(d) CONDUCTING THE SAVINGS VALIDATION

(1) The financial management office should be the Office of Primary Responsibility (OPR) for the overall validation effort. As such, it should develop the plan to conduct the savings validation effort. This section will take you through the following steps to complete your plan for conducting a savings validation:

• Step One: Validation Source Data

• Step Two: Rates and Factors

• Step Three: Savings Validation Schedule

• Step Four: "Apples-to-Apples" Comparison Methodology

• Step Five: Preliminary Savings Validation

• Step Six: Savings Validation OPRs

• Step Seven: Validation Package Coordination

• Step Eight: Approval

(2) Multi-year Savings Validation Plan (Figure 15.A). Review Figure 15.A to understand the planning task at hand for the validation effort. For each blank or set of blanks, there is a reference to the step that explains what you need to know in order to enter applicable data for your contract. After you fill in the blanks, Figure 15.A can be used as your plan for conducting a savings validation. You may then implement the plan according to your schedule.

MULTI-YEAR SAVINGS VALIDATION PLAN

FOR ____________________________________

STEP ONE: VALIDATION SOURCE DATA The Multi-year Source Document will be ____________________________________________________. | |||

The Annual-buy Source Document will be __________________________________________________. | |||

STEP TWO: RATES AND FACTORS The following rates and factors will apply: Inflation: _____________________________________________________________________________ Expenditure Patterns: ___________________________________________________________________ Discount Factors (for Present Value Analysis): _______________________________________________ Explanation (Required only if you plan to use rates and factors other than those prescribed at the time the validation is conducted): _________________________________________________________________ _____________________________________________________________________________________ _____________________________________________________________________________________ | |||

STEP THREE: SAVINGS VALIDATION SCHEDULE The savings validation will begin after_____________and will be completed no later than_____________. | |||

STEP FOUR: "APPLES-TO-APPLES" COMPARISON METHODOLOGY Explanation of Methodology: ______________________________________________________________ _____________________________________________________________________________________ _____________________________________________________________________________________ _____________________________________________________________________________________ _____________________________________________________________________________________ | |||

STEP FIVE: PRELIMINARY SAVINGS VALIDATION Will be Done: YES / NO. OPR will be: _____________________________________________________ | |||

STEP SIX: | SAVINGS VALIDATION OPRs | ||

A. Overall Implementation | ____________________________ | ||

B. Track and document "puts" and takes" from receipt of proposals through completion of negotiations | ____________________________ | ||

C. Perform analysis to develop an Annual-buy price comparable to the Multi-year price | ____________________________ | ||

D. Prepare Exhibits | ____________________________ | ||

E. Draft the Savings Validation Package - Overall | ____________________________ | ||

1. Cover Page and Table of Contents | ____________________________ | ||

2. Purpose and Background | ____________________________ | ||

3. Statement of Validated Multi-year Savings | ____________________________ | ||

4. Method of Determining Amount of Validated Multi-year Savings | ____________________________ | ||

5. Chronology of Events | ____________________________ | ||

6. Baseline Differences | ____________________________ | ||

7. Relationship Between the Contract Price and "Total Multi-year Cost" | ____________________________ | ||

8. Perform Administrative Effort Associated with Coordination and for Final Submission to Approving Authority | ____________________________ | ||

STEP SEVEN: VALIDATION PACKAGE COORDINATION | |||

A. Correct preparation of "Findings" in Support of Multi-year ____________________________ | |||

B. Correct preparation of exhibits | ____________________________ | ||

C. Consistency with Price Negotiation Memorandum | ____________________________ | ||

D. Consistency with Contractor Proposal | ____________________________ | ||

E. Overall effectiveness of package (logical presentation, appropriate content, internal consistency, editorially sound) | ____________________________ | ||

STEP EIGHT: APPROVAL | |||

Name: _________________________________________________________________________________ | |||

Title: __________________________________________________ | Date: _______________ | ||

Figure 15.A | |||

(3) Step One: Validation Source Data.

(i) The Air Force expects savings validations to be done at the time of contract award and reflect actual contract details. The two key "actual contract details" you will need are:

(A) The cost to the Government of the multi-year contract; and

(B) The cost to the Government of the annual-buy alternative.

(ii) You should decide which contractual documents you will use as the source of this data. Identify these documents in Figure 15.A as the Multi-year Source Document (MSD), which will provide (or be the basis for determining) the cost of the multi-year contract; and the Annual-buy Source Document (ASD), which will provide (or be the basis for determining) the cost of the annual-buy alternative.

