5.3 IMPLEMENTATION

5.3.1 The process for effecting the public sector equity injection will require the following key issues to be addressed:

5.3.1.1 The percentage of public sector equity:

• the expectation is that the CGU will invest, as a minority shareholder, between 30-49% of the overall equity requirement for a project. However the CGU reserves the right not to invest and consequently there may be some projects where no public sector equity investment is made; and

• prior to the start of a project's procurement CGU will advise a procuring Authority of the range of equity investment it will be able to make in its project. For example, it may state that it will invest public sector equity at a range of between 30-35% of the overall equity.3 This range will be set out in the project's OJEU and tender documentation provided to bidders.

5.3.1.2 The pricing of public sector equity

The pricing of public sector equity will be determined competitively through the project's procurement process.

5.3.1.3 Relationship of public sector equity to developer and other sources of equity finance:

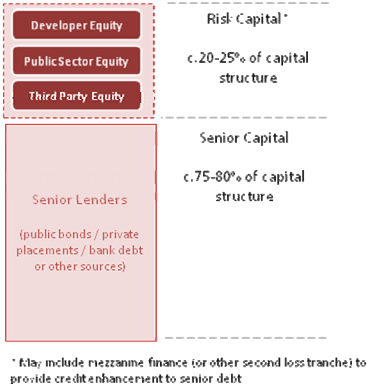

• Most of the former PFI projects had a highly leveraged capital structure involving the provision of debt and equity finance. This requirement for debt and equity finance will be retained under the new PF2 model with the level of debt being determined during a project's procurement and, in the majority of cases, without the need for a debt funding competition.

• Previously PFI projects were limited in their sources of equity finance, with the majority of it constituting developer equity (i.e. coming from the key construction and FM subcontractors to the project vehicle) and the rest from equity funds. However the new PF2 model of project envisages additional types of equity being injected into projects over and above 'traditional' developer equity. There will therefore be provision of public sector equity, as described above, and, in addition. it is anticipated that new entrants to the PF2 market, such as pension funds, will also invest equity.

• Whilst developer and public sector equity will be determined before the selection of a project's preferred bidder, the new entrant equity (''third party equity'') will be determined after this but before financial close of a project. The Government is proposing to pilot an initiative whereby there will be an equity funding competition in the period after the appointment of a project's preferred bidder, to determine this new type of third party equity.

• It is anticipated that the developer, public sector and third party equity providers will also invest a proportionate amount of sub-debt in the project. Mezzanine finance may also be invested.

Relationship of Public Sector Equity to Developer and other Sources of Equity Finance

______________________________________________________________________________

3 See Section 5.3.1.3 (Relationship of public sector equity to developer and other sources of equity finance) below which details the types of private sector equity investors envisaged under the new PF2 model.