Public Sector Comparator (PSC)

The PSC is a measure of what the project would cost if delivered through conventional procurement.

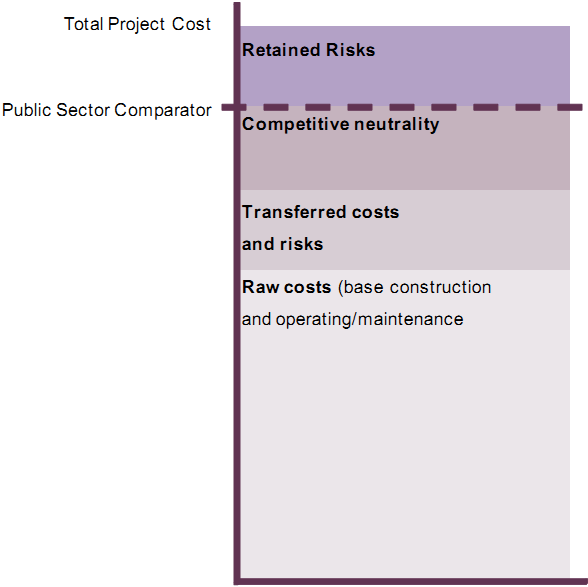

The PSC is made up of:

• the construction and operating costs of a project, plus

• provision for competitive neutrality adjustments to remove any advantages or disadvantages that accrue to a public sector procurer by virtue of its public ownership, plus

• provision for any additional costs and risks that would be transferred to the private sector partner under a PPP. These risks need to be added as a cost to the PSC because the public sector party would bear the cost of any risks that occur under conventional procurement.

The discount rate that is used to bring these costs to a common basis is critical. Small changes in the discount rate can have a significant impact on the total value of the PSC. When comparing the bids in the competitive tender with the PSC, it is important to ensure that the same discount rate is used for both13. If the bidders' cost of capital is known, then that is probably a better discount rate for this purpose than the general government discount rate set out in Treasury guidance14.

The concept of the PSC is illustrated in the diagram below. The dashed line represents the value of the PSC. It excludes the value of retained risks and costs because these are not passed to the private sector and would therefore not be priced in a tender:

The PSC is a valuable tool for ensuring that:

• all project risks have been identified and costed

• project go/no-go decisions are made on the best possible information, and

• bids are evaluated against a common benchmark.

While the PSC is often used in other countries at the tendering stage to evaluate the value for money of PPP bids, its value for this purpose is limited by the fact that inevitably, assumptions have to be made that have significant margins of error around them, such as the value of some of the project risks.

There is some partial evidence that PSCs tend to have a "pessimism" bias. The PSC's value for measuring a PPP's value-for-money should therefore not be overstated. The PPP's value-for-money is judged principally at the business case stage, and whether the best bid is acceptable will ultimately depend on whether the bidding process was judged to be sufficiently competitive.

Subject to this caveat and the caveat about the discount rate, Infrastructure Australia's "Volume 4: Public Sector Comparator Guidance"15 is a useful guide for putting together the PSC.

PSCs are not typically disclosed in other jurisdictions but this is being explored further.

___________________________________________________________________________________

13 The Infrastructure Australia "Public Sector comparator Guide" (see http://www.infrastructureaustralia.gov.au/public_private_partnership_policy_guidelines.aspx) advises using different discount rates, in effect to correct for deficiencies in the PSC. We consider that it is better to fix deficiencies in the PSC directly.

14 See http://www.treasury.govt.nz/publications/guidance/costbenefitanalysis/

15 See http://www.infrastructureaustralia.gov.au/public_private_partnership_policy_guidelines.aspx