs on the other TOC elements means that a reduction in Direct Costs of $1 could yield total savings on the TOC of up to approximately $1.75.

Figure 10: Relative size of TOC components10

Most experienced estimating practitioners are aware of these relationships and can provide current metrics and broad benchmarks of the interrelated ratios between each TOC component.

__________________________________________________________________________________

10 Cost proportions for a typical transport infrastructure project.