(iii) Ideally, a savings validation should be based on a negotiated multi-year contract and a negotiated annual-buy contract with priced options. The negotiated multi-year price and the total of the negotiated annual-buy prices would represent the real cost to the Government of each alternative. The difference between the two would consequently provide the best possible assessment of multi-year savings. If you plan to negotiate both contractual arrangements, your entry in Figure 15.A will look like this:

(A) "The Multi-year Source Document will be the negotiated multi-year contract supported by the associated Price Negotiation Memorandum."

(B) "The Annual-buy Source Document will be the negotiated annual-buy contract supported by the associated Price Negotiation Memorandum."

(iv) In some major systems acquisitions, however, the task of negotiating such contracts is so large and complex that the limited staff can only negotiate the contract the program office really intends to award: the multi-year contract. In these cases, you should decide what source document you will use as a basis for developing a comparable cost to the Government of the annual-buy arrangement. In this case, an alternative source document should be used as a basis for a comparable cost of the annual-buy.

(v) How to Select an Alternative Source Document to Use as a Basis for Developing a Comparable Cost of the Annual-buy Arrangement:

(A) Since you will be negotiating the multi-year arrangement, you should have a negotiated multi-year contract as the MSD. Since you do not plan to negotiate the alternative arrangement, which is an annual-buy with priced options, your ASD should be something less than a negotiated contract. The next few paragraphs explain how to consider the potential source documents you could use so you can select the one that will best serve your purposes.

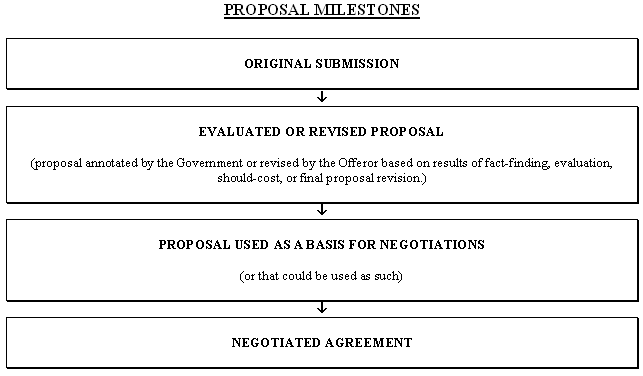

(B) Figure 15.B shows the major milestones in the life of a proposal. How much do you want the annual-buy proposal to mature before you use it, as your ASD is the key question to consider?

Figure 15.B

Consider each possibility:

(C) Original Submission. This is not an acceptable ASD. There is a danger that it will not be a true representation of how the offeror would actually conduct and price a series of annual-buys. This could stem from:

(1) The offeror, not experienced in preparing dual proposals, failing to make appropriate distinctions between its annual-buy and multi-year proposals.

(2) The offeror not devoting adequate time or attention to preparing the annual-buy proposal because:

(i) The offeror is aware of the fact that you do not intend to negotiate an annual-buy contract and feels certain the multi-year contract will be approved and used; or

(ii) The offeror is not interested in doing the work under an annual-buy contracting arrangement. Further, if the offeror is very interested in getting a multi-year contract, it may overstate the price of its annual-buy proposal to inflate the apparent multi-year savings and thus make the multi-year approach seem more attractive. You cannot be certain that these problems do not exist unless you evaluate the proposal in sufficient detail to determine that it is indeed a valid proposal.

(D) Evaluated or Revised Proposal. If, as indicated in Figure 16.B, this proposal reflects the results of Government fact-finding and proposal evaluation, then it can be considered a valid proposal. It can also be considered a valid proposal if it is the final proposal revision as the result of a competitive acquisition. As such, it can be an acceptable ASD.

(E) Proposal Used as a Basis for Negotiations. It is not unusual in major systems acquisitions for the proposal originally submitted to be revised prior to negotiations. Sometimes, there is more than one revision. In these situations, one of the revisions is finally identified and used as the basis for negotiations. You could arrange to have both the multi-year and annual-buy proposals brought to this point by requiring the offeror to update both proposals in tandem. In this way, the proposals should remain comparable to each other through this final iteration. From a savings validation standpoint, an annual-buy proposal that could be used as a basis for negotiations is the best ASD short of a negotiated annual-buy contract. From the standpoint of workload and the offeror's bid and proposal expenses, however, it may not be a reasonable choice.

(vi) Based on the above, identify your choice in Figure 15.A.

