Focus Interventions To Increase Exports/ Investments/ Tourism

With its limited resources, Government shall focus its interventions on key areas that are job generating, where the country enjoys comparative advantage, and with high growth potential.

1. Investment promotion, industry development in job-generating areas

To increase exports and encourage foreign and domestic investments, the government shall pursue intensive promotion and industry development as well as offer a more focused incentives package to stimulate the economy and allow all development partners an opportunity to take advantage of the gains from increased economic activities. The Philippine Export Development Plan 2011-2013 and 2014-2016 shall provide detailed strategies to implement the over-arching strategy of Moving Up the Value Chain to Double Exports. With more investments pouring in and more revenues from exports and tourism, consumption is boosted by higher purchasing power from a vibrant economy. With the fundamentals in place, this whole process becomes a cycle that leads to growth. To maximize the gains from targeted and holistic interventions, the following key areas will be pursued in the medium term:

a. Tourism

Tourism is a powerful driver for economic growth, infrastructure modernization, local area development, and employment generation. The increase in visitor expenditure and investment arising from tourism activities create livelihood and jobs in many local communities, which helps reduce poverty.

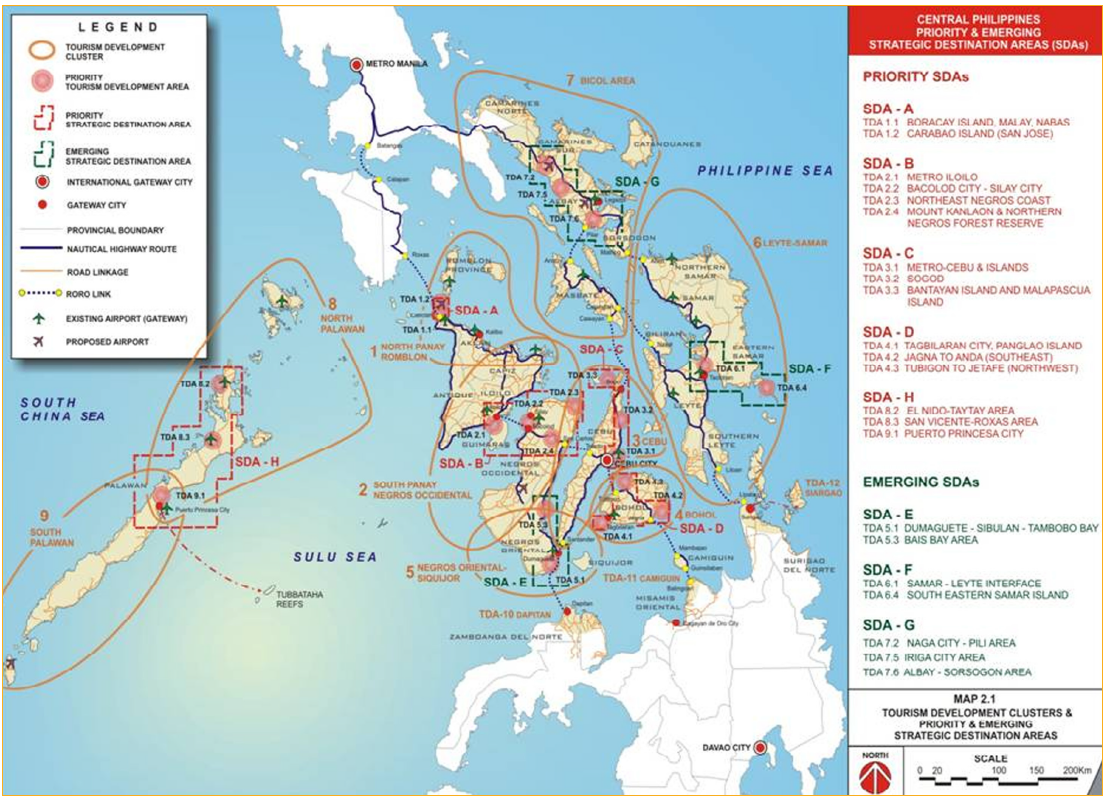

Figure 3.5: Strategic Destination Area for Tourism

Source: Department of Tourism and Japan Bank for International Cooperation- Sustainable Management Plan for Central Philippines.

