Source of profits in PPPs

Profit from the sale of PPP equity is only part of the potential profit from private investment in PPP projects. Most PFI/PPP contracts have a further 10 - 25 years to run and the full scale of profit/loss cannot be determined until the end of the contract. The termination of contracts or construction/operational problems may result in financial losses (see Appendix 4), but they are small compared to the speculative profits obtained from the sale of equity in the secondary market.

Construction contractors, banks or financial institutions, architects, consultants and lawyers and facilities management companies extract profits at different stages of the PPP process (see Table 2). PPP companies can potentially access profits from the SPC, the sale of shares in the SPC and by refinancing the projects' debt. In addition, parent companies will regularly re-value their portfolio of PPP assets in their annual report and accounts. This which may lead to financial benefits in determining the level of corporation tax and/or the company's share price (a list of and shareholding in SPC and joint venture companies is available in company annual reports).

Profit is also extracted as a result of the client requiring changes and additions not included in the original contract. Few buildings remain fit for purpose and must be adapted to take account of changes in social needs, changes in service delivery and technological advances over the contract period.

Table 2: Source of profit in PPP projects

Source of profit at various stages of a PPP project |

Planning |

Advice in preparation of options appraisal and business case |

Project management support |

Procurement |

Consultants provide procurement policy and strategy advice |

Provision of legal advice and negotiation of contract |

Provision of technical advice |

Design, Build & Finance |

Architectural design |

Engineering, environmental and other technical advice |

Landscape design |

Construction (including subcontractors and suppliers) |

Furniture and equipment |

Bank loans or sale of bonds |

Financial arrangement fees |

Procurement, management and technical consultants and legal advice/due diligence |

Operation and facilities management |

Maintenance, utilities and renewal (hard FM) |

Additional work and major changes required by the public authority |

Third party income from community and commercial use of facilities |

Contract variations |

Consultants to undertake benchmarking and review |

Facilities management support services (soft FM) |

Secondary market |

Legal due diligence |

Financial and legal advice |

Negotiating sale of equity |

Arranging refinancing |

Conclusion of contract or new contract |

Consultants to assess options and legal advice |

Source: based on Whitfield, 2010

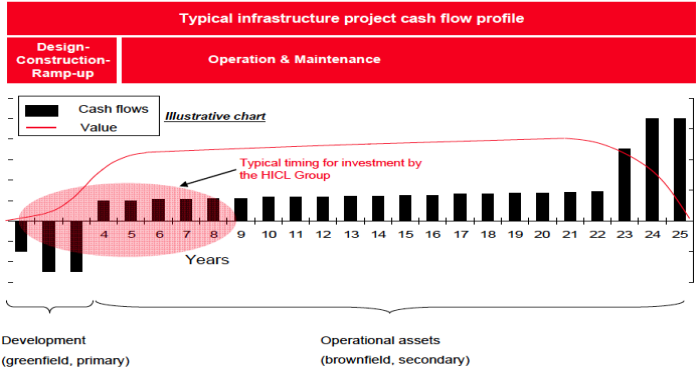

The financing of PPP projects is complex. The HICL Infrastructure Company Limited example below illustrates cash flows over the contract period. The negative cash flows in the first three years reflect the cost of financing construction followed by positive cash flows once the project is operational. It concludes with a short period before the end of the contract with a significant increased cash flow to the SPC.

The higher cash flows towards the end of the contract, particularly the dividends obtainable to the shareholders of the SPC, also indicate future additional profits over and above those already obtained by the SPC, the sale of equity and by refinancing.

Figure 1: Typical cash flow profile of a PPP project

Source: HICL presentation, 2010.

Once a project is operational, it may be refinanced and gains must be shared on a 50%/50% basis between the public and private sectors - see Part 3.