(4) Step Two: Rates and Factors

(i) When you transfer data from your source documents to the multi-year exhibits, the data will be subject to calculations involving inflation rates, expenditure patterns, and discount factors. You selected appropriate rates and factors when you prepared the MJP based on guidance in the earlier chapters. But you prepared the MJP up to two years before you will be validating multi-year savings. Consequently, the inflation rates and expenditure patterns that were prescribed then will probably have been superseded by different ones. It is possible, though not as likely, that different discount factors will also be prescribed by the time you do the savings validation. For planning purposes, you should simply recognize that the rates and factors that will apply to your savings validation would be those prescribed at the time you conduct the savings validation. In Figure 15.A, enter:

• "Inflation: OSD(C) prescribed rates current at the time savings are validated."

• "Expenditure Patterns: OSD(C) prescribed patterns current at the time savings are validated."

• "Discount Factors: 10% mid year annual rates at the time savings are validated."

(ii) If you plan to depart from this norm, enter in Figure 15.A precisely what you plan to use and provide an explanation in the space provided. For example, some programs have a tailored expenditure profile based on historical data. If you plan to use a tailored expenditure profile, identify it in Figure 15.A and explain why you will be using it under "Explanation."

(5) Step Three: Savings Validation Schedule.

(i) The objective of this step in your planning is to ensure that the savings validation does not delay contract award. Look at Figure 3.A in Chapter 3. Has your program developed its milestone schedule for conducting a multi-year contract? Where should the savings validation fit in?

(ii) Schedule the savings validation to begin as soon as the source documents are available. The OPR should allow at least two weeks to complete the effort. (Keep in mind that the savings validation effort includes obtaining the coordinations referred to in Step Seven of the plan). Keep the following things in mind when you schedule a completion date:

(A) Worst Case. For multi-year contracts requiring notification to Congress 30 days prior to contract award, you should complete the savings validation at least 75 days before the planned award date. This will allow 75 days in which to: (a) staff and obtain approval to proceed with a multi-year contract award; and (b) allow the Air Force to notify Congress. Chapter 16 explains how to obtain the approval and satisfy the Congressional notification requirement.

(B) Best Case. For multi-year contracts requiring notification to Congress concurrent with contract award, you should complete the savings validation at least 30 days before the planned award date. This will allow 30 days in which to staff and obtain approval to proceed with a multi-year contract award.

(6) Step Four: "Apples-to-Apples" Comparison Methodology.

(i) If in Step One you decided that you would negotiate both the multi-year and annual-buy arrangements, enter the following in Figure 15.A:

(A) "Compare the negotiated multi-year price with the total of the negotiated annual-buy prices."

Then go on to Step Five or

(B) If in Step One you decided that your MSD would be a negotiated multi-year contract and your ASD would be something less than a negotiated contract, you must decide how you will make the annual-buy data in the ASD comparable to that in the multi-year contract.

(C) Consider the differences that will exist between the two source documents when you are ready to validate multi-year savings (Figure 15.C):

Source Document Differences | ||

ANNUAL-BUY SOURCE DOCUMENT | MULTI-YEAR SOURCE DOCUMENT | |

Evaluated Proposal | Multi-year Contract | |

Current as of: | Months ago | Now |

Geared to Program Baseline as it existed: | When proposal was submitted | When negotiated agreement was reached |

Geared to Terms and Conditions: | In offeror's proposal | In negotiated contract |

Cost: | Proposed | Negotiated |

Profit: | Proposed | Negotiated |

Price: | Proposed | Negotiated |

Figure 15.C | ||

(D) You would be comparing apples and oranges if you compared the prices from the two Source Documents. To enable an apples-to-apples comparison, you should develop by analysis an annual-buy price that is comparable to the negotiated multi-year price. For this purpose, "comparable" means based on the same premises: the same program baseline, the same terms and conditions, and as negotiated rather than as proposed.

(E) To do this, you will have to identify and save the version of the multi-year proposal that is equivalent or roughly equivalent to the ASD. Then, when you conduct the savings validation, you can compare that multi-year proposal to the negotiated multi-year contract (your MSD) as follows:

(1) What baseline changes are reflected in the contract that were not reflected in the proposal?

(2) What terms and conditions changed that had an effect on cost and price (e.g., the terms of a warranty)?

(3) What is the difference between the proposed price and the negotiated price? If the negotiated price is $10 million lower than the proposed price, what is that $10 million reduction attributable to?

(i) Removal or reduction of some effort (i.e., baseline changes)?