Tourism development will be pursued in a sustainable manner to continuously create jobs and livelihood for local communities and generate foreign exchange for the economy while ensuring a high level of visitor satisfaction. Adherence to sound and manageable environmental practices in the development and promotion of tourist destinations as well as enhancement of tourism products and services will serve as cornerstones for planning, product development, human resources development, and marketing. Aiming to make the Philippines a destination of choice for tourism in the Asia-Pacific region, the government shall take the following measures:

• Encourage the diversification of existing destinations, and creation of new tourism areas and products including the expansion in room capacities through the implementation of the rules and regulations for the designation of Tourism Enterprises Zones (TEZs).

• Mobilize the enormous capacity of the country's LGUs at the provincial, city and municipal levels by strengthening their capacity to plan, regulate and guide tourism development so that it is environmentally and socially sustainable as well as economically inclusive and viable. Moreover, increase the competitiveness of the country's tourism enterprises and products by implementing partnership with the LGUs and the private sector to implement a mandatory system for the accreditation of tourism enterprises, including the formulation of a national standards and certification program for tourism facilities and services to ensure the highest quality and international comparability of the country's tourism products.

• Formulate a national tourism development plan (NTDP) as the framework for the identification of tourism destinations and products, domestic and international markets, marketing and promotion as well as prioritization of tourism infrastructure requirements by the Department of Public Works and Highways and the Department of Transportation and Communications, and designation of TEZs by the TIEZA. This will also provide the basis for LGUs to subsequently formulate their local tourism development plans. (Figure 3.5)

• Encourage LGUs to develop tourism related-products and services using the community-based and ecotourism approaches as implemented by innovative and entrepreneurial local governments in Bohol, Palawan, and Bicol, and have contributed to poverty reduction, protection of the environment, and gender equality in local areas. To this end, LGUs can seek the assistance of capable public and private higher education institutions in their areas, whose academic, research and extension programs in tourism-relevant disciplines and technical expertise can be tapped for local tourism/culture planning, tour guide services, standards-setting and quality assurance for the hospitality sector, site and institutional development, and the showcasing of cultural heritage.

• Undertake a focused and sustained international and domestic tourism promotion campaign and programs using both traditional and the new social networking media targeting existing and new markets as well as OFs.

• Launch focused and sustained international and domestic tourism programs using the new media with the support of OFs. Likewise, the support and cooperation mechanism for private sector and nongovernment organizations participation shall be enhanced. Efficient intra-government coordination system shall be put into practice in tourism promotional and planning activities. These shall involve the Tourism Promotions Board (as mandated by the Tourism Act of 2009) and the respective tourism related promotional units of the Department of Foreign Affairs (DFA), Department of Health (DOH), Philippine Retirement Authority (PRA), BOI, DTI, Department of Environment and Natural Resources (DENR), National Commission for Culture and the Arts (NCCA), and the various agencies and councils supporting culture and the arts (i.e. CCA, FDCP, and so forth). The entry of tourists under thematic programs (e.g. health and wellness and employment generation) shall be further facilitated in coordination with the DFA, Department of Justice (DOJ) and the BOI. Such a multi-dimensional stakeholder approach shall maximize the promotion of medical tourism; retirement; meetings, incentives, conventions and exhibitions (MICE); adventure and ecotourism; film production, and Philippine cultural and culinary diversity.

• Develop and implement a new tourism marketing campaign/ branding in consonance with the country's international image and trade promotion thrust.

