17.8 INSURANCE PREMIUM RISK SHARING SCHEDULE

17.8.1 An Authority may elect to provide some protection to the Contractor for changes in the market wide costs of maintaining operational phase insurances. The Authority will need to form a view as to the extent to which this will improve value for money. In projects where the Contractor retains end user risk, the Authority should consider whether it should give the Contractor any price protection in relation to increases in insurance premiums, as the Contractor may be able to manage such increases by increasing the price that the end user pays for the Services. If the Authority decides to provide such protection, the Insurance Premium Risk Sharing Schedule ("IPRSS") (see Schedule A below) is the only mechanic which should be used and is required drafting.

17.8.2 If an Authority elects to provide relief for changes in insurance costs the IPRSS should be included in the tender documents, and agreed by the relevant party prior to award of winning bidder status. The appointment of the winning bidder will typically occur a few months prior to Financial Close. The Base Cost against which changes are measured must be agreed between the Authority (in conjunction with its insurance adviser) and the bidder, prior to the selected bidder status being awarded). There should normally be no variation to the modelled insurance premium assumptions after the appointment of a winning bidder. Only in the event of a delay in Financial Close beyond the expected Financial Close date resulting in an increase in the construction price and giving rise to a legitimate change in the relevant sum(s) insured should the bid Base Cost be allowed to vary after the Contractor has been awarded winning bidder status. The Base Cost should be set at a long run median level, such that the probabilities of the outturn costs being higher or lower in the future (after adjusting for inflation) are the same. This will invariably differ from the prevailing cost of insurance at the Bid Date. Authorities and their advisers must take care to avoid accepting artificially depressed Base Cost figures which will underestimate the outturn unitary charge payment profile and simply lead to the Authority paying compensation above the upper 5% - 30% threshold during the Contract term. Conversely, they should not rely on the sharing of future cost reductions, below the lower 5% - 30% threshold, as justification for an overestimated Base Cost still representing value for money.

17.8.3 As stated in Section 17.3.3, the risk of increases in insurance costs should lie initially with the Contractor. However it may not be value for money for the Authority to require the Contractor to take on the full risk of market wide movements in operational phase insurance costs: the issue here is similar to that on uninsurability (see Section 17.9 (Risks that become Uninsurable). Senior Lenders may require the Contractor to establish large reserves against such risks (or increase the Unitary Charge to cover them), whereas if these risks are shared by the Authority, this may offer better value for money. However, if the Authority takes on the risk of some upward movements in market wide insurance costs, it should also receive a corresponding benefit from reductions.

17.8.4 Authorities may, therefore, agree that if there is a movement of more than a set percentage in the projected operational insurance costs on account of market wide factors, any excess will be shared 85% to the Authority and 15% to the Contractor. Leaving this 15% risk with the Contractor will ensure that, in the event of such an increase, the Contractor will remain incentivised and focused on seeking to reduce premiums at each renewal. (It should be noted that the Contractor's liability will nonetheless be limited given the uninsurability protection available should insurance no longer be available on a commercially viable basis (see Section 17.9 (Risks that become Uninsurable) and Clause 17.9 (b) (Uninsurable Risks)).

17.8.5 Authorities should benefit correspondingly from 85% of any falls in general market insurance costs in excess of a pre-set percentage reduction in the projected operational phase insurance costs. The trigger level for these premium risk-sharing provisions to apply should be pre-set by the Authority in its tender documents (so that bidders know what basis to bid on). The Authority should, before going to market with its tender documents, choose a trigger figure ("nil-change" band) of between 5% and 30% up and down (as a required drafting matter) thus taking on a potential liability (or benefit) for insurance premium price rises above (or below) the "nil-change" band. Authorities should take advice from their Insurance advisers when setting this threshold, and may be influenced by expected bidder behaviour which in turn will be influenced by current and projected market conditions. Clearly however the lower the trigger point is, the smaller the contingency which the Contractor allows for insurance price rises should be.

17.8.6 This insurance cost sharing arrangement is limited to market wide movements and so should not take into account the following:

• Any change in the cost of insurance which, with the exception of portfolio cost savings, is not attributable to a general movement in insurance costs across the PFI/PF2 market as a whole, (i.e. changes in insurance costs due to circumstances generally prevailing in the insurance market in which insurance for the majority of all PFI/PF2 projects (across all of the sectors) is placed). Accordingly changes in insurance costs which are project or sector-specific should not be taken into account;33

• changes in insurance premium tax;34 or

• changes in insurance intermediaries' fees and commissions.

17.8.7 As the PFI market has matured and become less fragmented, Contractors who may have set the modelled cost of insurance on the basis of a single project placement may, during the course of the operational phase of the Project, elect to effect insurance on a portfolio basis (i.e. under a policy also covering risks on other projects or other matters which are outside the scope of the Project). This may give rise to significant cost savings (Portfolio Cost Savings). Given the level of risk which the Authority is assuming, it is considered reasonable for the Authority to benefit from this approach. Accordingly, in the event that there are any insurance cost savings from portfolio placements, for the purpose of determining the Project Insurance Change and Insurance Cost Differential (see Schedule [A] (Insurance Premium Risk Sharing Schedule) below in Section 17.8.15 (Insurance Premium Risk Sharing Schedule), such savings should be considered in the same way as other factors causing a general market movement in insurance costs. Therefore, the actual cost of insurance is not adjusted to reflect what the cost of insurance would have been in the absence of such savings.

17.8.8 Whilst effecting insurance on a portfolio basis may lead to significant cost savings on an aggregated basis, it is possible that the position on an individual project within the proposed portfollio arrangement is undermined. Accordingly, an individual Authority should not be obliged to join a portfolio solution if the effect is to make it worse off.