(ii) Changed terms and conditions?

(iii) Results of negotiation (i.e., negotiation decrement)?

(F) Having identified these "puts-and-takes" from the multi-year proposal, you can apply them to the analogous ASD and in so doing estimate what the price of the annual-buy approach would have been had you negotiated the annual-buy contractual arrangement.

(ii) This requires cost estimating and pricing expertise, and a good audit trail from the point in time that the ASD was prepared through the completion of negotiations. Documenting these "puts-and-takes" is key to a good audit trail. Also, you should designate in this planning stage, a cost estimator and a price analyst to perform this analysis. These individuals will be able to do the analysis better and faster if they understand what is involved from the outset. Then, as they play their parts in fact-finding, evaluation, and negotiations; they can be alert to the changes and events that will affect the analysis they will be doing as part of the savings validation.

(7) Step Five: Preliminary Savings Validation.

(i) A preliminary savings validation is an informal assessment of multi-year savings based on the dual proposals submitted by the offeror(s). To do it, simply:

(A) Jot down the proposed price of the annual-buy arrangement;

(B) Subtract the proposed price of the multi-year contract; and

(C) Evaluate the resulting number, which represents "proposed" multi-year savings, by comparing it to the savings estimate in the multi-year justification package.

(ii) If the two savings figures are similar, chances are that your estimating assumptions are consistent with the offeror's intended approach to handling a multi-year contract. If the two savings figures are very different, one of the following problems may exist:

(A) One or more of your estimating assumptions was "off";

(B) The offeror failed to make appropriate distinctions in the way it would handle a multi-year contract versus a series of annual-buy contracts;

(C) The offeror sees different savings opportunities than you envisioned when you prepared the multi-year justification package; or

(D) The offeror has overstated the cost (and proposed price) of the annual-buy arrangement.

(iii) This preliminary savings validation requires little time and effort and no special documentation. It can alert you to potential problems, which can be investigated during the course of proposal evaluation. If you want to ensure that a preliminary savings validation is done, make sure to check the "Will Be Done" block in Figure 15.A and assign an OPR for the task.

(8) Step Six: Savings Validation OPRs.

(i) The financial manager should normally be responsible for developing and implementing the plan for conducting the savings validation. As the manager responsible for accomplishing the savings validation and managing financial resources, this individual should be aware of what will have to be done, the level of effort that will be required, and the other offices that need to be involved. As such, that person will assign OPRs for the required documents and efforts associated with the plan as follows:

(A) Assign the OPR for tracking and documenting "puts and "takes".

(B) Assign the OPR for annual-buy/multi-year price analysis and comparison.

(C) Assign the OPR for preparing required exhibits.

(ii) You should prepare updated multi-year exhibits based on "actual contract details." They should be prepared using the instructions found in earlier chapters of this guide. Keep in mind that the previous instructions were written primarily to guide someone preparing the exhibits based on estimates, when the multi-year feasibility study and MJP was being done. Instead of estimates, you will be using data from your Source Documents and your analysis. You should use the rates and factors you decided upon in Step Two. And you will base your "Cancellation Ceiling" entry in Exhibit MYP-1, Multi-year Procurement Criteria, on negotiated cancellation ceilings and a known funding plan rather than on estimates and projections.

(iii) Assign the OPR For Drafting The Savings Validation Package. The Savings Validation Package should consist of the following:

(A) Cover Sheet (similar to Figure 15.D);

(B) Table of Contents (similar to Figure 15.E); and

(C) Contents and Appendices as indicated in the Table of Contents.

|

PRODUCTION OF 720 F-16 AIRCRAFT |

|

Figure 15.D |

TABLE OF CONTENTS I. Purpose II. Background III. Statement of Validated Multi-year Savings IV. Method of Determining Amount of Validated Multi-year Savings V. Appendices A. Multi-year Justification Package B. Chronology of Events C. Baseline Differences D. Savings Validation Exhibits |

Figure 15.E |

(9) Step Seven: Validation Package Coordination.

Figure 15.A lists five characteristics the savings validation package should have. Assign appropriate offices to be responsible for reading the final package to ensure that the package meets these criteria. Their coordination will attest to the quality of the savings validation package.

(10) Step Eight: Approval.

Normally, the individual given this responsibility will be the program manager or the financial manager cited earlier. This individual should approve the plan by signing it in the approval block provided in Figure 15.A and approve the Savings Validation Package by signing it in the approval block of the cover letter in Figure 15.C.