• Promote public- private-sector partnerships both in infrastructure development and capacity expansion and modernization in the accommodation and recreation sectors, among others. The private sector will be engaged in extensive consultation to identify gaps, policy reforms and programs that will assist the tourism sector achieve its goals and objectives in the medium term. The Tourism Coordinating Council shall be the vehicle to strengthen such partnerships.

b. Business Process Outsourcing

The Philippines is now the second-largest destination for outsourcing and is soon expected to lead the global industry in terms of revenue earnings in voice/call center operations. The Philippines is projected by foreign analysts to lead in all aspect of BPO operations worldwide in the next five years. Thus, it is imperative to build the right value proposition to sustain both prevailing and prospective global positions.

• BPO, IT and IT related services comprise both voice (e.g., call centers) and non-voice (e.g., back office/knowledge process outsourcing (KPO), IT outsourcing, Engineering Services Outsourcing (ESO) and design process delivery, transcription, animation, and game development. Even as the Philippines takes the top position in the contact-center segment of the BPO industry, there is a need to nurture the growth in the KPO segment of the BPO industry, further enhance wage and work conditions, and strengthen the multi-stakeholder support framework. Thus, an average annual export growth of 20 percent shall be achieved from the following strategies: (1) development of a sustained data collection system for the services sector; (2) implementation of a comprehensive export branding program; and (3) legislation for data privacy and against cyber-crime in order to reduce risk perception of Philippine BPO services as well as pursue legislation of the Magna Carta for Call Centers Workers.

• In addition to BPO, Services and Creative Industries shall be promoted and enhanced. This will include other services such as accounting (professional services and outsourcing), education, engineering, franchising, interactive media with focus on animation, and gaming, health and wellness, and shipcrewing/ship management.

To support the industry, there is a need to nurture the talent pool, develop the infrastructure and regulatory support, and improve the socioeconomic environment. To this end, government shall:

• Enhance investment promotion and industry development strategies by synergizing initiatives and programs of the government and private sector to maximize resources;

• Harmonize the educational system with the changing needs of the industry;

• Advocate talent development through training and opportunity building, creating awareness that BPO provides high-paying jobs/careers, and focusing on expanding the talent pool;

• Sustain government commitment thru fiscal and non-fiscal incentives and facilitate the conduct of industry-focused road shows overseas;

• Improve the long-term risk perception and overall business environment; and

• Expand the development of "Next Wave Cities" in partnership with private sector.

c. Electronics

The electronics sector is a major driving force of the Philippine economy and has consistently been a source of high-value, high-impact investments preferred Original Design Manufacturer (ODM) and Original Equipment Manufacturer (OEM). Likewise, the country also houses some of the world's top electronic companies. There are two major players in the electronic components sector: the third-party subcontractors, which are mainly Filipino-owned, and the multinational plants which cater to the requirements of their parent companies.

The electronics industry will continue to be the driver of growth of Philippine merchandise exports. Shipments are foreseen to exceed US$30 billion by 2010. At an annual growth rate of 10 percent, electronics exports are expected to hit more than US$ 50 billion by 2016.

The priority sub-sectors for promotion for electronics are: (1) components/devices (semiconductors); (2) electronic data processing; (3) automotive electronics; and (4) solar power or photovoltaic cells.

To show the reliability of Philippine electronics and increase exports, country image branding and investment are significant. Likewise, this would entail aggressive promotion by: targeting emerging markets; conduct of high-level investment missions; integration of the electronics industry; establishment of human competencies throughout the value chain such as continuously growing talent pools in MS and PhD levels as long term strategy; and attract new players in potentially competitive sub-industries such as solar cells, growing capacity in IC design and the country's collaboration with Taiwan.

d. Mining

The Philippines is situated along a well-defined belt of volcanoes called the Circum-Pacific Rim of Fire making it one of the most mineralized countries in the world.

