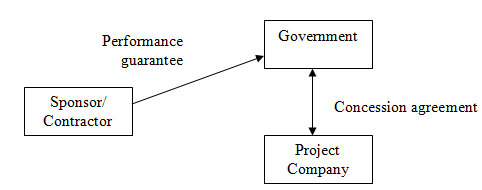

5.2.3 Performance Guarantee to Government.

A performance guarantee is an undertaking by one party (Party A) to another party (Party B) that it will ensure the performance of a third party (Party C), where Party C would generally have a preexisting contractual obligation with Party B. In the context of a PPP project, this can refer to the sponsors guaranteeing to the government (and also probably to the lenders) the performance obligations of the project company. The actual performance guaranteed is usually limited to the obligation under the concession agreement to complete the construction of the infrastructure asset on time and in budget.

A performance guarantee would need to deal with the following key issues:

• Trigger event. What event should trigger a breach of the performance guarantee? This is often a breach of certain obligations under the concession agreement.

• Consequences of default. A trigger event for the performance guarantee will invariably trigger a default of another financial agreement with lenders. Therefore the parties would need to address the interrelationship between the project company's (and the sponsors') obligations to the government with the project company's (and the sponsors') obligations to the lenders. It may be that the government needs to take its right to remedy on default subject to the lender's step in rights. On the other hand, a lender's step in right is exercised against the project company and performance guarantee is a right to damages against the sponsors, the two are not mutually exclusive (although the calculation of damages would be complicated).

• Expiry. A performance guarantee may be provided for the life of the concession agreement, or it may fall away on completion of construction of the infrastructure asset.

• Indemnity. The performance guarantee should be an indemnity and should pay for loss if completion is not actually achieved regardless of fault, and should exclude force majeure events.