Theoretical framework

PPP equity transactions should be considered in a financial and economic framework rather than an accounting/corporate finance approach evident in previous studies, which have been based solely on projected returns due to the lack of evidence (Hellowell and Vecchi, 2012).

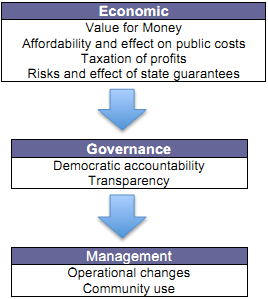

This study has developed a three-part framework consisting of economic, governance and management criteria using a cost/benefit and impact assessment approach designed to examine the wider implications of PPP equity transactions - see Figure 1.

PPP projects can only proceed if they demonstrate value for money. However, if excessive profits are obtained from the sale of PPP equity this indicates value for money was not achieved. The public sector is in effect paying a higher price for the PPP contract than it otherwise would. Affordability is a key issue; because PPP contract payments are 'protected' thus budget cuts must be imposed on frontline services.

There is evidence that risk transfer/pricing has been exaggerated and overpriced (Cuthbert and Cuthbert, 2008 and 2009, Shaoul et al, 2008).

The governance element of the framework is concerned with the transfer of majority or full ownership of PPP project companies to tax havens and accountability to public bodies and community organisations during the operational stage. It raises questions about the pre-completion of the contract period when future options will be examined. It also undermines policies that are intended to promote 'localism' - see Part 7. The equity sale process is highly secretive and the transfer of assets to tax havens makes transparency more opaque.

Figure 2: Theoretical framework