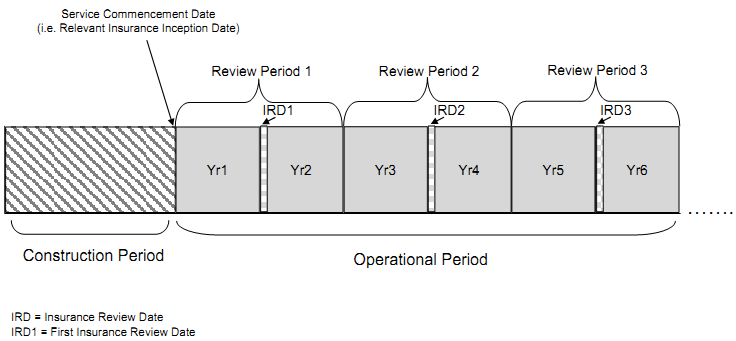

17.8.9 The cost-sharing calculations are to determine if any payments are to be made either by or to the Authority. This is based on a comparison of the relevant actual insurance cost with the relevant projected cost of insurance. With the exception of the first review, which should take place immediately after the first operational phase policy renewal, reviews of the actual insurance costs against the base projections, should take place biennially.35 The cost of insurance for the previous year and the cost of insurance for the current year are assessed at each review. A diagrammatic representation of this is given below.

17.8.10 The renewal process will be transparent, enforceable and supported by evidence. At each review date, an insurance cost report should be provided by the Contractor's insurance broker on behalf of both the Contractor and the Authority (as joint assured). This will be at the Contractor's cost. This should, inter alia, provide an assessment of the reasons for the changes in insurance costs for each of the main insurance covers and state the level of variation between the Base Cost and the actual insurance costs. (The bidder's financial model should contain a detailed breakdown of all insurance related costs in order to ensure transparency, including, but not limited to, the projected cost of each Relevant Insurance, insurance premium tax and brokers' fees and commissions).

17.8.11 For the cost sharing mechanic to operate effectively, there must be transparency, and the insurance costs assessment must be supported by appropriate evidence. When preparing the insurance cost report the broker should not only rely on the feedback from the insurance underwriter but should also refer to other suitable data sources. In addition PFI/PF2 insurance cost data will be collated centrally by HMT or its nominee and this will serve as an additional source of information. (When the report is submitted by the Contractor to the Authority, project insurance cost and deductible data for the relevant Insurance Review Period for each principal insurance cover is to be submitted to HMT or its nominee. This is intended to facilitate the creation and maintenance of a PFI/PF2 insurance cost database.)

17.8.12 Given that the Authority is a joint insured and will be providing relief to the Contractor above a 5% - 30% threshold, a duty of care should be owed by the insurance broker to the Authority. Furthermore, given that the Authority will, to an extent, be relying on the findings in the insurance cost report when determining monies due, it is important that the insurance broker understands and commits to providing this duty of care to the Authority when preparing the Joint Insurance Cost Report. (see paragraph 2.2 of Schedule [A] below). Accordingly, the brokers letter of undertaking should require that this report be addressed to the Contractor and Authority jointly.

17.8.13 In addition an Authority may wish to consider employing the services of an 'independent' insurance adviser to confirm the accuracy of the information in the Joint Insurance Cost Report and help generally in the renewal process. It is important that the insurance adviser is not affiliated with the insurance broker placing the insurances and producing the Joint Insurance Cost Report.

17.8.14 If an insurance risk becomes uninsurable (see Section 17.9 (Risks that become Uninsurable)) or a term or condition is no longer available (see Section 17.10 (Terms and Conditions that become Unavailable) the Base Cost (See "Definitions" in Schedule [A] below) should be adjusted to reflect the reduced level of cover being procured. Where possible the level of adjustment should be determined by the amount included in the Base Cost attributable to the uninsurable risk. Likewise, in circumstances of the Authority providing uninsurability protection (see Section 17.9 Risks that become Unisurable)), the Unitary Charge payable will be reduced by the cost most recently incurred for the insurance cover that is no longer being purchased by the Contractor. In practice, it may be difficult to discern from the financial model the cost projected to be incurred for the uninsurable risk, in which case it should be determined predominantly by the amount payable in the previous period for the particular risk.

17.8.15 It is not mandatory for an Authority to offer insurance premium risk sharing in the Contract. The decision on whether or not to do so must be taken in the light of the specific nature of the Project and a suitable value for money assessment. However, if the Authority does decide to offer insurance premium risk sharing, the only basis on which this may be included in the Contract is as set out below in this Section 17.8.15

The Contractor may in its pursuit of the best value for money for itself and the Authority wish to effect insurance for a period of in excess of one year, with insurance renewal taking place at intervals of in excess of 12 months. In this case, the Contractor should consult with the Authority before proceeding with the cover to ensure that both parties agree that it represents improved value for money. If an Authority elects to share insurance cost risk, the required drafting is as follows (to be included as a schedule to the Contract):

__________________________________________________________________________________________________________

33 This therefore includes changes in insurance costs attributable to the actions of the Contractor, which should not be taken into account given the correlation between Contractor performance and insurance premiums.

34 Insurance premium tax is considered a commercial risk for the Contractor in the same way as Corporation Tax.

35 The insurance market is cyclical and, arguably, if a period for aggregating insurance costs of, say, five years were used then there would be little need for the IPRSS. However, aggregating insurance costs over a period of several years can create working capital issues for Contractors and so a compromise period of two years has been chosen.