3.5 CONCESSIONS

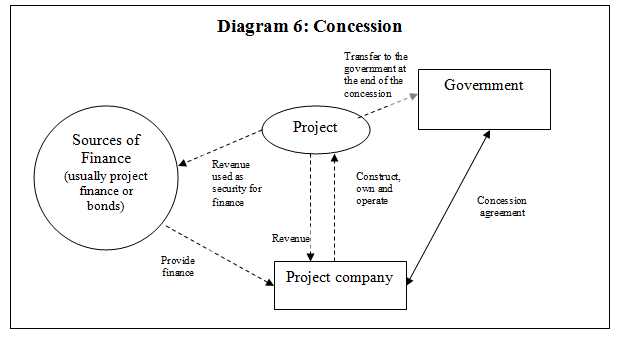

A typical concession structure would involve the private sector undertaking to finance, construct and maintain the infrastructure in return for the right to receive a stream of revenue from operating the infrastructure. The "private sector" is represented by the project company, which is usually a consortium of private firms (ie the sponsors) with expertise in designing, constructing or operating the project. The project company will obtain financing from various sources, and those providing the finance may provide it in the form of debt, equity or more likely both.

The construction of an infrastructure project typically involves a large financial commitment. This financial commitment may be so large that neither the government nor the private firms would or could undertake the project without project finance. In a typical loan, the borrowers would borrow from its lenders on the strength of its balance sheet. If the project fails, the borrower would be liable for the full amount of the loan (and will face insolvency if it is unable to do so). Such financing risk is often unacceptable to private firms or the government.

"Project financing" has enabled the private firms with expertise in infrastructure development to obtain financing to construct the infrastructure asset with limited or no recourse to the balance sheet of the participating private firms. This is also known as "off-balance sheet" financing, because lenders providing finance to the infrastructure project will look at the strength of the project rather than the assets (on the balance sheets) of the project sponsors.

As project financing rests heavily on the income stream of the project, it requires agreements for a project to be comprehensive and fully developed. Very careful due diligence of the project is needed to ensure the security and reliability of this income stream. Project finance is based on precise and highly structured assumptions and allocation of risks, which tend to add to the complexity and transaction costs.

Almost invariably, PPP projects are financed on a limited rather than no recourse basis. That is, where the project company fails to repay the lenders, the lenders are entitled to claim against the sponsors, the contractors (if different from the sponsors) or the host government in a limited number of circumstances or up to a specified monetary amount.

The lenders will be repaid through the expected revenue flow from the project. Therefore, a reasonably secure revenue stream from the project is required. As security, the lenders will want recourse to the assets of the project company. Unlike traditional project finance transactions such as a commercial real estate development (for example construction of a shopping center), development of infrastructure has an uncertain capital value and very limited potential for resale. Therefore, in addition to the right to the physical infrastructure asset, the lenders will seek additional security in the form of the assignment of the project agreements in the case of the project company's default.

The government typically contributes to this model of PPP by contribution to land, capital works, risk sharing, revenue diversion or purchase of the agreed infrastructure services.12

__________________________________________________________________________

12 See NSW Government, Working with Government: Guidelines for Privately Financed Projects, November 2001, iv.