The Mines and Geosciences Bureau (MGB) estimates that some nine million hectares of the Philippine total land area of 30 million hectares are geologically prospective for metallic minerals. Some of these areas may be developed further, particularly large ore bodies and linked with downstream processing industries. The operation of processing plants and value-adding activities which have a demand-pull effect on primary production will serve as a catalyst for the development of other industries and sectors generating economic activities. The multiplier effects of these industries will foster the growth of the mining industry throughout the country.

The Philippine Mining Act is regarded as among the first worldwide to mandate corporate social responsibility in mining projects and activities.

The current export oriented mining industry should aim at producing manufactured goods and industrial products based on an industrialization framework and supported by a strong R & D program on efficient and state of the art technologies. For instance, copper production should be linked with smelting and refining operations down to the manufacture of cable wires and other high value finished products. The Iron and Steel Industry should be rationalized to address not only the local requirements but should also compete in the export market.

Generation of more investments in mining and mineral processing and mineral based manufacturing industries is the key to doubling exports by the sector by 2016. Policies, goals, objectives, strategies and programs of both national and local government entities need to be in sync and focused on promoting mining and mineral processing to establish industrial zones in identified areas with substantial mineral deposits.

In the short-term, investment promotion activities of the BOI, DFA (and its Foreign Service Posts), and DTI (and its Foreign Trade Service Corp) may focus on pre-identified mining projects determined by both the BOI and the MGB as "problem-free" in terms of mining permits, in collaboration with the LGUs, and in consultation with local community. Other recommendations to further increase the sector's competitiveness and contribution to economic development are the following:

• Develop the framework for the industrialization of the Philippine Mining/Mineral Industry to support the country's export activities and vertical integration to stimulate downstream and upstream industries and encourage domestic processing of minerals for the export markets;

• Strictly enforce compliance with environmental and social development commitments;

• Cleanse inactive mining applications and non-performing mining contracts;

• Continue public information campaigns and increase dialogues with concerned groups. Inform the public about responsible mining that minimizes environmental impact;

• Harmonize national and local government policies, goals, objectives, strategies and programs; and

• Ensure international linkages to relevant global sustainable extractive industry standards and best practices and benchmarks (e.g. Extractive Industries Transparency Initiative or EITI).

e. Housing

Investing in mass and socialized housing will enable investors to enjoy incentives, as the government seeks to address the housing gap of 5.8 million units from 2010 to 2016 or about 800,000 units per year. The government has also increased the target number of housing loans from 75,000 to 150,000 housing units. This is in line with the government's thrust of facilitating access to a variety of housing options that are decent, affordable, and responsive to the diverse and changing needs of the people by providing incentives to low-cost mass housing developers.

f. Agribusiness/Forest-based Industries

As one of the identified priority areas, market-driven and competitiveness-led agribusiness/forest-based and livestock industries shall be continuously promoted in both inbound and outbound investment missions, and shall be included in promotional activities such as business matching and investment briefings.

To further raise investment in agro-based industries, the government shall provide incentives as well as identify lands that are adequate for certain agricultural products. These lands should have already been covered by agrarian reform and the agro-based industries will respect the security of tenure of the agrarian reform beneficiaries (ARBs) and will work to improve the income and livelihood of the ARBs. The domestic economy shall be strengthened through asset reforms, development of agriculture and promotion of industrialization. (See Chapter 4: Competitive and Sustainable Agriculture and Fisheries)

Among agro-based products exported by the Philippines, the exports of fresh and processed foods are seen growing at 10 percent annually, a performance that will come mainly from fresh fruits such as banana, pineapple, mango, papaya, and okra; preserved fruits; beverages; and processed marine products (e.g. tuna, shrimps, etc.). Markets of these products shall be expanded and diversified through international promotional events, inbound business matching and addressing the market access issues resulting from new requirements of target and growth markets. Government shall strengthen the certification system for Good Manufacturing Practices (GMP), Hazard Analysis Critical Control Point (HACPP), and ISO 22000 as well as halal and kosher food standards and certifications. The DOST and DTI shall assist food processors in improving the packaging of food products.

The DA shall ensure the production of specific varieties required by the market and other agri-products which are raw materials for processed food, e.g. allocation of sugar. Moreover, new Free Trade Agreements (FTAs) will be utilized to increase Philippine agricultural exports.

Coconut, which is widely available in the country, is an immense source for food and non food products. Non food-based products such as coconut 011 account for a significant portion of Philippine exports of coconut products with crude coconut oil accounting for most of coconut oil exports. To double exports of coconut products by 2016, value-added products such as refined coco oil, coco biodiesel and oleochemicals shall be promoted. Technology shall be developed to collect coconut water from the production of coconut oil. It is also imperative that supply of coconut should be available to processors.

Refined coco oil is used for both food and industrial/external applications. To promote the use of refined, bleached and deodorized (RBD) coco oil in the international food processing market, the government shall help in information campaigns to counter the negative publicity about coco oil (allegedly perpetuated by producers of competing products), and create an awareness of coconut oil's health benefits.

The Philippines already figures prominently in almost all categories and products of the worldwide coconut industry, but efforts shall be undertaken to further develop the coco-coir and coco-peat segments to export higher value products such as geo-textile for soil erosion control or green architecture projects, rubberized coir products for car seats, mats, bed mattresses, air filters, among others. Investments in technology shall be promoted and issues concerning material supply aggregation and consolidation shall be addressed.

Through a trilateral undertaking, the DA, DFA and the DTI, shall continue to source breeders for cattle and water buffalo in order to enhance the supply of beef and milk products in the market.

g. Logistics

The Philippines' international logistics activity is relatively small compared to nearby countries. Together with the growing MSMEs potentials and global supply chain relations, this low base indicates a potential for high growth for logistics and supply chain activities.

To expand the sector, the government shall encourage investments in the development and expansion of logistics infrastructure in the international market. It will also promote other existing ports such as those located in Batangas and Subic not only to decongest the Manila port but also to open opportunities to worldwide shipping in the new areas.

Furthermore, the government shall review and develop/reform policies and rules, such as customs practices; transshipment of cargoes in various modes (i.e. air-air, sea-air, and air-sea); and foreign shipping services along the entire multi-modal transportation chain.

h. Shipbuilding

The Philippine shipbuilding sector, which now ranks fifth in the industry, covers building, ship repair and shipbreaking, and accounts for two percent of the total world market. By 2014, investments are expected to grow by PhP93 Billion. Investment growth will be focused on serving identified markets, such as South Korea and Japan, although other markets opportunities will also be considered.

In addition, support for shipbuilding shall also come from promoting the country's human capital and continuously providing enhancement programs.

The export market, which is dominated by three foreign shipbuilders, accounts for more than 98 percent of the total turnover, with the number expected to increase. Under good management and with skilled human resources matched by capital, technology and global market opportunities, the industry is moving forward to make the Philippines the fourth largest shipbuilding nation in the world in the next five to ten years.

i. Infrastructure

Infrastructure plays a vital part in the country's economic development and growth. Investment shall be directed towards the development of air and sea ports; roads; agricultural support facilities such as irrigation systems and systems for water supply; commercial infrastructure for trade and exposition; waste management systems (i.e. solid and liquid waste); and energy source facilities for power supply. (Refer to Chapter 5: Accelerating Infrastructure Development).

j. Other High-potential Industries

While there are priority areas that will be focused on, the government will also be vigilant in nurturing industries that post potential in (1) domestic and export market demand; (2) job generation; (3) utilization of local talents and creativity; and (4) maximization of the total value chain. Prospective areas perceived as high-growth potential include: homestyle products; wearables; motor vehicle parts and components; garments; and construction and related materials, among others.

Homestyle Products. Annual growth of 7 percent is targeted in the design-driven homestyle products, which includes furniture and furnishings, holiday décor, houseware and ceramics, woodcraft, giftware (excluding toys), shellcraft, and basketwork. The booming outdoor market in China and India and non-traditional markets such as South America (Brazil), Eastern Europe and the Middle East shall be the target markets. Aggressive export promotion through international trade fairs shall be pursued. The strong design capability of exporters, capitalizing on the mixed-media furniture, shall be continuously developed and sustained.

Wearables. Fine jewelry is the major export product of this industry. It also covers costume jewelry, fashion accessories such as headgear, scarves, gloves, belts and bags. To attain the 10 percent annual growth target, the government shall help the industry gain international exposure through trade fairs and shall put in place uncomplicated export and import policies and regulations.

Motor Vehicle Parts and Components. This industry targets an average annual export growth of 12 percent for parts and components and up to 5 percent for completely-built up (CBU) exports. Wiring harness exports, driven by rising global market demand, are expected to grow in volume by 97 percent through more efficient operations, or almost US$ 24 million in additional annual export earnings. Earnings are also expected beginning 2012-2013 from projects with the U.S., Korea, Thailand, U.K. and Australia.

To attain the targets for CBU exports, government and the private sector shall aggressively encourage global car manufacturers to assign specific car models to be supplied by Philippine original equipment automotive parts manufacturers/exporters.

The Replacement Parts Market will be tapped in addition to the original equipment parts market. Products with high potential are: electric fuel system parts; substrates for catalytic converters, anti-lock brake system, leafsprings, radiators, exhaust system and mufflers, automotive rubber parts, alternators, automotive carpets, tempered safety glass, windscreen, weather-strips, automotive plastic parts, nuts and bolts, and aluminum alloy wheels.

Subcontracting for customized orders of various automotive metal and plastic fabrications such as casting, forging, stamping, machining, and tooling will be pursued.

Garments. The garments industry is one of the country's foreign exchange earners, exporting a total of US$1.67 billion in 2009. Top export markets include the US, Japan, Great Britain, Germany and Canada. For 2011, exports are estimated to increase by as much as US$2 billion. Employment in the industry, currently at 150,000 workers, is foreseen to increase considerably over the next five years.

Construction and Related Materials. The construction sector consists of (a) wood-based products (e.g. doors, windows, plywood and veneer, joineries/moldings); (b) metal-based products such as iron and steel, aluminum and copper products; (c) nonmetal-based products (except marble); and (d) chemical-based products (e.g. PVC plastic, vinyl, paints and varnish). By 2013, the construction industry is expected to reach a total of US$ 1.37 billion in export sales, with a 12 percent annual growth.

The formulation of a Construction Industry Strategic Plan for the 21st Century or CI21 is intended to provide a framework for the industry's accelerated growth.

2. Development and implementation of programs that will enhance productivity and efficiency through green programs and sustainable consumption and production patterns.

Programs will include PPP initiatives; projects in the countryside such as eco-efficiency and eco-design programs (i.e. Bayong Development, Bamboo and coconut, among others); advocacy programs that will be enhanced through LGU, community, and media partnerships; and funding of projects and programs through international grants shall be explored. Domestic efforts shall include the granting of incentives (i.e. through the BOI Investments Priorities Plan or IPP) to green projects and programs.

3. Development and implementation of technology development projects in various priority areas/sectors to boost its innovativeness and competitiveness (i.e. the design of an ICT-based English language learning to increase the human resource uptake of call centers).

4. Review indicators on the number of new technology-based firms created.

5. An integrated high-impact export promotion program that will enhance country branding will be adopted and implemented at the initiative of the DFA, DTI, DOT, DA, pooling their resources with other relevant stakeholders.

6. Industry and services shall be induced to ascend the value chain to develop higher local value-added products and services through a well-conceived and comprehensive industrial strategy.

Market diversification shall be achieved by: targeting high-economic growth markets such as China and India, participating in global supply chains with ASEAN; maximizing the benefits existing Free Trade Agreements; and strengthening our international trade policy negotiation structures.